Wv Tax Form it 140es

What is the Wv Tax Form It 140es

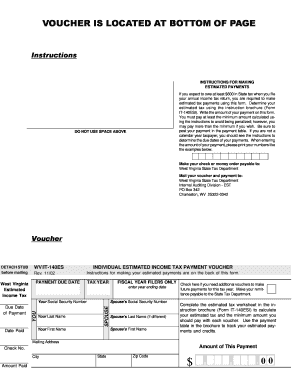

The Wv Tax Form It 140es is a state tax form used by residents of West Virginia to report their income and calculate their state tax liability. This form is essential for individuals who need to file their state income tax returns. It collects various financial information, including wages, interest, dividends, and other sources of income, allowing the West Virginia State Tax Department to assess the taxpayer's obligations accurately.

How to use the Wv Tax Form It 140es

To effectively use the Wv Tax Form It 140es, taxpayers should first gather all necessary financial documents, such as W-2 forms, 1099 forms, and any other income statements. After collecting these documents, individuals can begin filling out the form by entering their personal information, income details, and any applicable deductions or credits. It is important to follow the instructions provided with the form carefully to ensure accurate completion and compliance with state tax laws.

Steps to complete the Wv Tax Form It 140es

Completing the Wv Tax Form It 140es involves several key steps:

- Gather all relevant financial documents, including W-2s and 1099s.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income by entering amounts from your income statements.

- Calculate any deductions or credits you may qualify for, such as the standard deduction or specific tax credits.

- Compute your total tax liability based on the information provided.

- Review the completed form for accuracy before submission.

Legal use of the Wv Tax Form It 140es

The Wv Tax Form It 140es is legally binding when filled out correctly and submitted to the appropriate state authorities. It is crucial to ensure that all information is accurate and truthful, as providing false information can lead to penalties, including fines or legal repercussions. The form must be signed and dated by the taxpayer to validate its contents and confirm that the information provided is complete and correct.

Filing Deadlines / Important Dates

Taxpayers should be aware of the key deadlines associated with the Wv Tax Form It 140es. Typically, the form must be filed by April fifteenth of each year for the previous tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, taxpayers should keep track of any extensions or changes to deadlines announced by the West Virginia State Tax Department.

Form Submission Methods

The Wv Tax Form It 140es can be submitted through various methods. Taxpayers have the option to file online, which is often the most efficient method. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. When mailing the form, it is advisable to use certified mail to ensure that it is received by the tax authorities.

Key elements of the Wv Tax Form It 140es

Several key elements are essential to the Wv Tax Form It 140es. These include:

- Personal Information: Name, address, and Social Security number.

- Income Reporting: Total income from various sources.

- Deductions and Credits: Applicable deductions and tax credits that can reduce tax liability.

- Tax Computation: Calculation of total tax owed based on reported income.

- Signature: Taxpayer's signature and date to validate the form.

Quick guide on how to complete wv tax form it 140es

Effortlessly Prepare Wv Tax Form It 140es on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, as you can easily access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Wv Tax Form It 140es on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Modify and Electronically Sign Wv Tax Form It 140es with Ease

- Find Wv Tax Form It 140es and click on Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and has the same legal validity as a traditional wet signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Wv Tax Form It 140es and guarantee exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wv tax form it 140es

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Wv Tax Form It 140es?

The Wv Tax Form It 140es is an essential tax document used by individuals and businesses in West Virginia to report various tax-related information. This form simplifies the tax filing process and ensures compliance with state tax laws. Understanding how to fill out and submit the Wv Tax Form It 140es can save you time and potential penalties.

-

How can airSlate SignNow help with the Wv Tax Form It 140es?

airSlate SignNow enables users to easily eSign and send the Wv Tax Form It 140es without any hassle. Our platform streamlines the document management process, allowing for quick access and easy collaboration. With features specifically designed for businesses, you can ensure that your forms are securely signed and submitted.

-

Is there a cost associated with using airSlate SignNow for the Wv Tax Form It 140es?

Yes, airSlate SignNow offers a range of pricing plans to fit various budgets when dealing with documents like the Wv Tax Form It 140es. Our cost-effective solutions provide excellent value, especially for businesses that require frequent document signing and management. You can choose a plan that fits your needs without breaking the bank.

-

What features does airSlate SignNow offer for managing the Wv Tax Form It 140es?

airSlate SignNow offers a variety of features for efficiently managing the Wv Tax Form It 140es, including customizable templates, real-time tracking, and robust security measures. These features ensure that your forms are not only completed correctly but also stored securely. Additionally, you can automate workflows to streamline the signing process.

-

Are there integrations available with airSlate SignNow for the Wv Tax Form It 140es?

Absolutely! airSlate SignNow integrates seamlessly with a variety of applications, making it easier to handle the Wv Tax Form It 140es. Whether you need to connect with CRM systems or account management tools, our integrations enhance productivity and keep your documents organized. Utilize these connections to simplify your tax filing efforts.

-

How does airSlate SignNow ensure the security of the Wv Tax Form It 140es?

Security is a top priority at airSlate SignNow when handling the Wv Tax Form It 140es. Our platform uses advanced encryption and secure cloud storage to protect your sensitive information. You can be confident that your documents are safe from unauthorized access while remaining compliant with regulatory standards.

-

Can I track the status of my Wv Tax Form It 140es with airSlate SignNow?

Yes, with airSlate SignNow, you can effortlessly track the status of your Wv Tax Form It 140es in real-time. Our tracking feature provides updates on when your form has been viewed, signed, and finalized. This transparency helps you stay informed throughout the entire document management process.

Get more for Wv Tax Form It 140es

- Pr oper ty insp ec tio n osfm fire ca form

- Ahtc form 100 owners certificate owners certificate of continuing program compliance

- Informational text complexity analysis worksheetdocx azed

- Notice of final hearing ps 31152 8 ingov form

- Limited liability company ks form

- Boat status form

- Construction valuation training guide benefits va form

- Dmv 101 ps2 west virginia department of transportation transportation wv form

Find out other Wv Tax Form It 140es

- Sign Virginia Claim Myself

- Sign New York Permission Slip Free

- Sign Vermont Permission Slip Fast

- Sign Arizona Work Order Safe

- Sign Nebraska Work Order Now

- Sign Colorado Profit Sharing Agreement Template Secure

- Sign Connecticut Profit Sharing Agreement Template Computer

- How Can I Sign Maryland Profit Sharing Agreement Template

- How To Sign New York Profit Sharing Agreement Template

- Sign Pennsylvania Profit Sharing Agreement Template Simple

- Help Me With Sign Delaware Electrical Services Contract

- Sign Louisiana Electrical Services Contract Safe

- How Can I Sign Mississippi Electrical Services Contract

- Help Me With Sign West Virginia Electrical Services Contract

- Can I Sign Wyoming Electrical Services Contract

- Sign Ohio Non-Solicitation Agreement Now

- How Can I Sign Alaska Travel Agency Agreement

- How Can I Sign Missouri Travel Agency Agreement

- How Can I Sign Alabama Amendment to an LLC Operating Agreement

- Can I Sign Alabama Amendment to an LLC Operating Agreement