Wp4 Form

What is the wp4 form

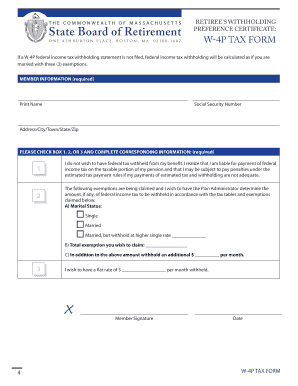

The wp4 form is a specific document used primarily for tax purposes in the United States. It is often associated with withholding allowances for employees. This form allows individuals to communicate their tax situation to their employers, ensuring that the correct amount of federal income tax is withheld from their paychecks. Understanding the wp4 form is essential for both employees and employers to maintain compliance with IRS regulations.

How to use the wp4 form

Using the wp4 form involves several straightforward steps. First, individuals need to obtain the form from a reliable source, such as the IRS website or their employer. Once the form is in hand, it should be filled out accurately, providing necessary personal information, including name, address, and Social Security number. After completing the form, it must be submitted to the employer, who will then use the information to adjust tax withholdings accordingly.

Steps to complete the wp4 form

Completing the wp4 form requires careful attention to detail. Here are the essential steps:

- Obtain the wp4 form from your employer or the IRS website.

- Fill in your personal information, including your full name, address, and Social Security number.

- Indicate your filing status and any withholding allowances you wish to claim.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to your employer for processing.

Legal use of the wp4 form

The wp4 form holds legal significance as it plays a crucial role in determining the amount of federal income tax withheld from an employee's paycheck. It is essential for the information provided to be accurate and truthful, as incorrect details can lead to penalties or issues with the IRS. Employers are required to keep the wp4 form on file for their records, ensuring compliance with tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the wp4 form are typically aligned with the start of employment or any changes in personal tax situations. It is advisable for employees to submit the form as soon as they begin a new job or experience a significant life event, such as marriage or the birth of a child, which may affect their tax withholding. Keeping track of these important dates helps ensure proper tax withholding throughout the year.

Who Issues the Form

The wp4 form is typically issued by employers to their employees. However, individuals can also access the form directly from the IRS website. Employers are responsible for providing the form to new hires and ensuring that they understand how to complete it accurately. This collaboration between employees and employers is vital for maintaining accurate tax records and compliance.

Quick guide on how to complete wp4 form

Effortlessly Prepare Wp4 Form on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly and seamlessly. Manage Wp4 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to Modify and eSign Wp4 Form with Ease

- Obtain Wp4 Form and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize signNow sections of your documents or redact sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and has the same legal standing as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether via email, text message (SMS), an invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Edit and eSign Wp4 Form and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wp4 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the wp4 form and how does it work?

The wp4 form is a customizable electronic document that allows users to collect information securely and efficiently. With airSlate SignNow, you can easily create, send, and eSign wp4 forms, streamlining your document workflows. This solution is designed to enhance productivity and reduce paper use.

-

How can airSlate SignNow improve my business's use of wp4 forms?

airSlate SignNow offers tools that simplify the management of wp4 forms, ensuring faster processing and better organization. The platform enhances collaboration by allowing multiple users to interact with the document simultaneously. This efficiency can lead to signNow time savings for your business.

-

What pricing options are available for using the wp4 form?

airSlate SignNow provides various pricing plans to accommodate different business needs regarding the wp4 form. Whether you are a freelancer or a large enterprise, you can choose a plan that fits your budget and scale. Each plan offers full access to the features surrounding wp4 forms, including eSigning and document tracking.

-

Can I integrate wp4 forms with other software tools?

Yes, airSlate SignNow supports integration with popular software tools, enhancing the functionality of your wp4 forms. You can easily connect with CRM, accounting, and other business applications to ensure seamless data entry and management. This integration helps maintain a smooth workflow across your business processes.

-

What features are included in the wp4 form option?

The wp4 form includes features such as customizable templates, eSignature capabilities, and real-time collaboration tools. You can also benefit from automated reminders and notifications, ensuring timely responses from recipients. These features are designed to enhance both the user experience and document security.

-

Is it safe to send wp4 forms through airSlate SignNow?

Absolutely! airSlate SignNow prioritizes security and ensures that wp4 forms are sent through encrypted channels. You can trust our platform to protect sensitive information while maintaining compliance with industry standards. Your data safety is our top priority, giving you peace of mind.

-

How quickly can I set up and start using wp4 forms?

Setting up wp4 forms with airSlate SignNow is quick and straightforward. You can create and customize your forms within minutes, allowing you to begin sending and receiving signed documents almost immediately. Our user-friendly platform is designed to minimize setup time and maximize productivity.

Get more for Wp4 Form

- Written notice of nonpayment individual form

- Get the minnesota notice of nonresponsibility individual form

- Owners request from lien claimant individual form

- Management shall incur no financial liability for form

- Understanding mechanics liens minnesota attorney general form

- Grantors certify that the grantors do not know of any wells on the described real property form

- Lien claimants verified statement individual form

- Revocation of transfer on death deed minn stat form

Find out other Wp4 Form

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement