Split Year Treatment Flowchart Form

What is the Split Year Treatment Flowchart

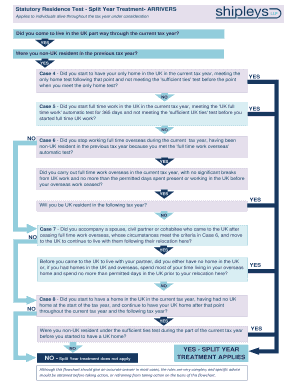

The split year treatment flowchart is a visual tool designed to assist taxpayers in determining their residency status for tax purposes when they have lived in more than one country during the tax year. This flowchart simplifies the decision-making process by guiding users through a series of questions based on their specific circumstances. It is particularly useful for expatriates, individuals working abroad, or those returning to the United States after living overseas.

How to use the Split Year Treatment Flowchart

To effectively use the split year treatment flowchart, start by identifying your residency status at the beginning and end of the tax year. Follow the flowchart step-by-step, answering each question based on your personal situation. The flowchart will lead you through various scenarios, helping you ascertain whether you qualify for split year treatment. It is essential to have relevant documentation on hand, such as travel records and employment contracts, to support your answers.

Steps to complete the Split Year Treatment Flowchart

Completing the split year treatment flowchart involves several key steps:

- Gather necessary documents, including travel itineraries and employment details.

- Review the flowchart and begin with the initial question regarding your residency status.

- Answer each question truthfully, following the flow of the chart to the next relevant question.

- Determine your eligibility for split year treatment based on your responses.

- Document your findings and retain the flowchart for your records, as it may be needed for tax filings.

Legal use of the Split Year Treatment Flowchart

The split year treatment flowchart serves as a legitimate method for determining residency status under U.S. tax law. When used correctly, it can help taxpayers comply with IRS regulations regarding foreign income and tax obligations. It is important to note that while the flowchart is a helpful guide, it does not replace the need for proper tax filing and reporting. Taxpayers should ensure they understand the implications of their residency status and consult a tax professional if needed.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding residency status and the split year treatment. According to IRS regulations, taxpayers must meet certain criteria to qualify for this treatment. The IRS outlines the substantial presence test and the green card test as key factors in determining residency. Familiarizing yourself with these guidelines is crucial to ensure compliance and avoid potential penalties.

Required Documents

When filling out the split year treatment flowchart, it is essential to have the following documents ready:

- Travel records, including flight itineraries and entry/exit stamps.

- Employment contracts or letters from employers.

- Tax returns from previous years, if applicable.

- Proof of residency, such as utility bills or lease agreements.

Filing Deadlines / Important Dates

Understanding filing deadlines is crucial for taxpayers utilizing the split year treatment flowchart. Generally, U.S. citizens and resident aliens must file their tax returns by April fifteenth of the following year. However, if you are living abroad, you may qualify for an automatic two-month extension. It is important to stay informed about any changes to deadlines that may arise due to specific circumstances, such as natural disasters or legislative changes.

Quick guide on how to complete split year treatment flowchart

Finalize Split Year Treatment Flowchart seamlessly on any device

Web-based document administration has become increasingly favored by companies and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed paperwork, as you can easily find the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents rapidly without delays. Manage Split Year Treatment Flowchart on any device with airSlate SignNow’s Android or iOS applications and simplify any document-related procedure today.

The simplest way to modify and eSign Split Year Treatment Flowchart effortlessly

- Obtain Split Year Treatment Flowchart and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure private data with tools that airSlate SignNow provides specifically for that aim.

- Create your electronic signature using the Sign tool, which takes moments and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to apply your changes.

- Choose how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Split Year Treatment Flowchart and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the split year treatment flowchart

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a split year treatment flowchart in airSlate SignNow?

The split year treatment flowchart is a visual representation that helps businesses manage the complexities of different fiscal years in their documentation processes. By using this flowchart in airSlate SignNow, users can easily determine the appropriate treatments and filings for their business needs, ensuring compliance and accuracy.

-

How can airSlate SignNow assist with split year treatment flowcharts?

airSlate SignNow provides tools that enable users to create and customize split year treatment flowcharts seamlessly. The platform allows for easy collaboration, ensuring that all stakeholders can contribute to and review the documentation process efficiently, which ultimately streamlines workflow.

-

Is there a cost associated with implementing a split year treatment flowchart in airSlate SignNow?

Yes, while airSlate SignNow offers competitive pricing, the cost of implementing a split year treatment flowchart will depend on the subscription plan chosen. Users can benefit from a cost-effective solution that streamlines their documentation and e-signature processes without breaking the bank.

-

What features are included in the split year treatment flowchart tool?

The split year treatment flowchart tool in airSlate SignNow comes with features such as customizable templates, integration capabilities, and easy-to-use drag-and-drop functionality. These features enhance user experience and operational efficiency when creating flowcharts tailored to specific business requirements.

-

Are there any integrations available for the split year treatment flowchart?

Yes, airSlate SignNow offers several integrations that can work in conjunction with the split year treatment flowchart. Users can easily integrate their existing software tools to enhance data transfer and streamline their documentation processes, helping maintain consistency and compliance.

-

What benefits can businesses expect from using a split year treatment flowchart?

Using a split year treatment flowchart in airSlate SignNow enables businesses to simplify their year-end and year-start processes by clearly outlining requirements and deadlines. This clarity reduces errors and ensures that all stakeholders are aligned, leading to better compliance and efficiency in document processing.

-

Is training available for using the split year treatment flowchart in airSlate SignNow?

Yes, airSlate SignNow provides training resources, including webinars and guides, to help users effectively utilize the split year treatment flowchart. This training ensures that all employees can leverage the tool to its fullest potential, maximizing the benefits of the platform.

Get more for Split Year Treatment Flowchart

- The trust for the benefit of the minor beneficiaries form

- Generally a will must be signed in the presence of form

- Common or other form of ownership

- Preparing your own will beatty form

- How to make a will online us legal forms

- Estate planning intake questionnaire form

- Safe deposit keys form

- Bareboat charter agreement ampquotchampionshipampquot imo no 9403516 form

Find out other Split Year Treatment Flowchart

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer