Restricted Endowment to Educational, Religious, or Charitable Institution Form

Understanding the Restricted Endowment To Educational, Religious, Or Charitable Institution

The restricted endowment to educational, religious, or charitable institutions is a financial contribution designated for specific purposes within these organizations. This type of endowment ensures that the funds are used according to the donor's wishes, often for scholarships, operational costs, or specific projects. By creating a restricted endowment, donors can support causes they care about while ensuring that their contributions are utilized effectively and responsibly.

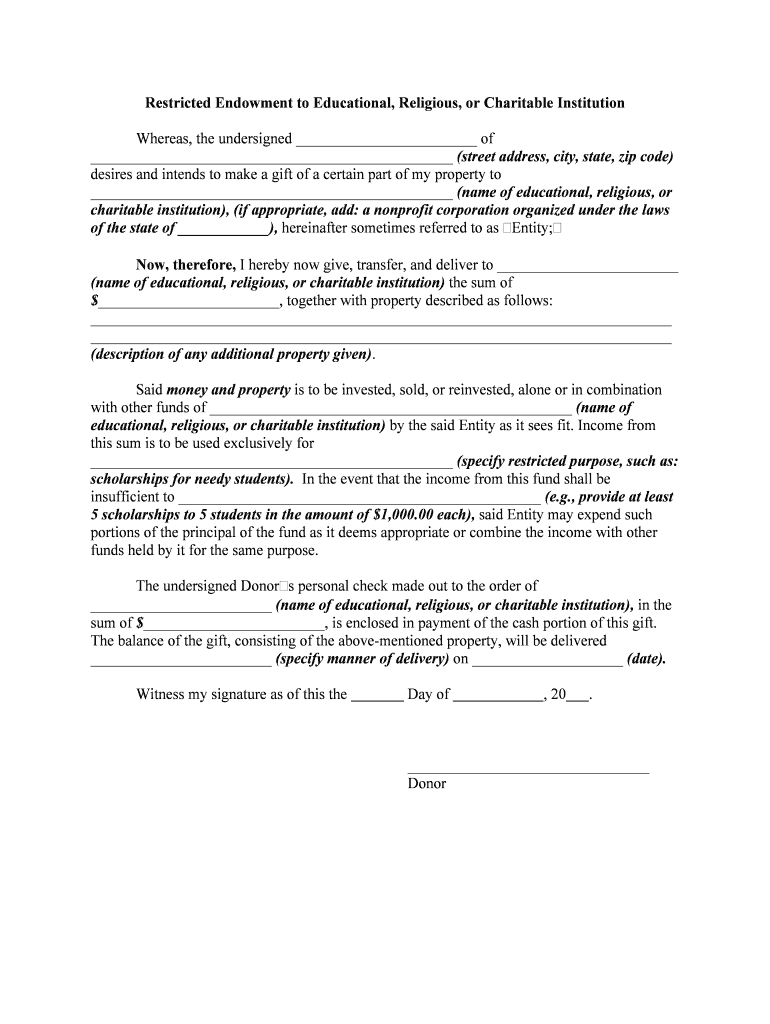

Steps to Complete the Restricted Endowment To Educational, Religious, Or Charitable Institution

Completing the restricted endowment form involves several key steps to ensure accuracy and compliance. Begin by gathering necessary information about the institution and the intended use of the funds. Next, fill out the form with precise details, including the donor's information and the specific restrictions on the endowment. It is crucial to review the form for completeness and accuracy before submission. Finally, ensure that the form is signed and dated to validate the agreement.

Legal Use of the Restricted Endowment To Educational, Religious, Or Charitable Institution

The legal use of the restricted endowment is governed by various regulations that ensure compliance with tax laws and charitable giving guidelines. To be considered legally binding, the endowment must clearly outline the restrictions and intended use of the funds. Compliance with the Internal Revenue Service (IRS) guidelines is essential, as it affects the tax-exempt status of both the donor and the receiving institution. It is advisable to consult legal counsel to ensure that all legal requirements are met.

Key Elements of the Restricted Endowment To Educational, Religious, Or Charitable Institution

Key elements of the restricted endowment include the donor's intent, the specific restrictions placed on the funds, and the intended beneficiaries. The donor's intent should be clearly articulated in the documentation to avoid ambiguity. Restrictions may include stipulations on how the funds can be used, such as for scholarships or specific programs. Understanding these elements is crucial for both the donor and the institution to ensure that the endowment is managed according to the donor's wishes.

Examples of Using the Restricted Endowment To Educational, Religious, Or Charitable Institution

Restricted endowments can be utilized in various ways within educational, religious, or charitable institutions. For instance, a university may receive a restricted endowment specifically for student scholarships, allowing it to support deserving students financially. Similarly, a religious organization might use a restricted endowment to fund community outreach programs. These examples highlight how targeted contributions can make a significant impact on specific initiatives within these organizations.

Eligibility Criteria for the Restricted Endowment To Educational, Religious, Or Charitable Institution

Eligibility criteria for establishing a restricted endowment typically include the donor's ability to legally transfer funds and the institution's status as a recognized educational, religious, or charitable organization. Donors must ensure that the institution meets the IRS requirements for tax-exempt status. Additionally, the intended use of the funds must align with the mission of the institution to qualify for the benefits associated with restricted endowments.

Quick guide on how to complete restricted endowment to educational religious or charitable institution

Manage Restricted Endowment To Educational, Religious, Or Charitable Institution seamlessly across all devices

Digital document management has surged in popularity among companies and individuals alike. It offers an ideal environmentally friendly option compared to traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides all the resources required to create, modify, and electronically sign your documents swiftly and without issues. Process Restricted Endowment To Educational, Religious, Or Charitable Institution on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and electronically sign Restricted Endowment To Educational, Religious, Or Charitable Institution effortlessly

- Locate Restricted Endowment To Educational, Religious, Or Charitable Institution and click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to preserve your changes.

- Select your preferred method to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Restricted Endowment To Educational, Religious, Or Charitable Institution and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Restricted Endowment To Educational, Religious, Or Charitable Institution?

A Restricted Endowment To Educational, Religious, Or Charitable Institution refers to funds that are specifically designated for a particular purpose within these organizations. This ensures that the donations made are used solely for the intended purpose, thereby supporting programs that align with the institution's mission.

-

How can airSlate SignNow help manage Restricted Endowments?

airSlate SignNow simplifies the documentation process for creating and managing Restricted Endowments To Educational, Religious, Or Charitable Institutions. With our eSigning capabilities, organizations can easily obtain signatures on agreements related to these funds, ensuring compliance and transparency throughout the process.

-

What are the pricing options for airSlate SignNow when dealing with Restricted Endowments?

airSlate SignNow offers flexible pricing plans suitable for organizations managing Restricted Endowments To Educational, Religious, Or Charitable Institutions. Our plans are designed to be cost-effective, allowing nonprofits and educational institutions to maximize their resources while maintaining efficient workflows.

-

What features support the creation of Restricted Endowments?

Our platform includes essential features such as customizable templates, secure document storage, and real-time tracking, all designed to make managing Restricted Endowments To Educational, Religious, Or Charitable Institutions more efficient. These tools help organizations create, send, and store essential documentation with ease.

-

Can airSlate SignNow integrate with other tools for managing Restricted Endowments?

Yes, airSlate SignNow integrates seamlessly with a variety of applications commonly used by Educational, Religious, Or Charitable Institutions. This includes CRM systems, accounting software, and project management tools, enhancing the management of Restricted Endowments and streamlining overall operations.

-

What are the benefits of using airSlate SignNow for Restricted Endowments?

Using airSlate SignNow for managing Restricted Endowments To Educational, Religious, Or Charitable Institutions provides enhanced security, improved collaboration, and increased efficiency. Organizations can quickly process documents, reduce paper waste, and maintain compliance with legal standards.

-

How does airSlate SignNow ensure the security of documents related to Restricted Endowments?

airSlate SignNow employs robust security measures such as encryption, secure data storage, and multi-factor authentication to protect documents related to Restricted Endowments To Educational, Religious, Or Charitable Institutions. These features ensure that sensitive information is safely managed throughout the signing process.

Get more for Restricted Endowment To Educational, Religious, Or Charitable Institution

- Home and sole prop loan application loan application form

- Health care professional verification form vermontgov vcic vermont

- Section i medical provider information

- Ar1000f 2019 form

- Both sides must be completed or the form will not be accepted

- Public law 110381 also known as michelles law allows dependent college students insured under their bcbstx form

- Fl 560 5528080 form

- Nevada breifing templetes form

Find out other Restricted Endowment To Educational, Religious, Or Charitable Institution

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP