Letter of Closure Idaho Central Credit Union Form

Understanding the Letter of Closure for Idaho Central Credit Union

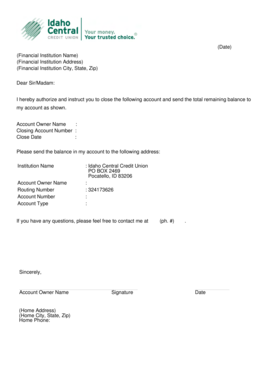

The Letter of Closure for Idaho Central Credit Union is an essential document that formally requests the closure of your account. This letter serves as a record of your intent to terminate your banking relationship with the institution. It typically includes your account details, such as the ICCU account number and any associated information required for processing the closure. Understanding the purpose and requirements of this letter can help ensure a smooth and efficient account closure process.

Steps to Complete the Letter of Closure for Idaho Central Credit Union

Completing the Letter of Closure involves several key steps to ensure that all necessary information is accurately provided. Begin by gathering your account details, including your ICCU account number and any other relevant identifiers. Next, clearly state your intention to close the account and include your personal information, such as your name and contact details. It is also important to specify how you would like any remaining funds to be handled, whether through a check or transfer to another account. Finally, sign and date the letter before submitting it to the credit union.

Legal Use of the Letter of Closure for Idaho Central Credit Union

The Letter of Closure is a legally binding document that signifies your request to terminate your account. To ensure its legal standing, it is crucial to follow proper procedures when drafting and submitting the letter. This includes providing accurate information and ensuring that your signature is included. The credit union may require this document to process your request officially, making it important to retain a copy for your records.

Key Elements of the Letter of Closure for Idaho Central Credit Union

When drafting the Letter of Closure, several key elements should be included to facilitate the process. These elements typically encompass:

- Your full name and address

- Your ICCU account number

- A clear statement requesting the closure of your account

- Instructions for handling any remaining balance

- Your signature and the date

Incorporating these elements will help ensure that the credit union has all the necessary information to process your request promptly.

How to Obtain the Letter of Closure for Idaho Central Credit Union

Obtaining the Letter of Closure can be done through various methods. Many credit unions provide a template or form on their website that can be filled out and submitted. Alternatively, you may choose to draft your own letter using the key elements outlined previously. If you are unsure about the process, contacting customer service at Idaho Central Credit Union can provide guidance and ensure that you have the correct format and information needed for your letter.

Examples of Using the Letter of Closure for Idaho Central Credit Union

There are various scenarios in which you might need to use the Letter of Closure. For instance, if you are moving to a different state and wish to close your account, this letter would formally communicate your decision. Similarly, if you have decided to consolidate your finances and no longer need the account, submitting this letter is a necessary step. Each of these situations highlights the importance of having a clear and formal request to close your account with Idaho Central Credit Union.

Quick guide on how to complete letter of closure idaho central credit union

Complete Letter Of Closure Idaho Central Credit Union effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly and without delays. Handle Letter Of Closure Idaho Central Credit Union on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Letter Of Closure Idaho Central Credit Union with ease

- Obtain Letter Of Closure Idaho Central Credit Union and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Letter Of Closure Idaho Central Credit Union and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the letter of closure idaho central credit union

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an ICCU account number and why is it important?

An ICCU account number is a unique identifier assigned to your account by Idaho Central Credit Union. It is essential for conducting transactions like sending or receiving funds, and it ensures that your financial activities are accurately tracked. Having your ICCU account number handy can streamline your banking process, especially when using services like airSlate SignNow.

-

How can I find my ICCU account number?

You can easily find your ICCU account number by checking your account statements or logging into your online banking portal. It is typically displayed at the top of the page along with your account details. If you need further assistance, you can contact ICCU customer support directly for help in locating your account number.

-

Does airSlate SignNow support ICCU account number integrations?

Yes, airSlate SignNow supports various integrations that can help you manage your ICCU account number effectively. You can connect your ICCU account to streamline document signing and transaction processes. This integration makes it easier to eSign documents related to your ICCU account transactions.

-

What are the benefits of using airSlate SignNow for documents involving my ICCU account number?

Using airSlate SignNow for documents related to your ICCU account number offers several benefits, including enhanced security and efficiency in document management. The platform allows you to securely sign and send important banking documents without the hassle of paperwork. Additionally, it reduces the time required for transaction approvals and increases overall productivity.

-

Can I update my ICCU account number in airSlate SignNow?

Yes, you can update your ICCU account number in airSlate SignNow. It is essential to keep your account information current to avoid any transaction issues. Simply log into your account settings, and you can edit your ICCU account number to ensure it is always accurate.

-

What pricing plans does airSlate SignNow offer for users with an ICCU account number?

airSlate SignNow offers several pricing plans to accommodate different business needs, whether you have an ICCU account number or not. Plans range from basic to premium, each providing various features tailored to user requirements. You can choose a plan that best fits your needs, ensuring you have access to the necessary tools for managing eSignatures and documentation.

-

Is airSlate SignNow suitable for small businesses that use ICCU account numbers?

Absolutely! airSlate SignNow is designed to be user-friendly and cost-effective for small businesses that utilize ICCU account numbers. It enables you to efficiently handle document signing and management, helping to streamline your business operations. Many small businesses have found success in using airSlate SignNow to enhance their workflow.

Get more for Letter Of Closure Idaho Central Credit Union

- Amendment no 1 to stock purchase agreement form

- Sf holdings group inc law insider form

- Metro sales inc v core consulting group llc et al no form

- Consolidated master deed for empire hills homeowners form

- Stock and asset purchase agreement sa louis dreyfus et form

- About barker pacific group form

- Purchase and sale and lease assignment agreement form

- Statement of additional information the

Find out other Letter Of Closure Idaho Central Credit Union

- Sign Michigan Overtime Authorization Form Mobile

- How To Sign Alabama Payroll Deduction Authorization

- How To Sign California Payroll Deduction Authorization

- How To Sign Utah Employee Emergency Notification Form

- Sign Maine Payroll Deduction Authorization Simple

- How To Sign Nebraska Payroll Deduction Authorization

- Sign Minnesota Employee Appraisal Form Online

- How To Sign Alabama Employee Satisfaction Survey

- Sign Colorado Employee Satisfaction Survey Easy

- Sign North Carolina Employee Compliance Survey Safe

- Can I Sign Oklahoma Employee Satisfaction Survey

- How Do I Sign Florida Self-Evaluation

- How Do I Sign Idaho Disclosure Notice

- Sign Illinois Drug Testing Consent Agreement Online

- Sign Louisiana Applicant Appraisal Form Evaluation Free

- Sign Maine Applicant Appraisal Form Questions Secure

- Sign Wisconsin Applicant Appraisal Form Questions Easy

- Sign Alabama Deed of Indemnity Template Later

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template