CD 405 Corporation Tax Return Submit Forms in the

What is the CD 405 Corporation Tax Return Submit Forms In The

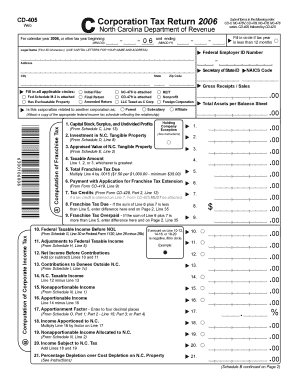

The CD 405 Corporation Tax Return Submit Forms In The is an essential document used by corporations in the United States to report their income, gains, losses, deductions, and credits. This form is crucial for determining the corporation's tax liability to the federal government. Corporations must accurately complete and submit this form to comply with IRS regulations. The form captures various financial data, including total revenue, cost of goods sold, and taxable income, which ultimately influences the amount of tax owed.

Steps to complete the CD 405 Corporation Tax Return Submit Forms In The

Completing the CD 405 Corporation Tax Return Submit Forms In The involves several important steps:

- Gather necessary financial documents, including income statements and balance sheets.

- Fill out the form with accurate figures, ensuring all income and deductions are reported.

- Review the completed form for any errors or omissions.

- Sign the form electronically using a compliant eSignature solution to ensure its validity.

- Submit the form through the designated method, either online or via mail.

Legal use of the CD 405 Corporation Tax Return Submit Forms In The

The legal use of the CD 405 Corporation Tax Return Submit Forms In The is governed by IRS regulations. To be considered valid, the form must be completed accurately and submitted on time. Electronic signatures are legally binding if they comply with the ESIGN Act and UETA, ensuring that the form holds up in legal contexts. Corporations should maintain a copy of the submitted form and any supporting documents for their records, as these may be required for audits or inquiries from the IRS.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines for the CD 405 Corporation Tax Return Submit Forms In The. The standard deadline for filing is the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations with a fiscal year ending on December 31, the deadline is typically April 15 of the following year. Extensions may be available, but it is crucial to file for an extension before the original deadline to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The CD 405 Corporation Tax Return Submit Forms In The can be submitted through various methods, providing flexibility for corporations. The primary submission methods include:

- Online: Corporations can file electronically through the IRS e-file system or authorized e-file providers.

- Mail: The completed form can be printed and mailed to the appropriate IRS address based on the corporation's location.

- In-Person: Some corporations may choose to deliver the form in person at designated IRS offices, although this method is less common.

Required Documents

To complete the CD 405 Corporation Tax Return Submit Forms In The, corporations must gather several required documents. These typically include:

- Financial statements, such as income statements and balance sheets.

- Records of all income received during the tax year.

- Documentation for deductions and credits claimed.

- Prior year tax returns for reference and consistency.

Quick guide on how to complete cd 405 corporation tax return submit forms in the

Complete CD 405 Corporation Tax Return Submit Forms In The effortlessly on any device

Online document management has become widespread among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without delays. Manage CD 405 Corporation Tax Return Submit Forms In The on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to alter and eSign CD 405 Corporation Tax Return Submit Forms In The with ease

- Obtain CD 405 Corporation Tax Return Submit Forms In The and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that use.

- Generate your signature with the Sign feature, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to submit your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in a few clicks from any device you prefer. Alter and eSign CD 405 Corporation Tax Return Submit Forms In The and ensure effective communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cd 405 corporation tax return submit forms in the

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CD 405 Corporation Tax Return Submit Forms In The?

The CD 405 Corporation Tax Return Submit Forms In The refers to a specific form that corporations must file to declare their annual profits and tax liabilities. With airSlate SignNow, you can easily eSign and submit these forms electronically, streamlining your tax filing process.

-

How does airSlate SignNow simplify the CD 405 Corporation Tax Return Submit Forms In The process?

airSlate SignNow simplifies the CD 405 Corporation Tax Return Submit Forms In The process by providing an intuitive platform for document signing and management. You can upload, sign, and send your forms securely, all while maintaining compliance with legal requirements.

-

What are the pricing options for using airSlate SignNow for CD 405 Corporation Tax Return Submit Forms In The?

airSlate SignNow offers various pricing plans that cater to businesses of all sizes. You can choose from monthly or annual subscriptions, which include features tailored for efficiently managing and submitting your CD 405 Corporation Tax Return Submit Forms In The.

-

Are there any integration capabilities for airSlate SignNow with other accounting software related to CD 405 Corporation Tax Return Submit Forms In The?

Yes, airSlate SignNow integrates seamlessly with leading accounting and tax software platforms. This integration allows you to streamline your workflows when preparing and submitting your CD 405 Corporation Tax Return Submit Forms In The.

-

What features does airSlate SignNow offer for managing CD 405 Corporation Tax Return Submit Forms In The?

airSlate SignNow offers features such as document templates, automated reminders, and secure cloud storage, all designed to help manage your CD 405 Corporation Tax Return Submit Forms In The efficiently. These tools ensure that you never miss a filing deadline.

-

How secure is the submission of CD 405 Corporation Tax Return Submit Forms In The through airSlate SignNow?

Security is a top priority for airSlate SignNow; we use advanced encryption and secure data storage practices. This ensures that your CD 405 Corporation Tax Return Submit Forms In The and all other sensitive documents are protected throughout the submission process.

-

Can airSlate SignNow help with tracking the status of my CD 405 Corporation Tax Return Submit Forms In The?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of your CD 405 Corporation Tax Return Submit Forms In The. You’ll receive notifications for each step of the submission process, keeping you informed every step of the way.

Get more for CD 405 Corporation Tax Return Submit Forms In The

- In the chancery court of wikiformorg

- Fillable online reaffirmation agreement clf162 fax email form

- Insert caption and style of case form

- 050914 daily corinthian e edition by daily corinthian issuu form

- Any and all powers of attorney form

- Psychiatric advance directives bazelon center for mental form

- 18 printable quit claim deed form washington state

- This letter concerns the contract for deed between you and i dated form

Find out other CD 405 Corporation Tax Return Submit Forms In The

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online