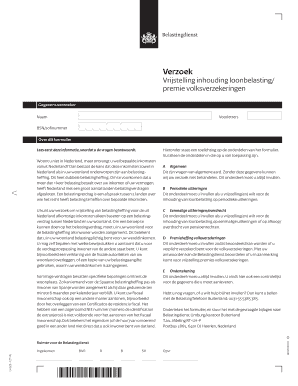

Verzoek Vrijstelling Inhouding Loonbelasting Premie Volksverzekeringen LH 020 1Z 1PL Pensioen Wk Form

What is the vrijstellingsverklaring voor loonbelasting en of premie volksverzekeringen?

The vrijstellingsverklaring voor loonbelasting en of premie volksverzekeringen is a formal request for exemption from wage tax and social security contributions in the Netherlands. This document is essential for individuals who meet specific criteria, allowing them to avoid unnecessary deductions from their wages. The form is particularly relevant for employees who may not need to contribute to certain social security schemes due to their unique circumstances, such as being a student or having a temporary work status.

Steps to complete the vrijstellingsverklaring voor loonbelasting en of premie volksverzekeringen

Completing the vrijstellingsverklaring involves several key steps to ensure accuracy and compliance. Begin by gathering necessary personal information, including your social security number and employment details. Next, fill out the form carefully, ensuring that all sections are completed accurately. After filling out the form, review it for any errors or omissions. Finally, submit the form to your employer or the relevant tax authority for processing. Utilizing digital tools can streamline this process, allowing for easy completion and submission.

Legal use of the vrijstellingsverklaring voor loonbelasting en of premie volksverzekeringen

This form is legally recognized and must be used in accordance with the regulations set forth by the Dutch tax authorities. It is crucial to ensure that the reasons for requesting the exemption are valid and supported by appropriate documentation. Failure to comply with the legal requirements can result in penalties or denial of the exemption. Therefore, understanding the legal framework surrounding this form is essential for any individual considering its use.

Eligibility Criteria for the vrijstellingsverklaring voor loonbelasting en of premie volksverzekeringen

Eligibility for the vrijstellingsverklaring is determined by specific criteria set by the tax authorities. Generally, individuals who are students, temporary workers, or those with low income may qualify for this exemption. It is important to review the guidelines carefully to determine if you meet the necessary conditions. Documentation supporting your eligibility may also be required when submitting the form.

Form Submission Methods for the vrijstellingsverklaring voor loonbelasting en of premie volksverzekeringen

The vrijstellingsverklaring can typically be submitted in various ways, including online through designated tax authority portals, by mail, or in person at local tax offices. Using digital submission methods can enhance efficiency and provide a quicker response time. Ensure that you follow the specific submission guidelines provided by the tax authority to avoid delays or issues with processing your request.

Required Documents for the vrijstellingsverklaring voor loonbelasting en of premie volksverzekeringen

When applying for the vrijstellingsverklaring, certain documents may be required to support your application. These can include proof of income, identification documents, and any relevant correspondence from your employer. It is advisable to prepare these documents in advance to facilitate a smooth application process. Having all necessary paperwork ready can help prevent delays and ensure that your request is processed efficiently.

Quick guide on how to complete verzoek vrijstelling inhouding loonbelasting premie volksverzekeringen lh 020 1z 1pl pensioen wk

Prepare Verzoek Vrijstelling Inhouding Loonbelasting Premie Volksverzekeringen LH 020 1Z 1PL Pensioen wk effortlessly on any device

Online document management has gained immense popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the required form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without delays. Manage Verzoek Vrijstelling Inhouding Loonbelasting Premie Volksverzekeringen LH 020 1Z 1PL Pensioen wk on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to edit and electronically sign Verzoek Vrijstelling Inhouding Loonbelasting Premie Volksverzekeringen LH 020 1Z 1PL Pensioen wk with ease

- Obtain Verzoek Vrijstelling Inhouding Loonbelasting Premie Volksverzekeringen LH 020 1Z 1PL Pensioen wk and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize signNow sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and then click on the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or mistakes that require new document copies to be printed. airSlate SignNow satisfies your document management needs in just a few clicks from any device of your choice. Revise and electronically sign Verzoek Vrijstelling Inhouding Loonbelasting Premie Volksverzekeringen LH 020 1Z 1PL Pensioen wk and ensure superior communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the verzoek vrijstelling inhouding loonbelasting premie volksverzekeringen lh 020 1z 1pl pensioen wk

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a vrijstellingsverklaring voor loonbelasting en of premie volksverzekeringen?

A vrijstellingsverklaring voor loonbelasting en of premie volksverzekeringen is a certificate that exempts individuals from paying certain taxes and social security premiums in the Netherlands. This document is essential for freelancers and self-employed individuals to ensure they are not overtaxed while working on multiple contracts. Utilizing airSlate SignNow can simplify the process of obtaining and managing this important document.

-

How can airSlate SignNow assist me with my vrijstellingsverklaring voor loonbelasting en of premie volksverzekeringen?

With airSlate SignNow, you can easily create and electronically sign your vrijstellingsverklaring voor loonbelasting en of premie volksverzekeringen. Our platform offers templates and streamlined workflows that save you time and reduce errors in the documentation process. Plus, the user-friendly interface ensures you can manage your documents with ease.

-

Is there a cost associated with using airSlate SignNow for my vrijstellingsverklaring?

Yes, airSlate SignNow offers a range of pricing plans tailored to different business needs. The plans are cost-effective, providing access to essential features that can simplify the management of ваши vrijstellingsverklaring voor loonbelasting en of premie volksverzekeringen. You can choose a plan that best suits your volume of document needs and your budget.

-

What features does airSlate SignNow offer for handling my vrijstellingsverklaring?

AirSlate SignNow provides a variety of features designed to streamline the management of your vrijstellingsverklaring voor loonbelasting en of premie volksverzekeringen. These include template creation, document tracking, and secure electronic signatures. Additionally, the platform supports integrations with other applications to enhance your workflow.

-

Are there benefits to using airSlate SignNow for my document signing needs?

Absolutely! Using airSlate SignNow for your vrijstellingsverklaring voor loonbelasting en of premie volksverzekeringen means you can benefit from increased efficiency, reduced paper waste, and enhanced security for your documents. Our platform enables you to complete transactions more quickly, and with signed documents stored securely, you can access them anytime.

-

Can I integrate airSlate SignNow with other tools I use?

Yes, airSlate SignNow is designed to integrate seamlessly with various business applications. This allows you to enhance your workflow and better manage your vrijstellingsverklaring voor loonbelasting en of premie volksverzekeringen alongside other tools you already use, such as Google Drive, Dropbox, and CRM systems.

-

What do I need to get started with airSlate SignNow for my vrijstellingsverklaring?

To get started with airSlate SignNow for your vrijstellingsverklaring voor loonbelasting en of premie volksverzekeringen, you'll need to create an account on our platform. After signing up, you can explore our features, choose a suitable pricing plan, and begin creating and managing your documents with ease.

Get more for Verzoek Vrijstelling Inhouding Loonbelasting Premie Volksverzekeringen LH 020 1Z 1PL Pensioen wk

- Belly dancing beware of the private lesson fraud shiranet form

- Non exclusive buyer broker agreement ampamp agency disclosure this is a legally binding contract form

- End user license ampamp service level agreement this is a legal form

- Contract for sale of goodssale on consignment form

- What is assignment of a trade mark form

- Reply and referral to distributor form

- Attorney generals guide for charities pdf california form

- What is a pre incorporation contractchroncom form

Find out other Verzoek Vrijstelling Inhouding Loonbelasting Premie Volksverzekeringen LH 020 1Z 1PL Pensioen wk

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template