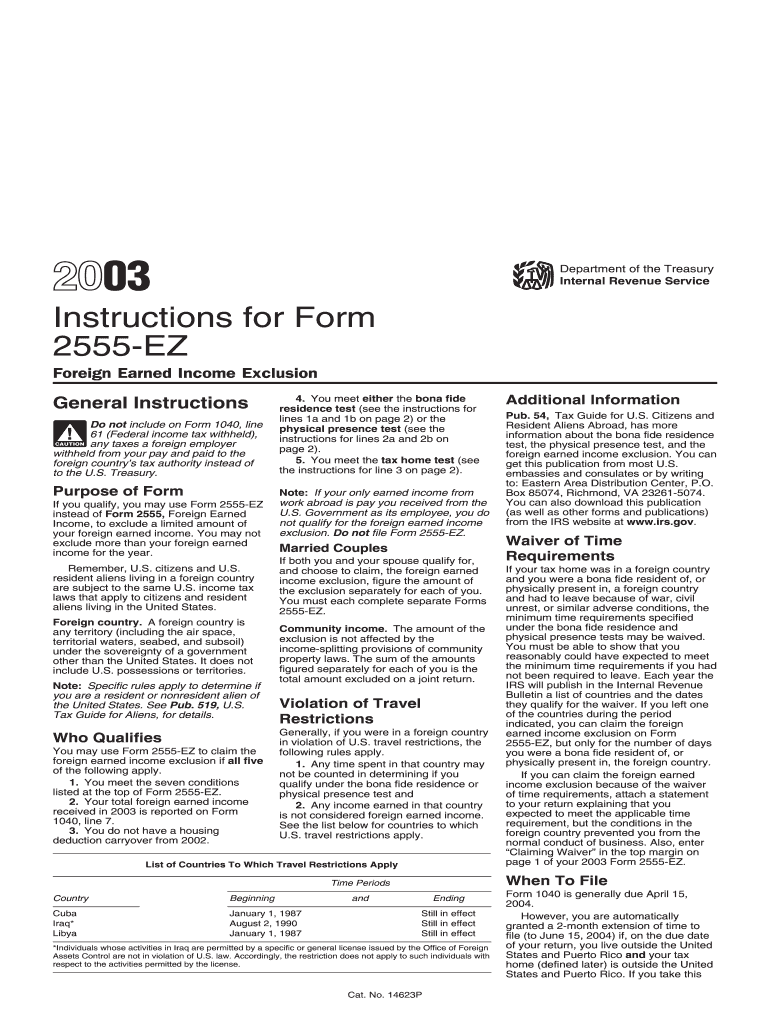

Instructions for Form 2555 EZ Foreign Earned Income Exclusion Department of the Treasury Internal Revenue Service General I

Understanding Form 2555 Instructions

The form 2555 instructions provide essential guidance for U.S. citizens and resident aliens who wish to claim the foreign earned income exclusion. This form allows eligible taxpayers to exclude a portion of their foreign earnings from U.S. taxation, thereby reducing their overall tax liability. The instructions detail the eligibility criteria, necessary documentation, and the calculation methods to ensure accurate completion of the form.

Steps to Complete Form 2555

Completing the form 2555 involves several key steps:

- Determine eligibility based on your foreign residency and income sources.

- Gather necessary documents, including proof of foreign earned income and residency.

- Fill out the form, ensuring accurate reporting of income and any applicable exclusions.

- Review the completed form for accuracy before submission.

Each step is crucial for ensuring compliance and maximizing potential tax benefits.

Required Documents for Form 2555

To successfully complete the form 2555, you will need to provide specific documentation, including:

- Proof of foreign earned income, such as pay stubs or tax returns from the foreign country.

- Documentation confirming your residency in a foreign country, such as a lease agreement or utility bills.

- Any other relevant tax documents that support your claims on the form.

Having these documents ready will facilitate a smoother filing process.

Filing Deadlines for Form 2555

It is important to be aware of the filing deadlines for the form 2555. Generally, the form must be submitted along with your annual tax return. The standard deadline for U.S. taxpayers is April 15. However, if you are living abroad, you may qualify for an automatic extension until June 15. Additional extensions may be available upon request.

Legal Use of Form 2555

The form 2555 is legally binding when completed accurately and submitted in accordance with IRS regulations. To ensure its validity, taxpayers must adhere to the instructions provided and maintain compliance with relevant tax laws. This includes accurate reporting of income and timely submission of the form to avoid penalties.

IRS Guidelines for Form 2555

The IRS provides comprehensive guidelines for completing the form 2555. These guidelines include detailed explanations of eligibility criteria, instructions for calculating the foreign earned income exclusion, and information on how to report foreign taxes paid. Familiarizing yourself with these guidelines is essential for a successful filing.

Eligibility Criteria for Form 2555

To qualify for the foreign earned income exclusion using the form 2555, you must meet specific eligibility criteria. This includes being a U.S. citizen or resident alien, having foreign earned income, and meeting either the bona fide residence test or the physical presence test. Understanding these criteria is crucial for determining your eligibility and maximizing potential tax benefits.

Quick guide on how to complete form 2555 ez

Complete form 2555 ez seamlessly on any platform

Digital document management has gained traction among companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, edit, and eSign your documents swiftly without delays. Manage form 2555 instructions on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign 2555 ez instructions effortlessly

- Locate 2555 instructions and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or conceal confidential information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your updates.

- Select how you would like to share your form, via email, SMS, or invitation link, or download it to your PC.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate the printing of additional document copies. airSlate SignNow fulfills your requirements in document management in just a few clicks from a device of your choice. Modify and eSign foreign earned income exclusion and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to form 2555 instructions

Create this form in 5 minutes!

How to create an eSignature for the 2555 ez instructions

How to make an electronic signature for your 2003 Instructions For Form 2555 Ez Foreign Earned Income Exclusion Department Of The Treasury Internal Revenue Service General in the online mode

How to create an eSignature for the 2003 Instructions For Form 2555 Ez Foreign Earned Income Exclusion Department Of The Treasury Internal Revenue Service General in Google Chrome

How to generate an electronic signature for signing the 2003 Instructions For Form 2555 Ez Foreign Earned Income Exclusion Department Of The Treasury Internal Revenue Service General in Gmail

How to generate an eSignature for the 2003 Instructions For Form 2555 Ez Foreign Earned Income Exclusion Department Of The Treasury Internal Revenue Service General right from your smartphone

How to create an electronic signature for the 2003 Instructions For Form 2555 Ez Foreign Earned Income Exclusion Department Of The Treasury Internal Revenue Service General on iOS

How to generate an eSignature for the 2003 Instructions For Form 2555 Ez Foreign Earned Income Exclusion Department Of The Treasury Internal Revenue Service General on Android OS

People also ask foreign earned income exclusion

-

What are the form 2555 instructions for expatriates?

The form 2555 instructions provide detailed guidance for expatriates to claim the Foreign Earned Income Exclusion. This includes eligibility criteria and how to correctly fill out the form to maximize tax benefits. Understanding these instructions is crucial for ensuring compliance and optimizing your tax obligations.

-

How can I access the latest form 2555 instructions?

You can access the latest form 2555 instructions directly from the IRS website, which offers comprehensive and updated guidelines. This is essential for ensuring you have the most accurate information when completing your form. Always refer to the official source to avoid any discrepancies.

-

Are there any fees associated with using airSlate SignNow to complete form 2555?

AirSlate SignNow offers a cost-effective solution for eSigning documents, including form 2555. While the platform does have subscription fees, it provides numerous features that simplify the eSigning process, making it a worthwhile investment for businesses and individuals alike. Check our pricing page for specific details.

-

What features does airSlate SignNow provide for handling form 2555?

AirSlate SignNow includes features such as document templates, secure eSigning, and collaboration tools, which streamline the process of handling form 2555. These capabilities enhance efficiency and reduce the time spent on paperwork. Users can easily customize their forms to fit specific needs.

-

How does airSlate SignNow enhance the process of submitting form 2555?

Using airSlate SignNow can signNowly enhance the process of submitting form 2555 by providing a clear, user-friendly interface for eSigning and managing documents. The platform also ensures that your submissions are secure and compliant, reducing the stress and complexity often associated with tax forms.

-

Can form 2555 instructions be integrated with other tax software?

Yes, airSlate SignNow can integrate with various tax software to help users efficiently manage form 2555 and its corresponding instructions. This integration allows for seamless data transfer and enhances the overall filing process. Such compatibility ensures you can use the tools that best suit your needs.

-

What benefits do I get by using airSlate SignNow for form 2555?

By using airSlate SignNow for form 2555, you gain access to streamlined workflows, enhanced security for sensitive information, and the ability to collect signatures remotely. This efficiency not only saves time but also helps prevent errors that can arise from manual processes. It's designed to support the needs of both individuals and businesses.

Get more for form 2555 ez

Find out other instructions 2555

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online