Kum and Go W2 Form

What is the Kum And Go W2

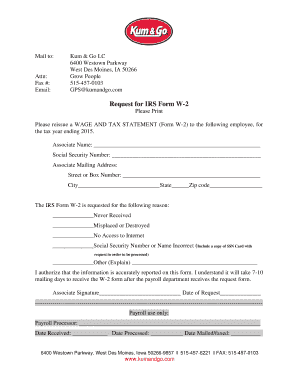

The Kum and Go W2 form is a tax document that reports an employee's annual wages and the amount of taxes withheld from their paychecks. This form is essential for employees to accurately file their income tax returns. It includes vital information such as the employee's Social Security number, total earnings, and federal and state tax withholdings. Understanding this form is crucial for ensuring compliance with tax regulations and for accurate financial reporting.

How to Obtain the Kum And Go W2

Employees can obtain their Kum and Go W2 form through several methods. Typically, employers provide this form at the end of the tax year, either electronically or in paper format. To access the electronic version, employees may need to log into the company’s payroll portal. For those who prefer a physical copy, it can be requested directly from the HR department. It is important to ensure that the correct mailing address is on file to receive the form if it is sent by mail.

Steps to Complete the Kum And Go W2

Completing the Kum and Go W2 form involves several key steps. First, ensure that all personal information is accurate, including your name, address, and Social Security number. Next, verify the earnings and withholdings listed on the form. If any discrepancies are found, contact your employer for clarification. Finally, use the information on the W2 to fill out your federal and state tax returns accurately. It is essential to keep a copy of the W2 for your records once completed.

Legal Use of the Kum And Go W2

The Kum and Go W2 form is legally binding and must be used in accordance with IRS regulations. It is important to ensure that the information provided is truthful and accurate, as any false statements can lead to penalties. The form serves as a crucial document for tax filing and must be submitted by the designated deadlines. Understanding the legal implications of this form helps employees avoid potential issues with tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Kum and Go W2 form are crucial for compliance with tax regulations. Employers are required to send out W2 forms to employees by January thirty-first of each year. Employees must file their tax returns by April fifteenth. Missing these deadlines can result in penalties and interest on unpaid taxes. Keeping track of these important dates ensures timely filing and helps avoid complications with the IRS.

Key Elements of the Kum And Go W2

The Kum and Go W2 form contains several key elements that are essential for accurate tax reporting. These include the employee's name, address, and Social Security number, as well as the employer's information. Additionally, the form details the total wages earned, federal income tax withheld, Social Security wages, and Medicare wages. Understanding these elements is vital for employees to ensure they report their income correctly on their tax returns.

Quick guide on how to complete kum and go w2

Effortlessly prepare Kum And Go W2 on any gadget

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, as you can easily find the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage Kum And Go W2 on any device using airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The simplest way to modify and eSign Kum And Go W2 with ease

- Find Kum And Go W2 and select Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and press the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your desktop.

Bid farewell to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your chosen device. Modify and eSign Kum And Go W2 while ensuring excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the kum and go w2

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the kum and go w2 and how can I access it?

The kum and go w2 is a document that outlines your earnings and taxes withheld for the year. You can access your kum and go w2 through the airSlate SignNow platform, which allows you to seamlessly eSign and manage these documents electronically.

-

How much does it cost to use airSlate SignNow for kum and go w2 eSigning?

airSlate SignNow offers a range of pricing plans, which are affordable and cater to different business needs. By using airSlate SignNow for your kum and go w2 eSigning, you’ll benefit from a cost-effective solution that enhances your workflow without breaking the bank.

-

What features does airSlate SignNow offer for kum and go w2 management?

airSlate SignNow provides features such as secure eSignature, document templates, and integration capabilities tailored for kum and go w2 management. These features ensure that your document handling is efficient, secure, and compliant with industry standards.

-

Can airSlate SignNow integrate with other tools for managing kum and go w2?

Yes, airSlate SignNow integrates with various productivity tools, making it easy to manage your kum and go w2 alongside your existing workflows. This integration ensures that you can streamline your operations while maintaining full control over your documents.

-

What are the benefits of using airSlate SignNow for kum and go w2 eSigning?

Using airSlate SignNow for kum and go w2 eSigning offers numerous benefits, including enhanced security, time savings, and improved accuracy. By digitizing the signing process, you can focus more on your business rather than paperwork.

-

Is the kum and go w2 eSignature legally binding?

Yes, the kum and go w2 eSignature obtained via airSlate SignNow is legally binding and compliant with electronic signature laws. You can confidently use airSlate SignNow to sign your kum and go w2, knowing that it holds the same legal weight as a handwritten signature.

-

How can I troubleshoot issues with my kum and go w2 on airSlate SignNow?

If you encounter issues with your kum and go w2 on airSlate SignNow, you can refer to their extensive help center for troubleshooting tips. Additionally, their customer support team is available to assist you with any specific concerns regarding your kum and go w2 documents.

Get more for Kum And Go W2

- South yorkshire chief constable form

- Australia request travel declaration form

- 2021 new zealand application form

- Wwwnavygovauundergraduate entry officersundergraduate entry officers royal australian navy form

- Casl memorandum of understanding office of the privacy form

- Wwwtemplaterollercomtemplate1866140form i ampquotnotice of participation party templateroller

- Business corporations act subsection 1071 form 8

- Parksaustraliagovaubotanic gardenspubanbg volunteer guide application form parksaustraliagovau

Find out other Kum And Go W2

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed