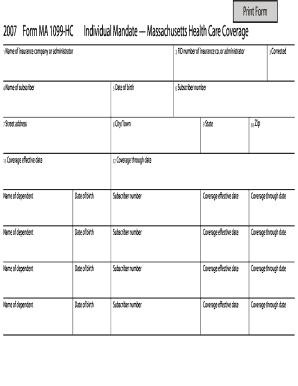

Ma 1099 Form

What is the MA 1099

The MA 1099 form is a tax document used to report various types of income other than wages, salaries, and tips. This form is crucial for individuals and businesses in Massachusetts to ensure accurate tax reporting. It is typically issued by businesses to report payments made to independent contractors, freelancers, and other non-employees. Understanding the MA 1099 is essential for both payers and recipients to comply with state tax regulations.

How to use the MA 1099

Using the MA 1099 form involves several steps. First, businesses must gather the necessary information about the payee, including their name, address, and taxpayer identification number. Next, the payer fills out the form with details of the payments made during the tax year. Once completed, the form must be provided to the recipient and filed with the Massachusetts Department of Revenue. Proper use of the MA 1099 helps ensure that all parties fulfill their tax obligations.

Steps to complete the MA 1099

Completing the MA 1099 form requires careful attention to detail. Follow these steps:

- Gather payee information: Collect the recipient’s name, address, and taxpayer identification number.

- Report payments: Enter the total amount paid to the recipient in the appropriate box on the form.

- Check for accuracy: Review all information for correctness to avoid issues with tax reporting.

- Provide copies: Distribute the required copies of the MA 1099 to the recipient and file with the state.

Legal use of the MA 1099

The MA 1099 form must be used in compliance with Massachusetts tax laws. It serves as a record of income for the recipient and is essential for their tax filings. To ensure legal validity, the form must be filled out accurately and submitted on time. Failure to comply with the legal requirements may result in penalties for both the payer and the recipient.

Filing Deadlines / Important Dates

Filing deadlines for the MA 1099 are critical for compliance. Typically, the forms must be issued to recipients by January thirty-first of the year following the tax year in which the payments were made. Additionally, the forms must be filed with the Massachusetts Department of Revenue by the end of February if filed on paper, or by the end of March if filed electronically. Being aware of these deadlines helps avoid late penalties.

Who Issues the Form

The MA 1099 form is issued by businesses, organizations, and individuals who make payments to non-employees. This includes independent contractors, freelancers, and service providers. It is the responsibility of the payer to accurately complete and distribute the form to the recipients and the state, ensuring all income is reported correctly.

Quick guide on how to complete ma 1099

Complete Ma 1099 smoothly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Manage Ma 1099 on any platform using the airSlate SignNow applications for Android or iOS and enhance any document-driven process today.

The easiest way to modify and electronically sign Ma 1099 effortlessly

- Locate Ma 1099 and then click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal significance as a traditional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, text message (SMS), an invite link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Edit and electronically sign Ma 1099 and ensure excellent communication at every stage of your form processing with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ma 1099

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a ma 1099 form?

The ma 1099 form is a document used in Massachusetts to report income received from various sources, such as freelance work or independent contracting. It is crucial for individuals to accurately report their earnings on this form to avoid any potential tax issues. Understanding how to complete the ma 1099 form is essential for compliance with state tax laws.

-

How can airSlate SignNow assist with the ma 1099 process?

airSlate SignNow provides a streamlined way to eSign and manage your ma 1099 forms electronically. By utilizing our platform, you can ensure that your forms are securely signed and stored, making it easier to keep track of your documents. This not only enhances convenience but also saves time during tax season.

-

Is airSlate SignNow suitable for small businesses handling ma 1099 forms?

Absolutely! airSlate SignNow is designed to be a cost-effective solution for small businesses dealing with ma 1099 forms. Our platform allows you to efficiently send, sign, and store your financial documents, simplifying the busy tax season processes while keeping your costs low.

-

What features does airSlate SignNow offer for managing ma 1099 forms?

Our platform provides features like customizable templates, secure document storage, and automated reminders for signing ma 1099 forms. Additionally, with airSlate SignNow, you can track document status and ensure all parties have completed their signatures promptly, enhancing your document management process.

-

Can I integrate airSlate SignNow with other tools for my ma 1099 management?

Yes, airSlate SignNow offers integrations with various applications you may already be using, like accounting software or customer relationship management systems. This allows for seamless transfer of data related to your ma 1099 forms and helps to keep all your financial documentation in sync across platforms.

-

What are the benefits of using airSlate SignNow for ma 1099 filing?

Using airSlate SignNow for your ma 1099 filing ensures faster processing times and increased accuracy in document management. The electronic signing feature eliminates the need for printing and mailing, reducing your carbon footprint. Moreover, you'll have a secure, organized way to track all submissions and signatures.

-

Is there a free trial for airSlate SignNow to manage ma 1099 forms?

Yes, airSlate SignNow offers a free trial that allows you to explore our features and see how effectively it can help you manage ma 1099 forms. This trial is perfect for businesses looking to understand the advantages of electronic document handling without any upfront investment.

Get more for Ma 1099

- Newtek business services corp investor relations form

- Control number ri name 3 form

- 2 403 7 13 3 7 16 10 and 7 6 11 form

- Fillable online sos ri what is a universal appointment bond form

- Date filed rhode island department of state form

- Rhode island installments fixed rate promissory note secured form

- Accounting part 3 flashcardsquizlet form

- Peterson exam 2 flashcardsquizlet form

Find out other Ma 1099

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed