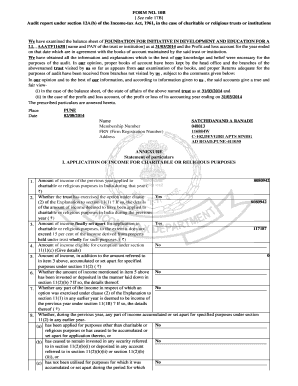

Form 10b

What is the Form 10b

The Form 10b is a specific document used under Rule 17b of the Income Tax Act. It is primarily utilized for reporting certain income and deductions related to business activities. This form plays a crucial role in ensuring compliance with tax regulations, allowing taxpayers to accurately report their financial information to the Internal Revenue Service (IRS). Understanding the purpose and requirements of the Form 10b is essential for individuals and businesses to fulfill their tax obligations effectively.

How to use the Form 10b

Using the Form 10b involves several key steps. First, gather all necessary financial documents, including income statements and expense reports. Next, accurately fill out the form by entering the required information, ensuring that all figures are precise and supported by documentation. After completing the form, review it thoroughly for any errors or omissions. Finally, submit the Form 10b to the IRS by the specified deadline to ensure compliance and avoid potential penalties.

Steps to complete the Form 10b

Completing the Form 10b requires a systematic approach:

- Gather documentation: Collect all relevant financial records, including income sources and allowable deductions.

- Fill out personal information: Enter your name, address, and taxpayer identification number at the top of the form.

- Report income: Accurately list all income earned during the tax year, including wages, dividends, and business income.

- Detail deductions: Itemize any deductions you are eligible for, ensuring that they comply with IRS regulations.

- Review and verify: Double-check all entries for accuracy and completeness before finalizing the form.

- Submit the form: Send the completed Form 10b to the IRS by the due date, either electronically or via mail.

Legal use of the Form 10b

The legal use of the Form 10b hinges on its compliance with IRS regulations. When filled out correctly, it serves as a valid declaration of income and deductions, providing legal protection in case of an audit. It is essential to adhere to the guidelines set forth by the IRS, as any discrepancies or inaccuracies can lead to penalties or legal repercussions. Utilizing electronic signature solutions can enhance the legal standing of the form, ensuring that it is processed efficiently and securely.

Key elements of the Form 10b

Several key elements must be included when completing the Form 10b:

- Taxpayer Identification: Accurate identification of the taxpayer is crucial for processing.

- Income Reporting: All sources of income must be clearly reported and categorized.

- Deductions: A detailed list of eligible deductions should be provided to reduce taxable income.

- Signature: The form must be signed, either physically or electronically, to validate its submission.

- Filing Date: Ensure the form is submitted by the designated deadline to avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Form 10b are critical to avoid penalties. Typically, the form must be submitted by April fifteenth of the tax year following the income being reported. However, if you are unable to meet this deadline, it is advisable to file for an extension. Knowing these important dates helps taxpayers stay compliant and avoid unnecessary complications with the IRS.

Quick guide on how to complete 17b 10b block one globalkochkodinbloomberg

Effortlessly Prepare 17b 10b block one globalkochkodinbloomberg on Any Device

Managing documents online has gained signNow traction among companies and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides all the tools necessary for you to create, modify, and eSign your documents swiftly without delays. Handle rule 17b on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to Edit and eSign rule 17b of income tax act with Ease

- Locate form 10b and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your updates.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiring form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign 17b 10b bullish globalkochkodinbloomberg and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to form 10b

Create this form in 5 minutes!

How to create an eSignature for the 17b 10b bullish globalkochkodinbloomberg

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask 17b 10b block one

-

What is rule 17b and how does it relate to electronic signatures?

Rule 17b governs the requirements for electronic signatures in certain transactions. It is crucial for businesses to ensure compliance with this rule when using tools like airSlate SignNow for eSigning documents, as it validates the legality of transactions and protects against fraud.

-

How does airSlate SignNow support compliance with rule 17b?

airSlate SignNow provides features such as audit trails and secure encryption, making it easier for businesses to comply with rule 17b. These features ensure that all electronic signatures meet the necessary legal standards, reducing the risk of disputes.

-

What pricing plans does airSlate SignNow offer for compliance with rule 17b?

airSlate SignNow offers flexible pricing plans that cater to different business sizes and needs. Even the most basic plan includes essential features to ensure compliance with rule 17b, allowing businesses to engage in secure eSigning without breaking the bank.

-

Can airSlate SignNow integrate with other software while ensuring rule 17b compliance?

Yes, airSlate SignNow seamlessly integrates with various software platforms, such as CRM and ERP systems, without sacrificing compliance with rule 17b. This compatibility allows for streamlined workflows while maintaining the integrity of signed documents.

-

What are the benefits of using airSlate SignNow for documents governed by rule 17b?

Using airSlate SignNow for documents under rule 17b offers numerous benefits, including increased efficiency and reduced turnaround times. The platform enables faster signing processes while ensuring that all signatures meet the legal requirements set forth by rule 17b.

-

Is airSlate SignNow suitable for international transactions under rule 17b?

Absolutely, airSlate SignNow is designed to facilitate international transactions while adhering to rule 17b standards. Its globally recognized eSignature capabilities ensure that your documents are compliant across borders, allowing for seamless business operations.

-

What security measures does airSlate SignNow implement to comply with rule 17b?

airSlate SignNow employs advanced security measures, including multi-factor authentication and encryption, to comply with rule 17b. These measures ensure that your documents are not only legally binding but also secure from unauthorized access.

Get more for rule 17b

- Maryland disclaimer 497310123 form

- Maryland notice lien 497310125 form

- Quitclaim deed from individual to husband and wife maryland form

- Warranty deed from individual to husband and wife maryland form

- Maryland sale form

- Quitclaim deed from corporation to husband and wife maryland form

- Warranty deed from corporation to husband and wife maryland form

- Quitclaim deed from corporation to individual maryland form

Find out other rule 17b of income tax act

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself