Maryland Non Resident Seller Transfer Withholding Tax Exemption Form

What is the Maryland Non Resident Seller Transfer Withholding Tax Exemption Form

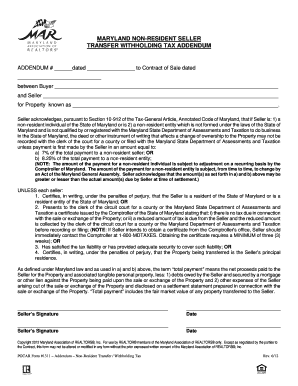

The Maryland Non Resident Seller Transfer Withholding Tax Exemption Form is a crucial document for non-resident sellers of real estate in Maryland. This form allows sellers to claim an exemption from the withholding tax that would typically be deducted from the sale proceeds. The withholding tax is designed to ensure that non-residents fulfill their tax obligations to the state. By submitting this form, sellers can avoid unnecessary withholding, provided they meet specific criteria outlined by the Maryland tax authorities.

Steps to Complete the Maryland Non Resident Seller Transfer Withholding Tax Exemption Form

Completing the Maryland Non Resident Seller Transfer Withholding Tax Exemption Form involves several key steps:

- Gather necessary information, including the seller's details, property information, and transaction specifics.

- Indicate eligibility for the exemption by checking the appropriate boxes on the form.

- Provide any required documentation that supports the exemption claim, such as proof of residency or tax status.

- Review the completed form for accuracy and completeness before submission.

Ensuring that all information is correct is essential, as errors may delay processing or lead to penalties.

How to Obtain the Maryland Non Resident Seller Transfer Withholding Tax Exemption Form

The Maryland Non Resident Seller Transfer Withholding Tax Exemption Form can be obtained through various channels. It is typically available on the official Maryland state tax website, where users can download a PDF version. Additionally, local tax offices may provide physical copies of the form. For those who prefer digital solutions, electronic versions can be filled out using e-signature platforms, ensuring a streamlined process.

Eligibility Criteria for the Maryland Non Resident Seller Transfer Withholding Tax Exemption Form

To be eligible for the Maryland Non Resident Seller Transfer Withholding Tax Exemption, sellers must meet specific criteria set by the state. Generally, these criteria include:

- The seller must not be a Maryland resident.

- The property sold must not be subject to the withholding tax due to specific exemptions, such as a sale price below a certain threshold.

- The seller must provide documentation that verifies their eligibility for the exemption.

It is essential for sellers to review these criteria carefully to ensure compliance and avoid potential tax liabilities.

Legal Use of the Maryland Non Resident Seller Transfer Withholding Tax Exemption Form

The legal use of the Maryland Non Resident Seller Transfer Withholding Tax Exemption Form is governed by state tax laws. This form must be accurately completed and submitted to the appropriate tax authority to be considered valid. Failure to use the form correctly can result in penalties, including the imposition of withholding taxes that the seller sought to avoid. Understanding the legal implications of the form is vital for non-resident sellers to protect their financial interests.

Form Submission Methods for the Maryland Non Resident Seller Transfer Withholding Tax Exemption Form

Once the Maryland Non Resident Seller Transfer Withholding Tax Exemption Form is completed, it can be submitted through various methods:

- Online submission via the Maryland state tax website, where electronic forms can be securely submitted.

- Mailing a physical copy of the form to the designated tax office address.

- In-person submission at local tax offices, which may offer assistance in completing the form if needed.

Choosing the appropriate submission method can help ensure timely processing and compliance with state regulations.

Quick guide on how to complete maryland non resident seller transfer withholding tax exemption form

Effortlessly Prepare Maryland Non Resident Seller Transfer Withholding Tax Exemption Form on Any Device

The management of documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the correct forms and securely store them online. airSlate SignNow provides all the necessary tools to quickly create, modify, and eSign your documents without any delays. Manage Maryland Non Resident Seller Transfer Withholding Tax Exemption Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to Edit and eSign Maryland Non Resident Seller Transfer Withholding Tax Exemption Form with Ease

- Obtain Maryland Non Resident Seller Transfer Withholding Tax Exemption Form and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes only seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form: via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious searches for forms, or errors that require reprinting new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign Maryland Non Resident Seller Transfer Withholding Tax Exemption Form to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the maryland non resident seller transfer withholding tax exemption form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Maryland non resident seller transfer withholding tax exemption form?

The Maryland non resident seller transfer withholding tax exemption form is a document that allows non-resident sellers of real estate to claim an exemption from withholding taxes at the time of property transfer. This form helps streamline the sales process and ensures that sellers are not unnecessarily taxed on their transactions.

-

Who is eligible to use the Maryland non resident seller transfer withholding tax exemption form?

Non-resident sellers of real estate in Maryland who meet specific criteria can use the Maryland non resident seller transfer withholding tax exemption form. Eligibility typically includes situations where the seller is exempt based on the amount realized from the sale or if they are a corporate entity that meets the requirements outlined by the state.

-

How can I access the Maryland non resident seller transfer withholding tax exemption form?

You can easily access the Maryland non resident seller transfer withholding tax exemption form through the Maryland State Department of Assessments and Taxation website or by utilizing digital solutions like airSlate SignNow for quick and efficient eSigning and document management.

-

Is there a fee for filing the Maryland non resident seller transfer withholding tax exemption form?

While there is no cost to file the Maryland non resident seller transfer withholding tax exemption form itself, there may be associated fees for the transaction or related services. It’s advised to consult with a tax professional or check the latest guidelines from the Maryland state government for comprehensive details.

-

How does airSlate SignNow help with the Maryland non resident seller transfer withholding tax exemption form?

airSlate SignNow simplifies the process by allowing users to easily fill out, sign, and send the Maryland non resident seller transfer withholding tax exemption form electronically. This cost-effective solution enhances efficiency and speeds up the transaction process for sellers.

-

Can I integrate airSlate SignNow with other applications to manage the Maryland non resident seller transfer withholding tax exemption form?

Yes, airSlate SignNow offers various integrations with popular applications such as Google Drive, Dropbox, and CRM systems to help you manage the Maryland non resident seller transfer withholding tax exemption form seamlessly. This allows for a more efficient workflow and document management system.

-

What are the benefits of using airSlate SignNow for handling the Maryland non resident seller transfer withholding tax exemption form?

Using airSlate SignNow provides numerous benefits, including a user-friendly interface, secure document handling, and faster processing times for the Maryland non resident seller transfer withholding tax exemption form. Additionally, the ability to eSign documents makes it easier for parties involved to complete transactions remotely.

Get more for Maryland Non Resident Seller Transfer Withholding Tax Exemption Form

- False statements and perjury an overview of federal form

- Usc02 18 usc ch 83 postal service united states form

- Courts instructions to the jury federal defenders form

- 18 us code1709 theft of mail matter by officer or employee form

- 18 us code1791 providing or possessing contraband in form

- Interference with commerce by robbery hobbs act racketeering form

- Robbery extortion and bribery in one place a fasorg form

- Internet gambling overview of federal criminal law form

Find out other Maryland Non Resident Seller Transfer Withholding Tax Exemption Form

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement