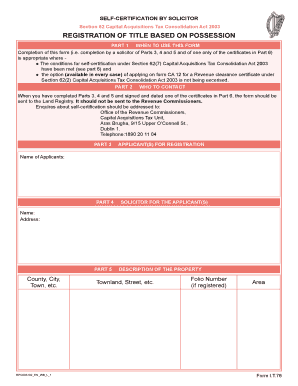

It76 Form

What is the IT76 Form

The IT76 form is a tax document used primarily for reporting purposes within the United States. It is essential for individuals and businesses to accurately report their income, deductions, and credits to the Internal Revenue Service (IRS). This form is particularly relevant for those who need to provide detailed information about their financial activities during the tax year. Understanding the purpose and requirements of the IT76 form is crucial for compliance with federal tax regulations.

How to Use the IT76 Form

Using the IT76 form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and previous tax returns. Next, fill out the form with precise information, ensuring that all entries are clear and legible. It's important to double-check calculations and verify that all required fields are completed. Once the form is filled out, it can be submitted electronically or via mail, depending on your preference and the specific guidelines provided by the IRS.

Steps to Complete the IT76 Form

Completing the IT76 form requires careful attention to detail. Follow these steps for successful completion:

- Gather all relevant financial documents.

- Review the form instructions thoroughly to understand each section.

- Enter your personal information accurately, including your name, address, and Social Security number.

- Fill in your income details, ensuring all sources of income are reported.

- List any deductions or credits you are eligible for, following the guidelines provided.

- Review the entire form for accuracy before submission.

Legal Use of the IT76 Form

The IT76 form is legally binding when completed and submitted according to IRS regulations. It is important to ensure that the information provided is truthful and accurate, as discrepancies can lead to penalties or audits. Utilizing a secure platform for electronic submission can enhance the legal validity of the form. Compliance with federal guidelines, such as the ESIGN Act, ensures that electronic signatures and submissions are recognized legally.

Filing Deadlines / Important Dates

Filing deadlines for the IT76 form are critical to avoid penalties. Typically, the form must be submitted by April 15 of the following tax year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It's advisable to keep track of any changes in deadlines announced by the IRS, as they may vary from year to year. Marking these dates on your calendar can help ensure timely submission.

Required Documents

To complete the IT76 form, certain documents are required. These typically include:

- W-2 forms from employers, detailing annual wages.

- 1099 forms for any freelance or contract work.

- Records of other income sources, such as dividends or interest.

- Documentation for deductions, such as receipts for business expenses.

Having these documents organized and readily available can streamline the process of filling out the IT76 form.

Quick guide on how to complete it76 form

Complete It76 Form effortlessly on any gadget

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to access the right form and securely save it online. airSlate SignNow provides all the resources necessary to create, modify, and eSign your documents promptly without delays. Manage It76 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The easiest way to edit and eSign It76 Form with minimal effort

- Locate It76 Form and then click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with features that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and holds the same legal authority as a traditional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Decide how you wish to submit your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your preference. Edit and eSign It76 Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it76 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the it76 form and how can airSlate SignNow help with it?

The it76 form is a tax form used for various official documentation processes. airSlate SignNow offers an efficient platform to electronically sign and send this form, ensuring security and compliance. Users can easily manage their it76 forms online, streamlining their documentation workflow.

-

Is there a cost associated with using airSlate SignNow for the it76 form?

Yes, airSlate SignNow offers flexible pricing plans that cater to different business needs, including usage with the it76 form. Depending on your organization's size and requirements, you can choose a plan that ensures cost-effective management of your documentation. A free trial is also available to explore its features.

-

What features does airSlate SignNow provide for managing the it76 form?

airSlate SignNow comes equipped with a range of features designed to streamline the processing of the it76 form. Key features include customizable templates, real-time tracking of document statuses, and automated reminders. These functions enhance efficiency and ensure that your forms are handled promptly.

-

Can I integrate airSlate SignNow with other software for handling the it76 form?

Absolutely! airSlate SignNow integrates seamlessly with numerous applications, allowing for organized management of the it76 form alongside your existing tools. Popular integrations include CRM systems, cloud storage, and other productivity applications, enhancing your overall workflow.

-

How secure is airSlate SignNow when it comes to the it76 form?

Security is a top priority at airSlate SignNow, especially with sensitive documents like the it76 form. The platform employs industry-leading encryption and security measures to protect your data. Additionally, it complies with legal requirements, ensuring your documents remain confidential and secure.

-

What are the benefits of using airSlate SignNow for the it76 form?

Using airSlate SignNow for the it76 form brings numerous benefits, including speed, efficiency, and reliability. The platform simplifies the signing process, reduces paper waste, and enhances team collaboration. Users experience reduced turnaround times on their forms, leading to quicker business operations.

-

Can I access the it76 form on mobile devices using airSlate SignNow?

Yes, airSlate SignNow offers a mobile-friendly interface that allows users to access and manage the it76 form on their smartphones and tablets. This ensures that you can stay productive on-the-go, sign documents, and track their status from anywhere. The mobile app mirrors the desktop functionality for convenience.

Get more for It76 Form

Find out other It76 Form

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document