MED 209, the Benefits Plan of the Presbyterian Church U S a Medicare Secondary Payer Small Employer Exception Election Employer Form

What is the MED 209, The Benefits Plan Of The Presbyterian Church U S A Medicare Secondary Payer Small Employer Exception Election Employer Certification Form

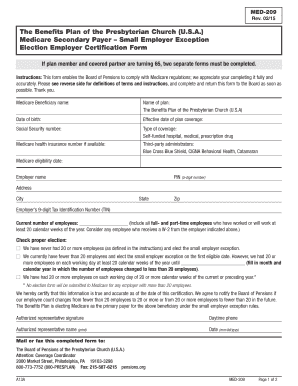

The MED 209 is a specific form utilized within the Benefits Plan of the Presbyterian Church (U.S.A.) to certify employer eligibility for the Medicare Secondary Payer Small Employer Exception. This form is crucial for small employers who wish to opt for the exception, allowing them to navigate the complexities of Medicare coordination of benefits. It ensures that employers meet the necessary criteria set forth by the Medicare program while facilitating the smooth processing of claims and benefits for employees enrolled in Medicare.

How to use the MED 209, The Benefits Plan Of The Presbyterian Church U S A Medicare Secondary Payer Small Employer Exception Election Employer Certification Form

Using the MED 209 form involves several steps that ensure compliance with both employer and Medicare requirements. Employers must first gather relevant information about their organization, including employee details and Medicare enrollment status. Once the necessary data is compiled, the form can be filled out electronically or in print. It is essential to review the completed form for accuracy before submission to avoid delays in processing. After completion, the form should be submitted according to the specified guidelines provided by the Benefits Plan.

Steps to complete the MED 209, The Benefits Plan Of The Presbyterian Church U S A Medicare Secondary Payer Small Employer Exception Election Employer Certification Form

Completing the MED 209 form involves the following steps:

- Gather necessary documentation, including employee Medicare information and employer identification details.

- Access the MED 209 form through the official Benefits Plan website or designated channels.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions.

- Submit the form electronically or via mail as per the instructions provided.

Legal use of the MED 209, The Benefits Plan Of The Presbyterian Church U S A Medicare Secondary Payer Small Employer Exception Election Employer Certification Form

The legal use of the MED 209 form is governed by federal regulations pertaining to Medicare and employer obligations. To ensure its validity, the form must be filled out correctly and signed by an authorized representative of the employer. Compliance with the Medicare Secondary Payer rules is essential, as improper use of the form can lead to penalties or denial of benefits. Employers are encouraged to keep a copy of the submitted form for their records and to ensure adherence to all legal requirements.

Key elements of the MED 209, The Benefits Plan Of The Presbyterian Church U S A Medicare Secondary Payer Small Employer Exception Election Employer Certification Form

Key elements of the MED 209 form include:

- Employer identification details, including name and address.

- Information about employees enrolled in Medicare.

- Certification of eligibility for the Small Employer Exception.

- Signature of an authorized employer representative.

Eligibility Criteria for the MED 209, The Benefits Plan Of The Presbyterian Church U S A Medicare Secondary Payer Small Employer Exception Election Employer Certification Form

To qualify for the Small Employer Exception under the Medicare Secondary Payer rules, employers must meet specific eligibility criteria. Generally, this includes having a limited number of employees, typically fewer than twenty, who are covered under a group health plan. Additionally, the employer must demonstrate that they are not otherwise subject to Medicare's primary payer rules. It is important for employers to review these criteria carefully to determine their eligibility before completing the MED 209 form.

Quick guide on how to complete med 209 the benefits plan of the presbyterian church u s a medicare secondary payer small employer exception election employer

Complete MED 209, The Benefits Plan Of The Presbyterian Church U S A Medicare Secondary Payer Small Employer Exception Election Employer effortlessly on any device

Digital document management has become a favorite among businesses and individuals alike. It offers a fantastic eco-friendly substitute for conventional printed and signed papers, allowing you to acquire the required form and securely save it online. airSlate SignNow equips you with all the capabilities you need to create, modify, and electronically sign your documents swiftly without any delays. Manage MED 209, The Benefits Plan Of The Presbyterian Church U S A Medicare Secondary Payer Small Employer Exception Election Employer on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The simplest way to edit and electronically sign MED 209, The Benefits Plan Of The Presbyterian Church U S A Medicare Secondary Payer Small Employer Exception Election Employer with ease

- Locate MED 209, The Benefits Plan Of The Presbyterian Church U S A Medicare Secondary Payer Small Employer Exception Election Employer and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight pertinent sections of your documents or redact sensitive information with tools designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a standard wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, SMS, invite link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes requiring reprints of new document versions. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and electronically sign MED 209, The Benefits Plan Of The Presbyterian Church U S A Medicare Secondary Payer Small Employer Exception Election Employer to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the med 209 the benefits plan of the presbyterian church u s a medicare secondary payer small employer exception election employer

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MED 209 form and why is it important?

The MED 209, The Benefits Plan Of The Presbyterian Church U S A Medicare Secondary Payer Small Employer Exception Election Employer Certification Form MED 209, The Benefits Plan Of The Presbyterian Church U S A Medicare Secondary, is crucial for small employers to signNow their eligibility for Medicare secondary payer benefits. Proper completion of this form ensures compliance with Medicare regulations and helps streamline the benefits process for employees.

-

How can airSlate SignNow help me with the MED 209 form?

airSlate SignNow offers an intuitive platform to easily fill out, sign, and manage the MED 209, The Benefits Plan Of The Presbyterian Church U S A Medicare Secondary Payer Small Employer Exception Election Employer Certification Form MED 209. Our e-signature solution simplifies the documentation process, reducing the time and effort involved in handling important forms.

-

Are there any costs associated with using airSlate SignNow for the MED 209 form?

Yes, airSlate SignNow provides various pricing plans that cater to different business needs. Our cost-effective solution provides great value, making it affordable to manage the MED 209, The Benefits Plan Of The Presbyterian Church U S A Medicare Secondary Payer Small Employer Exception Election Employer Certification Form MED 209 effectively.

-

What are the benefits of using airSlate SignNow for managing the MED 209 form?

Using airSlate SignNow streamlines the process of handling the MED 209, The Benefits Plan Of The Presbyterian Church U S A Medicare Secondary Payer Small Employer Exception Election Employer Certification Form MED 209. Our platform enhances efficiency through quick document access, secure e-signatures, and easy sharing, ensuring that all stakeholders can complete the necessary processes smoothly.

-

Can I integrate airSlate SignNow with existing software for completing the MED 209 form?

Absolutely! airSlate SignNow supports integrations with numerous applications, allowing you to seamlessly process the MED 209, The Benefits Plan Of The Presbyterian Church U S A Medicare Secondary Payer Small Employer Exception Election Employer Certification Form MED 209 alongside your current systems. This flexibility makes it easier to incorporate into your existing workflows.

-

How secure is the airSlate SignNow platform when handling the MED 209 form?

Security is a top priority for airSlate SignNow. When dealing with sensitive documents like the MED 209, The Benefits Plan Of The Presbyterian Church U S A Medicare Secondary Payer Small Employer Exception Election Employer Certification Form MED 209, we implement advanced encryption and compliance measures, ensuring that your information is protected and confidential.

-

What features are available on airSlate SignNow for handling the MED 209 form?

airSlate SignNow offers a variety of features designed to simplify the management of the MED 209, The Benefits Plan Of The Presbyterian Church U S A Medicare Secondary Payer Small Employer Exception Election Employer Certification Form MED 209, including customizable templates, reminders, and tracking tools. These features help you stay organized and ensure timely completion of important documents.

Get more for MED 209, The Benefits Plan Of The Presbyterian Church U S A Medicare Secondary Payer Small Employer Exception Election Employer

- New mexico judgment for restitutionus legal forms

- Domestic abuse family violence protection act albuquerque form

- Service of process information for petition for order of protection from

- Request for order to omit petitioners address and telephone form

- Response to petition for order of protection from domestic form

- Faqs domestic abuse under new mexico family violence form

- New mexico protective orders laws state laws findlaw form

- Domestic violence orders of protection under new mexicos form

Find out other MED 209, The Benefits Plan Of The Presbyterian Church U S A Medicare Secondary Payer Small Employer Exception Election Employer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement