Formulir Know Your Customer Know Your Customer Form Anz Com

Understanding the Formulir Know Your Customer (KYC) Form

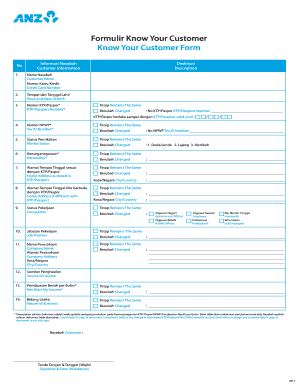

The Formulir Know Your Customer (KYC) is a crucial document used to verify the identity of customers in various financial and legal contexts. This form is essential for businesses to comply with regulations aimed at preventing fraud, money laundering, and other illicit activities. The KYC process involves collecting personal information, such as name, address, date of birth, and identification documents. By accurately completing the Formulir KYC, organizations can ensure they meet compliance standards while fostering a secure environment for their clients.

Steps to Complete the Formulir KYC

Filling out the Formulir KYC requires careful attention to detail. Here are the key steps to ensure proper completion:

- Gather necessary identification documents, such as a government-issued ID, utility bills, or bank statements.

- Accurately fill in personal information, ensuring all details match the provided documents.

- Review the form for any errors or omissions before submission.

- Submit the completed form through the designated method, whether online or in person.

Legal Use of the Formulir KYC

The Formulir KYC is legally binding when completed correctly and submitted according to regulatory guidelines. It serves as a safeguard for both the business and the customer, ensuring that all parties are protected against identity theft and fraud. Compliance with laws such as the Bank Secrecy Act and the USA PATRIOT Act is crucial, as these regulations mandate the use of KYC procedures in financial transactions. By adhering to these legal frameworks, businesses can mitigate risks and enhance their credibility in the marketplace.

Key Elements of the Formulir KYC

Understanding the key elements of the Formulir KYC is vital for effective completion. The main components typically include:

- Personal Information: Full name, address, date of birth, and contact details.

- Identification Documents: Government-issued ID numbers and copies of relevant documents.

- Source of Funds: Information regarding how the individual or entity will fund their account.

- Signature: A declaration that the information provided is accurate and complete.

How to Obtain the Formulir KYC

The Formulir KYC can typically be obtained directly from the financial institution or service provider requiring it. Many organizations offer digital versions of the form that can be downloaded from their websites. Alternatively, physical copies may be available at branch locations. It is important to ensure that you are using the most current version of the form to comply with any updates in regulations.

Examples of Using the Formulir KYC

Businesses across various sectors utilize the Formulir KYC to verify customer identities. Common scenarios include:

- Financial institutions requiring KYC for account openings.

- Investment firms needing to confirm the identities of clients before transactions.

- Online service providers implementing KYC to prevent fraud and ensure compliance.

Quick guide on how to complete formulir know your customer know your customer form anzcom

Complete Formulir Know Your Customer Know Your Customer Form Anz com seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents quickly and without delays. Manage Formulir Know Your Customer Know Your Customer Form Anz com on any device with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Formulir Know Your Customer Know Your Customer Form Anz com effortlessly

- Find Formulir Know Your Customer Know Your Customer Form Anz com and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Select relevant sections of your documents or obscure sensitive data with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Formulir Know Your Customer Know Your Customer Form Anz com and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an anz formulir form?

The anz formulir form is a specific document designed for various business applications, streamlining the signing process. By utilizing airSlate SignNow, you can easily create, customize, and send anz formulir forms for electronic signatures, ensuring efficiency and compliance.

-

How much does airSlate SignNow cost for processing anz formulir forms?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes looking to manage their anz formulir forms. Each plan provides extensive features suited for document signing at competitive prices, allowing you to choose the best fit without breaking the bank.

-

What features does airSlate SignNow provide for anz formulir forms?

With airSlate SignNow, you gain access to features such as customizable templates for anz formulir forms, real-time tracking, and secure audit trails. These tools ensure that your forms are completed efficiently while maintaining high levels of security and accountability.

-

Can I integrate airSlate SignNow with other applications for my anz formulir forms?

Yes, airSlate SignNow seamlessly integrates with various applications such as Google Drive, Salesforce, and more, making it easy to manage your anz formulir forms. This integration capability allows for streamlined workflows and data synchronization across your preferred platforms.

-

What are the benefits of using airSlate SignNow for anz formulir forms?

Using airSlate SignNow for your anz formulir forms brings benefits such as time savings, enhanced collaboration, and reduced paper usage. The user-friendly interface simplifies the signing process, which increases productivity and improves the overall experience for both senders and signers.

-

Is airSlate SignNow secure for handling anz formulir forms?

Absolutely! airSlate SignNow employs industry-leading security measures to ensure that your anz formulir forms are protected. With features like data encryption and secure cloud storage, you can trust that your documents are safe during the signing process.

-

How do I get started with creating anz formulir forms in airSlate SignNow?

Getting started with airSlate SignNow is easy! Sign up for an account, select the 'Create New Form' option, and choose the anz formulir form template you wish to customize. From there, you can add your document details and start sending it for eSignature.

Get more for Formulir Know Your Customer Know Your Customer Form Anz com

- Flrulesorggatewayreadreffiledr 504 ad valorem tax exemption application r 1121 and form

- Application for homestead tax discount veterans age 65 and form

- What employers need to know about reemployment tax form

- International fuel tax agreement florida department of florida dept of revenue florida dept of revenuelicense application form

- Pdf florida business tax application business information florida

- Floridarevenuecompagespriorformsflorida dept of revenue prior years florida tax forms

- Fillable online property tax exemption for homestead form

- Discretionary sales surtax information dr 15dss r 1114

Find out other Formulir Know Your Customer Know Your Customer Form Anz com

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online