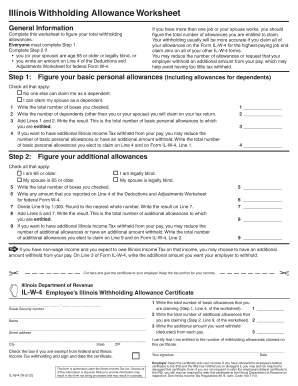

Form IL?W?4 Employee's Illinois Withholding Allowance Certificate

Understanding the Form W-4 and Allowances

The Form W-4 is a crucial document used by employees in the United States to indicate their tax withholding preferences to their employer. Allowances on the W-4 determine how much federal income tax is withheld from an employee's paycheck. The more allowances claimed, the less tax is withheld, which can result in a larger take-home pay. Conversely, claiming fewer allowances means more tax is withheld, which may lead to a refund when filing taxes. It is essential to understand your personal financial situation to accurately complete this form.

How to Complete the Form W-4

Completing the Form W-4 involves several steps. First, employees should provide their personal information, including name, address, Social Security number, and filing status. Next, the form requires the employee to calculate the number of allowances they wish to claim. This calculation can be based on factors such as dependents, tax credits, and other deductions. Finally, the employee must sign and date the form before submitting it to their employer. It is important to review the form periodically, especially after major life changes, to ensure that the withholding amount remains appropriate.

Key Elements of the Form W-4

The Form W-4 consists of several key elements that employees need to be aware of. These include:

- Personal Information: Name, address, and Social Security number.

- Filing Status: Options include single, married, or head of household.

- Allowances: The number of allowances claimed affects withholding amounts.

- Additional Withholding: Employees can specify any additional amount to be withheld from each paycheck.

- Signature: A signature is required to validate the form.

IRS Guidelines for Allowances on the W-4

The Internal Revenue Service (IRS) provides guidelines for determining the number of allowances an employee may claim on the W-4. These guidelines take into account various factors such as the employee's income, number of dependents, and eligibility for tax credits. The IRS also encourages employees to use the IRS Withholding Estimator, an online tool that helps individuals calculate the appropriate number of allowances based on their specific financial situation. Following these guidelines can help prevent under-withholding or over-withholding throughout the year.

Filing Deadlines for the W-4

While there is no specific deadline for submitting a Form W-4, it is recommended that employees complete it as soon as they start a new job or experience a significant life change, such as marriage or the birth of a child. Additionally, employees should consider submitting a new W-4 whenever they want to adjust their withholding amounts. Employers are required to implement the changes in withholding as soon as possible after receiving the updated form.

Digital Submission of the W-4

Submitting the Form W-4 digitally is becoming increasingly common as businesses adopt electronic document management systems. Many employers now allow employees to complete and submit the W-4 electronically, which can streamline the process. When submitting digitally, it is important to ensure that the electronic signature is compliant with legal standards, such as those outlined by the ESIGN Act. Using a reliable electronic signature solution can help ensure that the submission is secure and legally binding.

Quick guide on how to complete form ilw4 employeeamp39s illinois withholding allowance certificate

Complete Form IL?W?4 Employee's Illinois Withholding Allowance Certificate effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without any holdups. Manage Form IL?W?4 Employee's Illinois Withholding Allowance Certificate on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

How to alter and electronically sign Form IL?W?4 Employee's Illinois Withholding Allowance Certificate with ease

- Locate Form IL?W?4 Employee's Illinois Withholding Allowance Certificate and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form—via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Form IL?W?4 Employee's Illinois Withholding Allowance Certificate and ensure exceptional communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ilw4 employeeamp39s illinois withholding allowance certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What does allowances mean on W4 forms?

Allowances on W4 forms refer to the number of exemptions you claim to determine how much tax is withheld from your paycheck. The more allowances you claim, the less tax will be withheld, which can increase your take-home pay but may result in owing taxes at the end of the year. Understanding what allowances mean on W4 is crucial for managing your tax obligations effectively.

-

How does airSlate SignNow help with W4 forms?

airSlate SignNow simplifies the process of filling out W4 forms electronically, allowing you to easily input the necessary information, including allowances. By using our online platform, you can ensure your forms are submitted on time and accurately reflect what allowances mean on W4, streamlining your tax preparation efforts.

-

What features does airSlate SignNow offer for document signing?

airSlate SignNow offers robust features for document signing, including eSigning, document storage, and customizable templates. Our platform allows you to sign W4 forms efficiently, ensuring all relevant information, such as what allowances mean on W4, is clearly documented and easily accessible. This enhances both compliance and productivity.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses looking to manage their document signing processes, including W4s. Our pricing plans cater to different needs, making it easier for you to choose a package that fits your budget while ensuring you can efficiently manage your W4 allowances and other documents.

-

Can airSlate SignNow integrate with other software systems?

Absolutely! airSlate SignNow offers integrations with various software applications, including HR systems and payroll tools, which can help you handle W4 forms seamlessly. By connecting with these systems, you can automate and synchronize the information related to what allowances mean on W4, minimizing manual input and errors.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for tax forms like the W4 allows for more efficient workflows, quicker processing, and enhanced security. You can easily manage allowances and other critical data digitally, signNowly reducing the time spent on paperwork. This helps in staying organized and ensuring compliance with tax regulations.

-

How secure is the information shared on airSlate SignNow?

airSlate SignNow prioritizes the security of your data with advanced encryption and security protocols. When filling out W4 forms and inputting allowances, you can trust that your information is protected against unauthorized access. Our commitment to security ensures your sensitive tax information remains confidential.

Get more for Form IL?W?4 Employee's Illinois Withholding Allowance Certificate

- Ucc financing statement amendment form ingov

- Ucc services online tennessee secretary of state tngov form

- The will is form

- That the affidavit can be completed by the notary form

- Your wills start on the next page form

- Your will starts on the next page form

- Recommended to be signed by you in front of two witnesses who are not related to you form

- Tennessee last will and testament lawwills form

Find out other Form IL?W?4 Employee's Illinois Withholding Allowance Certificate

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement