Tax Return Form

What is the Tax Return

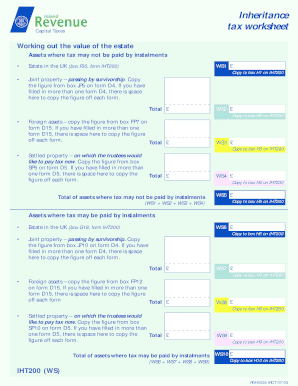

A tax return is a formal document that individuals and businesses submit to the tax authorities, detailing their income, expenses, and other relevant financial information for a specific tax year. In the context of the United Kingdom Inland Revenue, this document is essential for determining tax contributions owed or refunds due. It typically includes various forms, such as the IHT200 for inheritance tax, and must be completed accurately to ensure compliance with tax regulations.

Steps to Complete the Tax Return

Completing a tax return involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including income statements, expense receipts, and any relevant prior tax returns. Next, fill out the appropriate forms, such as the IHT200 or other relevant tax documents, ensuring that all information is accurate and complete. After filling out the forms, review them carefully for any errors or omissions. Finally, submit the completed tax return by the specified deadline, either electronically or via mail, depending on the submission method chosen.

Legal Use of the Tax Return

The legal use of a tax return is crucial for ensuring that the document is recognized by tax authorities. To be considered valid, the return must comply with specific regulations set forth by the United Kingdom Inland Revenue. This includes providing accurate information, adhering to filing deadlines, and ensuring that all required signatures are included. Utilizing a reliable electronic signature tool can enhance the legal standing of the document, as it provides a secure method for signing and submitting tax returns.

Required Documents

When preparing a tax return, several documents are essential for accurate completion. Commonly required documents include:

- W-2 forms from employers detailing annual income

- 1099 forms for freelance or contract work

- Receipts for deductible expenses

- Prior year tax returns for reference

- Bank statements and investment income reports

Having these documents on hand will facilitate a smoother preparation process and help ensure compliance with tax regulations.

Form Submission Methods

Tax returns can be submitted through various methods, allowing for flexibility based on individual preferences. Common submission methods include:

- Online Submission: Many taxpayers opt to file their returns electronically through authorized platforms, which can expedite processing times.

- Mail Submission: Taxpayers may also choose to print their completed forms and send them via postal service to the appropriate tax authority address.

- In-Person Submission: Some individuals may prefer to submit their returns in person at designated tax offices, providing an opportunity for immediate assistance if needed.

Each method has its advantages, and taxpayers should choose the one that best fits their needs and comfort level.

Filing Deadlines / Important Dates

Filing deadlines are crucial for ensuring that tax returns are submitted on time to avoid penalties. In the United States, the typical deadline for individual tax returns is April 15. However, this date may vary depending on specific circumstances, such as weekends or holidays. It is essential for taxpayers to be aware of these deadlines and plan accordingly to avoid any late fees or complications with their tax filings.

Quick guide on how to complete tax return 22374904

Effortlessly Finalize Tax Return on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides all the tools needed to create, modify, and electronically sign your documents swiftly without any holdups. Manage Tax Return across any platform using the airSlate SignNow apps for Android or iOS and enhance your document-based workflows today.

How to Modify and eSign Tax Return with Ease

- Find Tax Return and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click the Done button to preserve your edits.

- Choose how you wish to send your form—via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Tax Return and guarantee seamless communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax return 22374904

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow for handling documents with the United Kingdom Inland Revenue?

airSlate SignNow provides a range of features essential for managing documents related to the United Kingdom Inland Revenue. You can easily create, send, and eSign documents securely, ensuring full compliance with UK tax regulations. The platform also allows for customizable templates and workflows, streamlining the process of interacting with the UK Inland Revenue.

-

How does airSlate SignNow help in ensuring compliance with the United Kingdom Inland Revenue requirements?

Using airSlate SignNow assures that your documents adhere to the standards set by the United Kingdom Inland Revenue. The platform provides secure storage and audit trails that keep track of every document interaction, making it easy to demonstrate compliance. Moreover, electronic signatures used in airSlate SignNow are legally binding in the UK, thus aligning with Inland Revenue guidelines.

-

What pricing options are available for airSlate SignNow when dealing with the United Kingdom Inland Revenue?

airSlate SignNow offers competitive pricing plans tailored to meet the needs of businesses managing documents linked to the United Kingdom Inland Revenue. You can choose from various subscription tiers, ensuring cost-effectiveness without sacrificing essential features. Additionally, a free trial is available for you to explore its functionalities before making a commitment.

-

Can airSlate SignNow integrate with other tools commonly used for UK tax filings and the United Kingdom Inland Revenue?

Yes, airSlate SignNow easily integrates with popular accounting and tax software that are frequently utilized for filing with the United Kingdom Inland Revenue. This integration facilitates smoother workflows and reduces the risk of errors during document preparation. You can streamline your operations by connecting airSlate SignNow with your existing tools for enhanced productivity.

-

What benefits does airSlate SignNow provide for businesses engaging with the United Kingdom Inland Revenue?

airSlate SignNow offers numerous benefits for businesses engaging with the United Kingdom Inland Revenue, including improved efficiency in document management. By allowing electronic signatures, it speeds up the approval process and reduces paperwork. This not only saves time but also minimizes the chances of errors, ensuring a more seamless interaction with the Inland Revenue.

-

Is airSlate SignNow suitable for small businesses dealing with the United Kingdom Inland Revenue?

Absolutely! airSlate SignNow is designed to be user-friendly and cost-effective, making it an ideal solution for small businesses interacting with the United Kingdom Inland Revenue. Its features provide the necessary tools to manage documents efficiently without overwhelming complexity or high costs, ensuring that smaller enterprises can stay compliant and organized.

-

How secure is airSlate SignNow when sending documents to the United Kingdom Inland Revenue?

Security is paramount in airSlate SignNow, especially when dealing with sensitive documents related to the United Kingdom Inland Revenue. The platform utilizes encryption and secure connections to protect your documents from unauthorized access. Additionally, it complies with UK data protection regulations, ensuring that all information remains confidential and secure.

Get more for Tax Return

- Control number ga p019 pkg form

- Trademark and service mark applications and forms georgia

- Georgia family law formsus legal forms

- Free minor child power of attorney form

- Control number hi p010 pkg form

- Sample contract for deedhawaii deed formsus legal forms

- Hawaii mortgage formsus legal forms

- Hawaii legal forms hawaii legal documents uslegalforms

Find out other Tax Return

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template