Form 8829 PDF

What is the Form 8829 Pdf

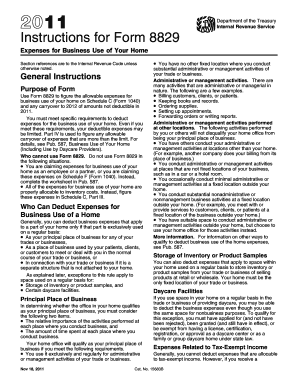

The Form 8829, officially known as the "Expenses for Business Use of Your Home," is a tax form used by individuals who are self-employed or operate a business from their home. This form allows taxpayers to calculate and claim deductions for expenses related to the business use of their residence. It is particularly relevant for those who have a dedicated space in their home that is used exclusively for business purposes. The form helps in determining the allowable expenses such as mortgage interest, utilities, and repairs, which can significantly reduce taxable income.

How to use the Form 8829 Pdf

Using the Form 8829 involves several steps to ensure accurate reporting of home office expenses. Taxpayers must first determine if they qualify for the deduction by meeting specific criteria, such as using a portion of their home regularly and exclusively for business. Once eligibility is established, the form must be filled out with detailed information regarding the home office space, including its size and the total area of the home. The next step is to list all applicable expenses, which can include direct expenses like repairs specific to the office and indirect expenses like a portion of utilities. After completing the form, it should be attached to the taxpayer's annual income tax return.

Steps to complete the Form 8829 Pdf

Completing the Form 8829 involves a systematic approach to ensure all relevant information is accurately reported. Here are the essential steps:

- Determine eligibility by confirming the home office is used regularly and exclusively for business.

- Measure the size of the home office and the total size of the home to calculate the percentage used for business.

- Gather all relevant expense records, including mortgage interest, utilities, and repairs.

- Fill out the form by entering the calculated percentage and listing all applicable expenses.

- Review the completed form for accuracy before attaching it to your tax return.

Legal use of the Form 8829 Pdf

The legal use of Form 8829 is governed by IRS regulations, which stipulate that the deductions claimed must be legitimate and substantiated by appropriate documentation. Taxpayers must ensure that the home office is used exclusively for business activities and that all claimed expenses are directly related to the business use of the home. Failure to comply with these regulations can result in penalties or disallowance of the claimed deductions. It is advisable to maintain thorough records and receipts to support the claims made on the form.

Filing Deadlines / Important Dates

Filing deadlines for Form 8829 align with the general tax filing deadlines for individuals in the United States. Typically, the form must be submitted along with the annual income tax return, which is due on April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any changes in tax law that may affect filing dates or requirements. It's essential to stay informed to avoid late penalties.

Required Documents

To complete the Form 8829 accurately, several documents are necessary. Taxpayers should gather:

- Proof of home ownership or rental agreement.

- Records of all expenses related to the home, including mortgage statements, utility bills, and repair invoices.

- Documentation showing the size of the home and the home office space.

- Any additional records that support the business use of the home.

Quick guide on how to complete form 8829 pdf

Effortlessly Prepare Form 8829 Pdf on Any Device

Digital document management has gained traction among businesses and individuals. It offers a superb environmentally friendly alternative to traditional printed and signed documents, as it allows you to access the correct forms and securely store them online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents rapidly without any holdups. Manage Form 8829 Pdf on any device using the airSlate SignNow Android or iOS applications and enhance your document-related processes today.

The Easiest Way to Modify and eSign Form 8829 Pdf Effortlessly

- Locate Form 8829 Pdf and click Obtain Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Signature tool, which takes only a few seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and then click the Finish button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Put behind you the concerns of lost or misfiled documents, the hassle of searching for forms, or errors that necessitate printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 8829 Pdf and ensure outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8829 pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8829 Pdf and why is it important?

Form 8829 Pdf is a tax form used by self-employed individuals to deduct home office expenses. It's crucial for optimizing tax returns and ensuring that eligible expenses are captured correctly. With airSlate SignNow, you can easily fill and sign Form 8829 Pdf electronically, streamlining your tax preparation process.

-

How can airSlate SignNow help with Form 8829 Pdf preparation?

airSlate SignNow offers a user-friendly platform to create, edit, and eSign Form 8829 Pdf effortlessly. Users can fill in their details, upload additional documents, and ensure everything is accurate before submission. This saves time and reduces the likelihood of errors when filing taxes.

-

Is there a cost associated with using airSlate SignNow for Form 8829 Pdf?

Yes, airSlate SignNow operates on a subscription model, offering various pricing tiers to accommodate different business needs. Each plan includes access to features like eSigning and document creation, which makes managing your Form 8829 Pdf simple and affordable. You can start with a free trial to explore the benefits before committing.

-

Can I integrate airSlate SignNow with my accounting software for Form 8829 Pdf?

Absolutely! airSlate SignNow supports integrations with popular accounting software, allowing you to sync your Form 8829 Pdf data seamlessly. This integration ensures accurate record-keeping and simplifies the process of sending tax documents directly from your accounting platform.

-

What features does airSlate SignNow offer for managing Form 8829 Pdf?

airSlate SignNow provides advanced features such as customizable templates, automatic reminders, and secure cloud storage for Form 8829 Pdf. These tools enhance your document management experience, making it easier to track, send, and sign forms efficiently. Additionally, the platform ensures that all documents are stored securely and accessed from anywhere.

-

How does airSlate SignNow ensure the security of my Form 8829 Pdf?

Security is a top priority at airSlate SignNow, and we implement robust measures to protect your Form 8829 Pdf and other documents. Our platform uses advanced encryption to secure data in transit and at rest, ensuring that only authorized users have access. Regular security audits further enhance the safety of your sensitive information.

-

Can I use airSlate SignNow to send Form 8829 Pdf to multiple recipients?

Yes, airSlate SignNow allows you to send Form 8829 Pdf to multiple recipients simultaneously. This feature is particularly useful for professionals who need approvals or signatures from various parties. The intuitive interface simplifies the process, ensuring all stakeholders can collaborate seamlessly on the document.

Get more for Form 8829 Pdf

- Control number tx p007 pkg form

- Control number tx p013 pkg form

- Bill of sale form texas power of attorney revocation form

- Liberty and justice for texas office of the attorney general form

- This package is an important tool to help you organize your legal affairs after relocating form

- Physicians on behalf of a minor form

- Control number tx p029 pkg form

- Control number tx p032 pkg form

Find out other Form 8829 Pdf

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online