Announcement 61 Failure by Certain Charitable Organizations to Meet Certain Qualification Requirements; Taxes on Excess B Form

What is the Announcement 61 Failure By Certain Charitable Organizations To Meet Certain Qualification Requirements; Taxes On Excess B

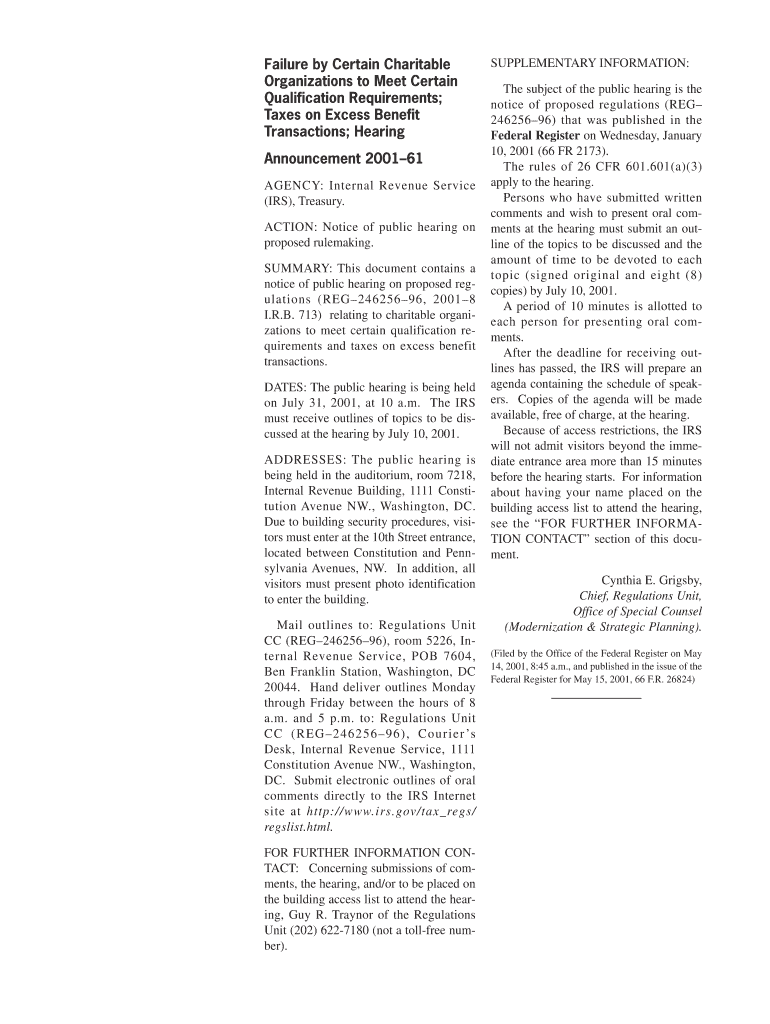

The Announcement 61 addresses the failure of specific charitable organizations to comply with qualification requirements set forth by the IRS. This document outlines the tax implications for organizations that do not meet the necessary criteria, particularly concerning excess tax liabilities. It serves as a guideline for understanding the responsibilities of charitable organizations and the potential consequences of non-compliance.

Key elements of the Announcement 61 Failure By Certain Charitable Organizations To Meet Certain Qualification Requirements; Taxes On Excess B

Several key elements define the Announcement 61. These include:

- Qualification Requirements: Organizations must adhere to specific operational and financial standards to maintain their tax-exempt status.

- Excess Tax Liabilities: If an organization fails to meet these requirements, it may incur taxes on excess revenues that exceed allowable limits.

- Compliance Guidelines: The announcement provides clear guidelines for organizations to follow in order to avoid penalties and maintain compliance.

Steps to complete the Announcement 61 Failure By Certain Charitable Organizations To Meet Certain Qualification Requirements; Taxes On Excess B

Completing the necessary documentation related to Announcement 61 involves several steps:

- Review the qualification requirements outlined by the IRS to ensure your organization is compliant.

- Assess your current financial status to determine if any excess revenues exist.

- Gather all necessary documentation that demonstrates compliance with the qualification standards.

- Complete the required forms accurately, ensuring all information is current and correct.

- Submit the forms to the IRS by the specified deadlines to avoid penalties.

Legal use of the Announcement 61 Failure By Certain Charitable Organizations To Meet Certain Qualification Requirements; Taxes On Excess B

The legal use of Announcement 61 is crucial for maintaining compliance with IRS regulations. Organizations must understand the legal implications of failing to meet qualification requirements, which can lead to significant tax liabilities. Properly completing and submitting the necessary forms ensures that organizations remain in good standing and avoid legal repercussions.

Filing Deadlines / Important Dates

Organizations must be aware of specific filing deadlines related to Announcement 61 to avoid penalties. Important dates include:

- Annual filing deadlines for tax-exempt organizations.

- Specific dates for submitting any required documentation related to excess tax liabilities.

- Notification deadlines for any changes in operational status that may affect qualification.

Penalties for Non-Compliance

Failure to comply with the requirements outlined in Announcement 61 can result in serious penalties. These may include:

- Imposition of taxes on excess revenues.

- Loss of tax-exempt status, which can significantly impact the organization’s operations.

- Potential legal action from regulatory bodies if compliance issues persist.

Quick guide on how to complete announcement 2001 61 failure by certain charitable organizations to meet certain qualification requirements taxes on excess

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained popularity among organizations and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents promptly without any hold-ups. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Edit and Electronically Sign [SKS] with Ease

- Acquire [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive details with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow takes care of your document management needs in just a few clicks from your chosen device. Edit and electronically sign [SKS] and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Announcement 61 Failure By Certain Charitable Organizations To Meet Certain Qualification Requirements; Taxes On Excess B

Create this form in 5 minutes!

How to create an eSignature for the announcement 2001 61 failure by certain charitable organizations to meet certain qualification requirements taxes on excess

How to make an electronic signature for the Announcement 2001 61 Failure By Certain Charitable Organizations To Meet Certain Qualification Requirements Taxes On Excess in the online mode

How to generate an electronic signature for the Announcement 2001 61 Failure By Certain Charitable Organizations To Meet Certain Qualification Requirements Taxes On Excess in Google Chrome

How to create an electronic signature for putting it on the Announcement 2001 61 Failure By Certain Charitable Organizations To Meet Certain Qualification Requirements Taxes On Excess in Gmail

How to make an electronic signature for the Announcement 2001 61 Failure By Certain Charitable Organizations To Meet Certain Qualification Requirements Taxes On Excess straight from your smartphone

How to generate an electronic signature for the Announcement 2001 61 Failure By Certain Charitable Organizations To Meet Certain Qualification Requirements Taxes On Excess on iOS

How to make an electronic signature for the Announcement 2001 61 Failure By Certain Charitable Organizations To Meet Certain Qualification Requirements Taxes On Excess on Android devices

People also ask

-

What is Announcement 61 regarding charitable organizations?

Announcement 61 addresses the failure by certain charitable organizations to meet specific qualification requirements for tax-exempt status. Organizations not complying with these requirements may face taxes on excess benefits granted to insiders, making it crucial for non-profits to understand the implications of this announcement.

-

How can airSlate SignNow help organizations comply with Announcement 61?

airSlate SignNow facilitates the efficient management of documentation necessary for compliance with Announcement 61. By allowing organizations to electronically sign and store important documents, it aids in maintaining proper records that reflect compliance with qualification requirements.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers several pricing plans to suit a range of organizational needs, ensuring cost-effective solutions for businesses wanting to comply with Announcement 61. With subscription tiers that provide access to various features, non-profits can choose what fits their budget while maintaining compliance.

-

What key features of airSlate SignNow support document management for charitable organizations?

Key features of airSlate SignNow include document templates, collaboration tools, and secure eSignature capabilities. These tools help organizations streamline their documentation processes, ensuring they remain compliant with requirements set by Announcement 61 while saving time.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates with popular business applications such as Google Drive, Salesforce, and Zapier. These integrations allow organizations to enhance their workflow efficiency, ensuring they can manage compliance with Announcement 61 seamlessly within their existing systems.

-

What benefits does using airSlate SignNow provide for compliance with tax regulations?

Using airSlate SignNow ensures that charitable organizations have access to an organized, efficient way to manage documents related to tax regulations, including Announcement 61. The platform offers the assurance that documents are securely signed and stored, minimizing the risk of non-compliance.

-

How does airSlate SignNow ensure document security for nonprofits?

airSlate SignNow employs advanced security measures including encryption and secure access protocols to protect sensitive documents. This level of security is particularly important for organizations dealing with compliance issues related to Announcement 61, as it safeguards against unauthorized access.

Get more for Announcement 61 Failure By Certain Charitable Organizations To Meet Certain Qualification Requirements; Taxes On Excess B

- Home school verification form ahsra org

- Migracell form

- Tenancy application form ray mascaro amp co pty ltd

- Attestato di qualifica professionale regionale form

- United states navy deceased retiree survivor s guide form

- Equuitrust service request form

- M249 qualification scorecard form

- Brother2brother returns form

Find out other Announcement 61 Failure By Certain Charitable Organizations To Meet Certain Qualification Requirements; Taxes On Excess B

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure