1040EXT ME Individual Income Tax Extension Payment Voucher Form

What is the 1040EXT ME individual Income Tax Extension Payment Voucher

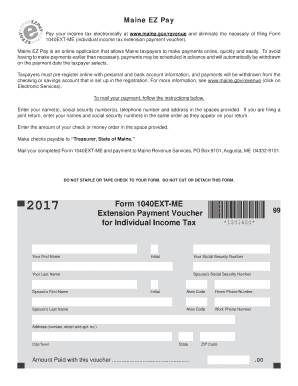

The 1040EXT ME individual Income Tax Extension Payment Voucher is a form used by taxpayers in Maine to request an extension for filing their state income tax returns. This voucher allows individuals to make a payment toward their estimated tax liability while extending the filing deadline. It is essential for taxpayers who may need additional time to prepare their tax documents, ensuring they remain compliant with state tax regulations.

How to use the 1040EXT ME individual Income Tax Extension Payment Voucher

To use the 1040EXT ME individual Income Tax Extension Payment Voucher, taxpayers must first complete the form with accurate information, including their name, address, and Social Security number. After filling out the necessary details, individuals should calculate their estimated tax payment based on their income. Once completed, the voucher should be submitted along with the payment to the Maine Revenue Services, either online or via mail. It is crucial to keep a copy of the voucher for personal records.

Steps to complete the 1040EXT ME individual Income Tax Extension Payment Voucher

Completing the 1040EXT ME individual Income Tax Extension Payment Voucher involves several key steps:

- Obtain the form from the Maine Revenue Services website or through authorized sources.

- Fill in your personal information, including your full name, address, and Social Security number.

- Calculate your estimated tax payment based on your income and any applicable deductions.

- Review the completed voucher for accuracy to avoid any errors.

- Submit the voucher along with your payment to the appropriate address or online portal.

Legal use of the 1040EXT ME individual Income Tax Extension Payment Voucher

The legal use of the 1040EXT ME individual Income Tax Extension Payment Voucher is governed by Maine state tax laws. By submitting this voucher, taxpayers are formally requesting an extension to file their income tax return while ensuring that they pay any estimated taxes owed. This legal framework protects taxpayers from potential penalties associated with late filing, provided they adhere to the guidelines set forth by the Maine Revenue Services.

Filing Deadlines / Important Dates

Taxpayers must be aware of key filing deadlines when using the 1040EXT ME individual Income Tax Extension Payment Voucher. Typically, the deadline for submitting the voucher is the same as the original tax return due date, which is usually April 15. However, it is advisable to check for any changes or specific dates each tax year. Filing the voucher on time ensures that taxpayers can avoid penalties and interest on unpaid taxes.

Required Documents

When completing the 1040EXT ME individual Income Tax Extension Payment Voucher, certain documents may be required to support your estimated tax payment. These may include:

- Prior year tax returns to estimate current income.

- Documentation of income sources, such as W-2s or 1099s.

- Records of any deductions or credits that may apply.

Having these documents on hand can facilitate accurate calculations and ensure compliance with state tax requirements.

Quick guide on how to complete 1040ext me individual income tax extension payment voucher

Effortlessly create 1040EXT ME individual Income Tax Extension Payment Voucher on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides all the necessary tools for you to generate, modify, and electronically sign your documents quickly and efficiently. Manage 1040EXT ME individual Income Tax Extension Payment Voucher on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

Easily edit and electronically sign 1040EXT ME individual Income Tax Extension Payment Voucher

- Find 1040EXT ME individual Income Tax Extension Payment Voucher and click on Get Form to begin.

- Use the available tools to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with features that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to deliver your form, via email, text (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or mislaid documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign 1040EXT ME individual Income Tax Extension Payment Voucher and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

For a resident alien individual having farm income in the home country, India, how to report the agricultural income in US income tax return? Does the form 1040 schedule F needs to be filled?

The answer is yes, it should be. Remember that you will receive a credit for any Indian taxes you pay.

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

-

How can I raise a dispute with income tax in India, when the previous employer filings in form 26AS does not match the payments made to me?

In my view, You can not raise dispute with department in this regard.Department will go by 26AS only. They will not allow any random proof given by employer.Better ask your employer to make correct changes in his TDS return of that particular period. So that 26AS will get updated and there after you can claim what is right.This is my opinion only. You can raise query and draft a letter to department with necessary proof like bank statement or pay slip you get etc.Thanks.

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

Create this form in 5 minutes!

How to create an eSignature for the 1040ext me individual income tax extension payment voucher

How to generate an electronic signature for your 1040ext Me Individual Income Tax Extension Payment Voucher in the online mode

How to generate an electronic signature for your 1040ext Me Individual Income Tax Extension Payment Voucher in Chrome

How to generate an electronic signature for signing the 1040ext Me Individual Income Tax Extension Payment Voucher in Gmail

How to make an electronic signature for the 1040ext Me Individual Income Tax Extension Payment Voucher right from your smartphone

How to generate an electronic signature for the 1040ext Me Individual Income Tax Extension Payment Voucher on iOS devices

How to create an eSignature for the 1040ext Me Individual Income Tax Extension Payment Voucher on Android devices

People also ask

-

What is the 1040EXT ME individual Income Tax Extension Payment Voucher?

The 1040EXT ME individual Income Tax Extension Payment Voucher is a form used by Maine residents to request an extension for filing their state income tax return. This voucher allows individuals to estimate and pay any taxes owed by the original due date, helping to avoid penalties and interest on late payments.

-

How do I use the 1040EXT ME individual Income Tax Extension Payment Voucher with airSlate SignNow?

Using the 1040EXT ME individual Income Tax Extension Payment Voucher with airSlate SignNow is simple. You can upload the form to our platform, fill it out electronically, and eSign it. This streamlined process saves time and ensures your submission is accurate and compliant.

-

What are the benefits of using airSlate SignNow for the 1040EXT ME individual Income Tax Extension Payment Voucher?

AirSlate SignNow offers several benefits for managing your 1040EXT ME individual Income Tax Extension Payment Voucher. It provides a user-friendly interface, secure eSigning capabilities, and the ability to track the status of your documents. This makes it easier for you to manage your tax extension efficiently.

-

Is there a cost associated with using airSlate SignNow for the 1040EXT ME individual Income Tax Extension Payment Voucher?

Yes, there is a cost associated with using airSlate SignNow for the 1040EXT ME individual Income Tax Extension Payment Voucher, but it is designed to be cost-effective. Our pricing plans are competitive and tailored to meet the needs of individuals and businesses alike, ensuring you get great value for your eSigning needs.

-

Can I integrate airSlate SignNow with other software for handling the 1040EXT ME individual Income Tax Extension Payment Voucher?

Absolutely! AirSlate SignNow offers seamless integrations with various software applications, making it easy to handle the 1040EXT ME individual Income Tax Extension Payment Voucher. Whether you use accounting software or document management systems, our solution can enhance your workflow.

-

What features does airSlate SignNow offer for the 1040EXT ME individual Income Tax Extension Payment Voucher?

AirSlate SignNow includes features that simplify the process of completing the 1040EXT ME individual Income Tax Extension Payment Voucher. Key features include electronic signatures, document templates, real-time collaboration, and secure storage, ensuring you can handle your tax extension efficiently and securely.

-

How secure is airSlate SignNow when handling the 1040EXT ME individual Income Tax Extension Payment Voucher?

Security is a top priority at airSlate SignNow. When handling the 1040EXT ME individual Income Tax Extension Payment Voucher, we use encryption and secure data protocols to protect your sensitive information. Our platform is compliant with industry standards, ensuring your documents remain confidential.

Get more for 1040EXT ME individual Income Tax Extension Payment Voucher

- Oregon advance directive form

- 2 130 1 form

- Fillabe oregon request to energize an electrical form

- Oregon surcharge form 2011

- Sds 0539a form

- Notice confidential information form has been filed oregon courts oregon

- How to make confidential information form oregon 2011

- Filliable lane county or stalking protective order form

Find out other 1040EXT ME individual Income Tax Extension Payment Voucher

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement