Form 720, Quarterly Federal Excise Tax ReturnInternal IRS

What is the Form 720, Quarterly Federal Excise Tax Return

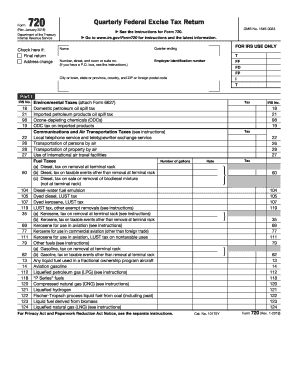

The Form 720, Quarterly Federal Excise Tax Return, is a tax form used by businesses in the United States to report and pay federal excise taxes. These taxes apply to specific goods, services, and activities, such as the sale of fuel, certain types of insurance, and the use of facilities for certain types of transportation. The form is filed quarterly, and it is essential for businesses to accurately report their excise tax liabilities to remain compliant with IRS regulations.

Steps to complete the Form 720, Quarterly Federal Excise Tax Return

Completing the Form 720 requires careful attention to detail to ensure compliance with IRS guidelines. Here are the essential steps:

- Gather necessary information, including business identification details and relevant tax data.

- Determine the applicable excise tax rates for your business activities.

- Fill out the required sections of the form, ensuring all figures are accurate and complete.

- Calculate the total excise tax owed based on the information provided.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the appropriate deadline, either electronically or via mail.

How to obtain the Form 720, Quarterly Federal Excise Tax Return

The Form 720 can be obtained directly from the IRS website or through authorized tax preparation software. Businesses can download a printable version of the form, which is available in PDF format. Additionally, tax professionals can assist in acquiring the form and ensuring it is filled out correctly.

Filing Deadlines / Important Dates

Filing deadlines for the Form 720 are crucial for businesses to avoid penalties. The form must be submitted quarterly, with specific due dates typically falling on the last day of the month following the end of each quarter. The deadlines are:

- First Quarter: April 30

- Second Quarter: July 31

- Third Quarter: October 31

- Fourth Quarter: January 31 of the following year

Legal use of the Form 720, Quarterly Federal Excise Tax Return

The Form 720 is legally binding when completed and submitted according to IRS regulations. It is essential for businesses to ensure that all information is accurate and that the form is signed by an authorized representative. Failure to comply with legal requirements can result in penalties, including fines and interest on unpaid taxes.

Penalties for Non-Compliance

Businesses that fail to file the Form 720 on time or provide inaccurate information may face significant penalties. The IRS imposes fines based on the amount of tax owed and the duration of the delay. Additionally, interest accrues on unpaid taxes, increasing the overall financial burden. Understanding these penalties emphasizes the importance of timely and accurate filing.

Quick guide on how to complete form 720 quarterly federal excise tax returninternal irs

Effortlessly Prepare Form 720, Quarterly Federal Excise Tax ReturnInternal IRS on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily find the correct template and securely save it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without any delays. Manage Form 720, Quarterly Federal Excise Tax ReturnInternal IRS on any platform using airSlate SignNow applications for Android or iOS and streamline your document-focused processes today.

How to Modify and eSign Form 720, Quarterly Federal Excise Tax ReturnInternal IRS with Ease

- Find Form 720, Quarterly Federal Excise Tax ReturnInternal IRS and click Get Form to begin.

- Use the tools available to complete your document.

- Mark important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Decide how you wish to distribute your form, via email, text message (SMS), or shareable link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow caters to all your document management requirements in just a few clicks from your chosen device. Modify and eSign Form 720, Quarterly Federal Excise Tax ReturnInternal IRS and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 720 quarterly federal excise tax returninternal irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 720, Quarterly Federal Excise Tax ReturnInternal IRS?

Form 720, Quarterly Federal Excise Tax ReturnInternal IRS, is the document businesses use to report and pay federal excise taxes on certain goods and services. This form is typically filed quarterly and ensures compliance with federal tax regulations. Understanding its requirements is crucial for businesses to avoid penalties.

-

How can airSlate SignNow help with Form 720, Quarterly Federal Excise Tax ReturnInternal IRS?

airSlate SignNow streamlines the process of preparing and signing the Form 720, Quarterly Federal Excise Tax ReturnInternal IRS. By using our platform, you can easily create, send, and eSign necessary documents, making compliance more efficient. This reduces the time spent on paperwork, allowing you to focus on your business operations.

-

What are the pricing options for using airSlate SignNow for Form 720, Quarterly Federal Excise Tax ReturnInternal IRS?

airSlate SignNow offers various pricing plans to suit your business needs, starting from a basic plan to more advanced options. Each plan provides access to features that help you manage your Form 720, Quarterly Federal Excise Tax ReturnInternal IRS, and other documents seamlessly. Our pricing is designed to be affordable, ensuring you get maximum value for your investment.

-

What features does airSlate SignNow offer for eSigning Form 720, Quarterly Federal Excise Tax ReturnInternal IRS?

With airSlate SignNow, you can easily eSign Form 720, Quarterly Federal Excise Tax ReturnInternal IRS using secure and legally binding signatures. Our platform supports multiple signers, document templates, and real-time tracking of your document’s status. These features simplify the signing process and enhance overall productivity.

-

Is airSlate SignNow suitable for small businesses managing Form 720, Quarterly Federal Excise Tax ReturnInternal IRS?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small businesses. Our user-friendly interface and cost-effective solutions make it easy for small businesses to manage their Form 720, Quarterly Federal Excise Tax ReturnInternal IRS efficiently. With minimal training, you can automate your document workflows.

-

Can I integrate airSlate SignNow with other software for filing Form 720, Quarterly Federal Excise Tax ReturnInternal IRS?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software. This allows for a smooth flow of information when preparing your Form 720, Quarterly Federal Excise Tax ReturnInternal IRS. Integrations can enhance efficiency and ensure your filings are as accurate as possible.

-

What benefits does airSlate SignNow provide for handling Form 720, Quarterly Federal Excise Tax ReturnInternal IRS?

Using airSlate SignNow for your Form 720, Quarterly Federal Excise Tax ReturnInternal IRS offers multiple benefits, including time savings, improved accuracy, and reduced paperwork. Our solution streamlines the document workflow, allowing for quicker turnaround times. Additionally, the secure storage of documents ensures you stay organized and compliant.

Get more for Form 720, Quarterly Federal Excise Tax ReturnInternal IRS

- 40 guide for hearing officers in nlrb representation and form

- Rules of practice in air safety proceedings federal register form

- Medicare program payment policies under the physician fee form

- 28th aug issuu form

- Navigating the amended new york false claims act latest form

- Bank of california v connolly california court of form

- New york business corporation law section 904 a merger or form

- Frances kulka browne form

Find out other Form 720, Quarterly Federal Excise Tax ReturnInternal IRS

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now