Form 1001 Rev July , NOT Fill in Capable Ownership, Exemption, or Reduced Rate Certificate

What is the Form 1001 Rev July 1998, Not Fill In Capable Ownership, Exemption, Or Reduced Rate Certificate

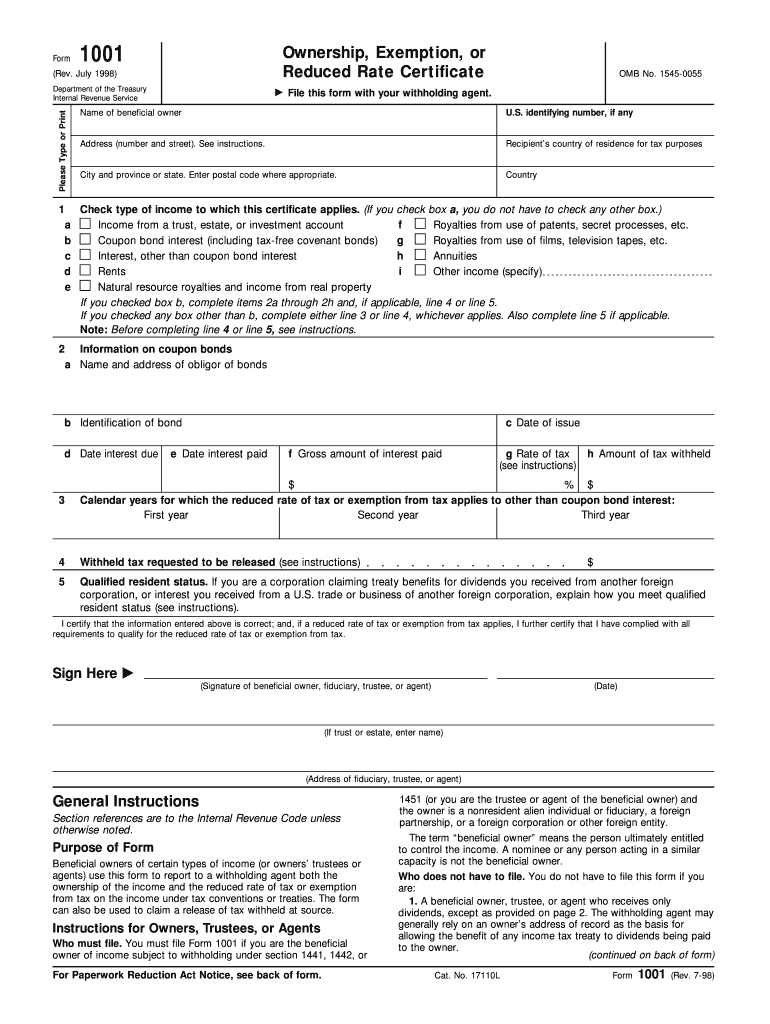

The Form 1001 Rev July 1998 is a critical document used in the context of tax exemptions and reduced rate certificates. This form is specifically designed for individuals and entities to claim ownership exemptions on certain types of income. It is essential for ensuring compliance with U.S. tax regulations, particularly for foreign entities receiving income from U.S. sources. Understanding the purpose and implications of this form is vital for anyone involved in international transactions or tax reporting.

How to use the Form 1001 Rev July 1998, Not Fill In Capable Ownership, Exemption, Or Reduced Rate Certificate

Using the Form 1001 involves several steps to ensure accurate completion and submission. First, gather all necessary information, including your taxpayer identification number and details about the income you are claiming an exemption for. Next, fill out the form carefully, ensuring that all sections are completed accurately. Once completed, the form must be submitted to the appropriate withholding agent or financial institution. It is advisable to keep a copy for your records to ensure compliance and facilitate future reference.

Steps to complete the Form 1001 Rev July 1998, Not Fill In Capable Ownership, Exemption, Or Reduced Rate Certificate

Completing the Form 1001 requires attention to detail. Follow these steps:

- Obtain the latest version of the form from the IRS or authorized sources.

- Provide your name, address, and taxpayer identification number in the designated fields.

- Indicate the type of income for which you are claiming an exemption.

- Sign and date the form to validate your claims.

- Submit the form to the relevant party, such as a bank or other financial institution.

Legal use of the Form 1001 Rev July 1998, Not Fill In Capable Ownership, Exemption, Or Reduced Rate Certificate

The legal use of the Form 1001 is governed by U.S. tax laws, which stipulate that the form must be used accurately to claim exemptions. It is crucial to understand that submitting this form without proper eligibility or documentation can lead to penalties. The form serves as a declaration of the taxpayer's status and must be completed truthfully to maintain compliance with IRS regulations. Failure to adhere to these legal requirements can result in tax liabilities or legal repercussions.

Key elements of the Form 1001 Rev July 1998, Not Fill In Capable Ownership, Exemption, Or Reduced Rate Certificate

Several key elements are essential when dealing with the Form 1001. These include:

- Taxpayer Identification Number: This number is crucial for identifying the entity or individual claiming the exemption.

- Type of Income: Clearly specify the income type for which the exemption is claimed.

- Signature and Date: The form must be signed and dated to be considered valid.

- Supporting Documentation: Any necessary documentation that supports the exemption claim should be attached.

Eligibility Criteria for the Form 1001 Rev July 1998, Not Fill In Capable Ownership, Exemption, Or Reduced Rate Certificate

Eligibility for using the Form 1001 primarily depends on the taxpayer's status and the nature of the income. Generally, foreign entities receiving certain types of income from U.S. sources may qualify for exemptions. It is vital to review the specific criteria outlined by the IRS to determine eligibility. This may include factors such as the type of income, the residency status of the taxpayer, and compliance with U.S. tax laws.

Quick guide on how to complete form 1001

Effortlessly prepare form 1001 on any device

Managing documents online has gained signNow traction among organizations and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents quickly without any hold-ups. Handle form 1001 on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

Edit and eSign form 1001 with ease

- Obtain form 1001 and click on Get Form to initiate the process.

- Utilize the tools available to complete your form.

- Highlight necessary sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, be it via email, SMS, or shareable link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign form 1001 and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to form 1001

Create this form in 5 minutes!

How to create an eSignature for the form 1001

How to create an electronic signature for your Form 1001 Rev July 1998 Not Fill In Capable Ownership Exemption Or Reduced Rate Certificate in the online mode

How to create an electronic signature for your Form 1001 Rev July 1998 Not Fill In Capable Ownership Exemption Or Reduced Rate Certificate in Chrome

How to generate an electronic signature for signing the Form 1001 Rev July 1998 Not Fill In Capable Ownership Exemption Or Reduced Rate Certificate in Gmail

How to make an electronic signature for the Form 1001 Rev July 1998 Not Fill In Capable Ownership Exemption Or Reduced Rate Certificate from your smart phone

How to create an eSignature for the Form 1001 Rev July 1998 Not Fill In Capable Ownership Exemption Or Reduced Rate Certificate on iOS

How to generate an eSignature for the Form 1001 Rev July 1998 Not Fill In Capable Ownership Exemption Or Reduced Rate Certificate on Android devices

People also ask form 1001

-

What is form 1001, and how is it used in the airSlate SignNow platform?

Form 1001 is a customizable document template designed to facilitate electronic signatures on the airSlate SignNow platform. Businesses can use form 1001 to streamline their document signing process, making it efficient and secure. This template helps users gather necessary data and approvals quickly.

-

How can I integrate form 1001 with other tools I use?

airSlate SignNow allows seamless integration of form 1001 with various tools like CRM systems, cloud storage, and workflow apps. By utilizing our API and built-in integrations, users can automate document workflows and enhance productivity. Integration ensures that your processes remain smooth and efficient.

-

What pricing options are available for using form 1001 with airSlate SignNow?

AirSlate SignNow offers a variety of pricing plans based on your needs, enabling you to utilize form 1001 according to your budget. Our plans include affordable options for small businesses and features suited for larger enterprises. You can choose a plan that provides the best value while accessing all functionalities of form 1001.

-

What are the main features of form 1001 in airSlate SignNow?

Form 1001 includes features such as customizable fields, automated reminder settings, and secure electronic signature capabilities. These features simplify the signing process and help maintain compliance with legal standards. Additionally, users can track document status and receive notifications upon completion.

-

What are the benefits of using form 1001 for my business?

Using form 1001 enhances workflow efficiency and reduces paperwork, allowing your business to operate more smoothly. It also accelerates the document approval process, leading to faster decision-making. The user-friendly design ensures that employees and clients can easily understand and complete the form.

-

Is form 1001 secure for sensitive documents?

Yes, form 1001 on airSlate SignNow meets industry-leading security standards, ensuring that all documents are securely transmitted and stored. We use advanced encryption methods and multi-factor authentication to protect sensitive information. Your data privacy and security are our top priorities.

-

Can I customize form 1001 for different use cases?

Absolutely! Form 1001 is highly customizable, allowing you to tailor it to various use cases, such as contracts, agreements, or approval requests. This flexibility enables businesses to adjust fields, branding, and workflows to fit their specific needs and enhance user experience.

Get more for form 1001

- The case of the long lost son worksheet answers form

- Richmor aviation schenectady form

- Oregon bin application form

- This form pdf united teletech financial utfinancial

- Section 3 2 the gas laws answer key form

- Oylax form

- Application for salvage title colorado form

- Recorded statement summary claims pages form

Find out other form 1001

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online