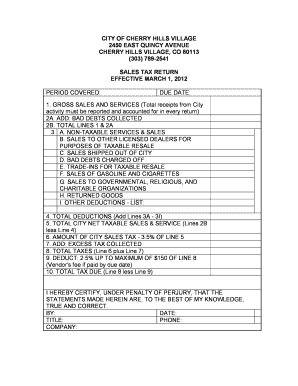

Cherry Hills Village Sales Tax Form

What is the Cherry Hills Village Sales Tax

The Cherry Hills Village sales tax is a local tax imposed on the sale of goods and services within the municipality. This tax is collected by businesses at the point of sale and is typically added to the purchase price. The revenue generated from this tax is used to fund various public services and infrastructure projects in the community, such as education, transportation, and public safety. Understanding the specifics of this tax is essential for both residents and businesses operating in the area.

Steps to complete the Cherry Hills Village Sales Tax

Completing the Cherry Hills Village sales tax form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including sales records and receipts. Next, accurately calculate the total sales tax owed based on the applicable rate. Fill out the sales tax form with precise details, including your business information and the total sales amount. After completing the form, review it for any errors before submitting it. Finally, ensure that you submit the form by the designated deadline to avoid any penalties.

Legal use of the Cherry Hills Village Sales Tax

The legal use of the Cherry Hills Village sales tax is governed by local and state regulations. Businesses must collect this tax on taxable sales and remit it to the appropriate authorities. It is crucial for businesses to understand which transactions are subject to sales tax and to maintain accurate records of all sales and tax collected. Non-compliance with sales tax regulations can result in significant penalties, including fines and interest on unpaid amounts. Therefore, staying informed about legal obligations is essential for business owners.

Form Submission Methods

There are several methods available for submitting the Cherry Hills Village sales tax form. Businesses can choose to submit the form online through the local government’s tax portal, which often provides a streamlined process. Alternatively, forms can be mailed directly to the tax authority or submitted in person at designated offices. Each method has its advantages, and businesses should select the one that best fits their operational needs while ensuring timely submission.

Penalties for Non-Compliance

Failure to comply with the Cherry Hills Village sales tax requirements can lead to various penalties. Businesses that do not collect or remit the correct amount of sales tax may face fines, interest charges on overdue amounts, and potential legal action. It is important for businesses to remain vigilant in their tax obligations to avoid these consequences. Regular audits and consultations with tax professionals can help ensure compliance and mitigate risks.

Key elements of the Cherry Hills Village Sales Tax

Several key elements define the Cherry Hills Village sales tax framework. These include the tax rate, which may vary based on the type of goods or services sold, and the specific exemptions that apply. Understanding these elements helps businesses determine their tax liabilities accurately. Additionally, staying updated on any changes to tax legislation or rates is crucial for maintaining compliance and ensuring proper tax collection.

Quick guide on how to complete cherry hills village sales tax

Complete cherry hills village sales tax effortlessly on any gadget

Online document management has gained signNow traction among organizations and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly without delays. Manage cherry hills village sales tax on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven workflow today.

How to modify and eSign cherry hills village sales tax with ease

- Obtain cherry hills village sales tax and click on Get Form to initiate.

- Utilize the tools we offer to finalize your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose your preferred method to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your choosing. Edit and eSign cherry hills village sales tax and ensure outstanding communication at any stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to cherry hills village sales tax

Create this form in 5 minutes!

How to create an eSignature for the cherry hills village sales tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask cherry hills village sales tax

-

What is the cherry hills village sales tax rate?

The cherry hills village sales tax rate is currently set at a specific percentage that businesses must apply to their sales transactions. It's essential to stay informed about this rate to ensure compliance with local tax regulations. You can easily calculate the total cost of your products by applying the cherry hills village sales tax rate during your sales transactions.

-

How does airSlate SignNow help with managing cherry hills village sales tax?

airSlate SignNow provides businesses with the tools needed to manage documents related to sales tax efficiently. With its eSigning and document management features, you can streamline the process of filing and maintaining records relevant to the cherry hills village sales tax compliance. This ensures that all necessary documentation is easily accessible and properly organized.

-

Are there any additional fees related to cherry hills village sales tax when using airSlate SignNow?

When using airSlate SignNow, there are no additional fees specifically attached to cherry hills village sales tax beyond the standard service costs. However, businesses are responsible for correctly calculating and remitting the sales tax as per local regulations. It's crucial to factor in the cherry hills village sales tax when pricing your products.

-

Can I integrate airSlate SignNow with my accounting software for cherry hills village sales tax reporting?

Yes, airSlate SignNow integrates seamlessly with various accounting software solutions, allowing you to manage your cherry hills village sales tax reporting efficiently. This integration helps you track transactions and ensures that your tax reporting is accurate. Keeping your tax records organized is essential for compliance and financial health.

-

What features does airSlate SignNow offer to simplify cherry hills village sales tax compliance?

airSlate SignNow offers features such as customizable templates, automated reminders, and secure eSigning to simplify compliance with cherry hills village sales tax regulations. These tools ensure that all necessary documents are completed accurately and on time. By streamlining your document flow, you can focus more on sales and less on paperwork.

-

Is airSlate SignNow suitable for businesses of all sizes dealing with cherry hills village sales tax?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, from startups to large enterprises, managing cherry hills village sales tax. Its user-friendly interface and scalable features make it an ideal solution for any business needing to handle eSigning and document management efficiently. This flexibility helps you adapt to changing business needs while maintaining compliance.

-

What are the benefits of using airSlate SignNow for cherry hills village sales tax-related documents?

Using airSlate SignNow for cherry hills village sales tax-related documents offers enhanced efficiency and accuracy in document handling. By digitizing your workflows, you can reduce errors associated with manual entries and improve the speed of processing. This leads to timely compliance with cherry hills village sales tax requirements, ultimately saving you time and resources.

Get more for cherry hills village sales tax

Find out other cherry hills village sales tax

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple