Form Sc8857

What is the Form SC8857

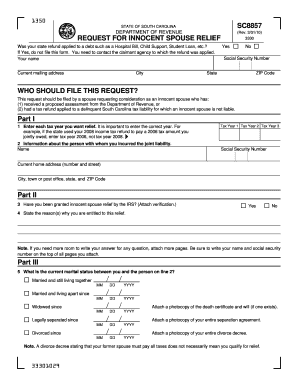

The Form SC8857, also known as the Request for Innocent Spouse Relief, is a tax form used by individuals in the United States to seek relief from tax liabilities incurred by a spouse or former spouse. This form is particularly relevant for taxpayers who believe they should not be held responsible for taxes due to their spouse's actions, such as underreporting income or claiming improper deductions. By submitting this form, individuals can request that the IRS consider their circumstances and potentially relieve them from the obligation to pay certain taxes.

How to use the Form SC8857

Using the Form SC8857 involves several steps to ensure that the request for relief is properly submitted. First, gather all necessary documentation that supports your claim, including tax returns and any relevant correspondence with the IRS. Next, complete the form accurately, providing all requested information about your marital status and the tax liabilities in question. Once the form is filled out, review it for accuracy before submitting it to the IRS. It is advisable to keep copies of all documents submitted for your records.

Steps to complete the Form SC8857

Completing the Form SC8857 requires careful attention to detail. Follow these steps:

- Begin by providing your personal information, including your name, address, and Social Security number.

- Indicate your marital status and provide details about your spouse or former spouse.

- List the tax years for which you are requesting relief and explain why you believe you qualify for innocent spouse relief.

- Attach any supporting documentation that substantiates your claim, such as tax returns or IRS notices.

- Sign and date the form before submitting it to the appropriate IRS address.

Legal use of the Form SC8857

The legal use of the Form SC8857 is governed by specific IRS guidelines that outline eligibility for innocent spouse relief. To qualify, the requesting spouse must demonstrate that they were unaware of the tax issues and that it would be unfair to hold them liable for the tax debt. The IRS evaluates each request based on the facts and circumstances surrounding the case, including the level of participation in the tax matters and any potential economic hardship that may result from enforcing the tax liability.

Filing Deadlines / Important Dates

Filing deadlines for the Form SC8857 are crucial for ensuring that your request for relief is considered. Generally, the form must be submitted within two years of the IRS initiating collection actions against you. It is important to stay informed about any changes in IRS regulations or deadlines that may affect your submission. Keeping track of important dates can help prevent complications in your case.

Required Documents

When submitting the Form SC8857, it is essential to include all required documents to support your claim. These may include:

- Your tax returns for the years in question.

- Any notices or correspondence from the IRS related to the tax liabilities.

- Documentation that demonstrates your financial situation, such as pay stubs or bank statements.

- Any other relevant information that may assist the IRS in evaluating your request.

Quick guide on how to complete form sc8857

Complete Form Sc8857 effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Form Sc8857 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Form Sc8857 with ease

- Locate Form Sc8857 and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant portions of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Modify and eSign Form Sc8857 and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form sc8857

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form Sc8857 and how can airSlate SignNow help?

Form Sc8857 is a document used for requesting the IRS to settle tax liabilities. airSlate SignNow offers a user-friendly platform that allows users to easily fill out, sign, and manage Form Sc8857 online, ensuring a smooth filing process.

-

How much does it cost to use airSlate SignNow for Form Sc8857?

airSlate SignNow offers various pricing plans designed for individual users and businesses. You can choose a plan that suits your needs and budget, whether you only need to fill out Form Sc8857 occasionally or require frequent access to document signing services.

-

What features does airSlate SignNow offer for managing Form Sc8857?

airSlate SignNow provides advanced features such as templates, custom branding, and real-time tracking for Form Sc8857. These tools streamline the signing process and enhance overall efficiency, allowing you to focus on your core business activities.

-

Are there any integrations available for Form Sc8857 with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications and platforms, enhancing your ability to manage Form Sc8857. You can connect it with popular software like Google Drive, Salesforce, and Dropbox, making it easier to access and share your important documents.

-

Can I sign Form Sc8857 electronically using airSlate SignNow?

Absolutely! airSlate SignNow allows you to electronically sign Form Sc8857 with just a few clicks. This feature not only saves time but also ensures that your documents are legally binding and secure.

-

What are the benefits of using airSlate SignNow for Form Sc8857?

Using airSlate SignNow for Form Sc8857 provides numerous benefits, including improved accuracy, time savings, and reduced paperwork. The platform's intuitive interface and streamlined processes help you manage your documents efficiently.

-

Is user support available for issues with Form Sc8857 in airSlate SignNow?

Yes, airSlate SignNow offers comprehensive customer support to assist you with any issues related to Form Sc8857. Our support team is available via chat and email to ensure your experience is smooth and satisfactory.

Get more for Form Sc8857

- Laws enforced by the employment litigation section form

- Business law post test 3 homework flashcardsquizlet form

- No 15 3839 in the united states court of appeals form

- Eleventh circuit pattern jury instructions insider trading by form

- Civil rights without remedies vicarious liability under title form

- Tax considerations when settling employment cases form

- Revenge isnt wise avoiding retaliation claims form

- Chapter 1 arizona attorney general form

Find out other Form Sc8857

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors