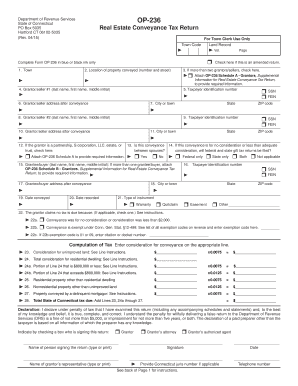

Op236 Form

What is the Op236

The Op236 is a specific form used for various administrative purposes, often related to compliance and documentation in a business or legal context. This form is essential for ensuring that the required information is accurately captured and processed. Understanding the purpose of the Op236 is crucial for individuals and organizations that need to navigate its requirements effectively.

How to use the Op236

Using the Op236 involves a series of steps to ensure that all necessary information is accurately filled out. First, gather all relevant data and documents required to complete the form. Next, carefully enter the information in the designated fields, ensuring accuracy to avoid any issues during processing. Once completed, review the form for any errors or omissions before submission, as this can prevent delays in processing.

Steps to complete the Op236

Completing the Op236 requires a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather all necessary documents and information.

- Fill out the form with accurate details, ensuring that all required fields are completed.

- Review the form for accuracy, checking for any potential errors.

- Submit the form according to the specified submission methods, whether online, by mail, or in person.

Legal use of the Op236

The Op236 must be used in accordance with applicable laws and regulations to ensure its legal validity. This includes adhering to any specific guidelines set forth by relevant authorities. Proper execution of the form is essential for it to be recognized as legally binding, which may include obtaining necessary signatures and ensuring compliance with eSignature laws.

Examples of using the Op236

There are various scenarios in which the Op236 may be utilized. For instance, businesses may use this form to document agreements, while individuals might need it for personal legal matters. Understanding the context in which the Op236 is applied can help users navigate its requirements more effectively and ensure proper usage.

Required Documents

To complete the Op236, certain documents may be required. These typically include identification documents, proof of address, and any other relevant information that supports the completion of the form. Ensuring that all required documents are on hand before starting the process can streamline the completion and submission of the Op236.

Form Submission Methods

The Op236 can be submitted through various methods, depending on the specific requirements of the issuing authority. Common submission methods include:

- Online submission through designated platforms.

- Mailing the completed form to the appropriate address.

- In-person submission at specified locations.

Quick guide on how to complete op236 291978826

Effortlessly Prepare Op236 on Any Device

The management of online documents has gained popularity among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Op236 on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Modify and eSign Op236 with Ease

- Find Op236 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign Op236 to ensure clear communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the op236 291978826

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is op236 and how does it work?

op236 is an advanced feature within airSlate SignNow that streamlines the process of sending and eSigning documents. With op236, users can quickly create templates and automate workflows, signNowly reducing the time spent on paperwork. This feature is designed to enhance efficiency and organization in document management.

-

How much does airSlate SignNow cost with op236 features?

The pricing for airSlate SignNow varies based on the plan selected, but all plans include op236 capabilities. This cost-effective solution ensures that businesses get the most value for their investment, providing access to powerful tools without breaking the bank. For detailed pricing information, please visit our pricing page.

-

What are the key benefits of using op236 in airSlate SignNow?

Using op236 in airSlate SignNow allows businesses to save time and resources through document automation and seamless eSigning. It enhances collaboration by enabling multiple parties to sign documents simultaneously. Additionally, op236 improves compliance by providing a secure audit trail of all signed documents.

-

Can I integrate op236 with other applications?

Yes, op236 supports integrations with various applications to enhance its functionality. This allows users to streamline their workflow by connecting airSlate SignNow with CRM systems, cloud storage services, and more. Seamless integrations help businesses maintain productivity and ensure data consistency across platforms.

-

Is op236 user-friendly for non-technical users?

Absolutely! airSlate SignNow, including the op236 feature, is designed with user-friendliness in mind. Non-technical users can easily navigate the platform, create templates, and send documents for eSignature without any technical expertise. Our intuitive interface ensures that anyone can use it efficiently.

-

What types of documents can I manage with op236?

With op236, you can manage a wide variety of documents, including contracts, agreements, and forms. Whether it’s legal documents or simple approval requests, airSlate SignNow allows users to customize their workflows around these documents. The versatility of op236 makes it suitable for various industries and business needs.

-

Does op236 provide security for sensitive documents?

Yes, security is a top priority with op236 in airSlate SignNow. The platform employs industry-standard encryption and provides secure storage for all your documents. Additionally, you'll have access to features like two-factor authentication and detailed audit trails to ensure that your sensitive information remains protected.

Get more for Op236

- Nh prior authorization form

- Nh prior authorization form 575686933

- Application for new louisiana pharmacy technician form

- Pharmacy technicians louisiana board of pharmacystate form

- Rcc incident intake information form georgia department of

- Handfingers form

- Aia physical exam form school webmasters

- Physical therapy board of california authorization for health information release physical therapy board of california

Find out other Op236

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation