Colorado Individual Income Tax Form 104 FileYourTaxes Com

What is the Colorado Individual Income Tax Form 104 FileYourTaxes com

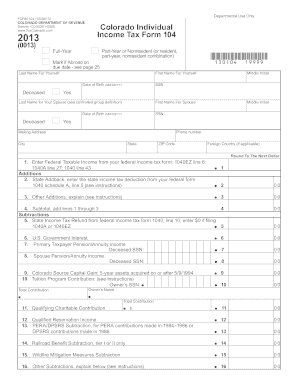

The Colorado Individual Income Tax Form 104 is a crucial document used by residents of Colorado to report their annual income and calculate their state tax liability. This form is essential for individuals who earn income in Colorado, as it helps determine the amount of tax owed or the refund due. It encompasses various income sources, deductions, and credits that may apply to taxpayers, ensuring compliance with state tax regulations.

How to use the Colorado Individual Income Tax Form 104 FileYourTaxes com

Using the Colorado Individual Income Tax Form 104 involves several steps. First, gather all necessary financial documents, including W-2s, 1099s, and any records of deductions. Next, download the form from the official state website or access it through a tax preparation platform. Fill out the form accurately, ensuring all income and deductions are reported. Finally, submit the completed form electronically or via mail, depending on your preference and the submission methods available.

Steps to complete the Colorado Individual Income Tax Form 104 FileYourTaxes com

Completing the Colorado Individual Income Tax Form 104 requires careful attention to detail. Follow these steps:

- Gather all relevant documents, including income statements and receipts for deductions.

- Download the form from a reliable source.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income from all sources accurately.

- Claim any deductions or credits for which you qualify.

- Calculate your total tax liability or refund.

- Review the form for accuracy before submission.

Legal use of the Colorado Individual Income Tax Form 104 FileYourTaxes com

The Colorado Individual Income Tax Form 104 is legally binding when completed and submitted according to state regulations. It is vital to ensure that all information is accurate and truthful, as any discrepancies can lead to penalties or audits. Utilizing a secure platform for electronic submission can further enhance the legal standing of the form, as it ensures compliance with eSignature laws and provides a digital certificate for verification.

Filing Deadlines / Important Dates

Filing deadlines for the Colorado Individual Income Tax Form 104 are typically aligned with federal tax deadlines. Generally, individual taxpayers must submit their forms by April 15 each year. If this date falls on a weekend or holiday, the deadline may be extended. It is essential to stay informed about any changes to these dates to avoid late penalties.

Form Submission Methods (Online / Mail / In-Person)

The Colorado Individual Income Tax Form 104 can be submitted through various methods. Taxpayers have the option to file online using approved e-filing software, which often streamlines the process and reduces errors. Alternatively, individuals may choose to print the form and mail it to the appropriate state address. In-person submission is also available at designated tax offices, providing another avenue for taxpayers who prefer face-to-face assistance.

Quick guide on how to complete colorado individual income tax form 104 fileyourtaxes com

Accomplish Colorado Individual Income Tax Form 104 FileYourTaxes com effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, enabling you to access the appropriate form and safely store it online. airSlate SignNow provides all the resources necessary to create, modify, and eSign your documents quickly without holdups. Manage Colorado Individual Income Tax Form 104 FileYourTaxes com on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented workflow today.

How to modify and eSign Colorado Individual Income Tax Form 104 FileYourTaxes com seamlessly

- Obtain Colorado Individual Income Tax Form 104 FileYourTaxes com and click Get Form to begin.

- Make use of the tools available to finalize your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you choose. Alter and eSign Colorado Individual Income Tax Form 104 FileYourTaxes com to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the colorado individual income tax form 104 fileyourtaxes com

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Colorado Individual Income Tax Form 104 FileYourTaxes com?

The Colorado Individual Income Tax Form 104 is an essential document used by residents to report their income and calculate taxes owed. FileYourTaxes com provides a user-friendly platform to easily access and complete this form, helping you stay compliant with state tax regulations.

-

How much does it cost to file the Colorado Individual Income Tax Form 104 on FileYourTaxes com?

The pricing for filing the Colorado Individual Income Tax Form 104 on FileYourTaxes com is competitive and designed to fit various budgets. We offer different packages that cater to individual and business needs, ensuring you find a solution that works for you without breaking the bank.

-

What features does FileYourTaxes com offer for the Colorado Individual Income Tax Form 104?

FileYourTaxes com offers a range of features to assist with the Colorado Individual Income Tax Form 104, including step-by-step guidance, automatic calculations, and e-filing options. These features streamline the filing process, making it quicker and easier to submit your tax return.

-

Is it safe to use FileYourTaxes com for my Colorado Individual Income Tax Form 104?

Yes, FileYourTaxes com prioritizes the security of your personal and financial information. We use advanced encryption technologies to protect your data, ensuring a safe experience while you prepare and submit your Colorado Individual Income Tax Form 104.

-

Can I integrate FileYourTaxes com with other accounting software?

Absolutely! FileYourTaxes com supports integration with various accounting software, making it easier to manage your financial documents and tax filings. This seamless integration helps you streamline your workflow and ensures that your Colorado Individual Income Tax Form 104 is accurate and up-to-date.

-

What are the benefits of using FileYourTaxes com for the Colorado Individual Income Tax Form 104?

Using FileYourTaxes com for your Colorado Individual Income Tax Form 104 offers numerous benefits, including time savings, ease of use, and expert support. The platform is designed to simplify the tax filing process, allowing you to focus on what matters most, whether that's your business or personal time.

-

How can I get help if I have questions about the Colorado Individual Income Tax Form 104 on FileYourTaxes com?

If you have questions regarding the Colorado Individual Income Tax Form 104, FileYourTaxes com provides extensive resources including FAQs, guides, and customer support. Our dedicated team is available to assist you with any inquiries you might have about the filing process.

Get more for Colorado Individual Income Tax Form 104 FileYourTaxes com

- Department of labor and workforce developmentcontact us form

- All accounts cds and other investments for form

- This wills designed to be completed on your computer form

- Option is chosen form

- Administrator is often your spouse but you should form

- No issue or concern over separation or children form

- Also name an alternate in case your spouse form

- New jersey mutual wills package with last us legal forms

Find out other Colorado Individual Income Tax Form 104 FileYourTaxes com

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure