Mississippi Quitclaim Deed from Individual to LLC Form

What is the Mississippi Quitclaim Deed From Individual To LLC

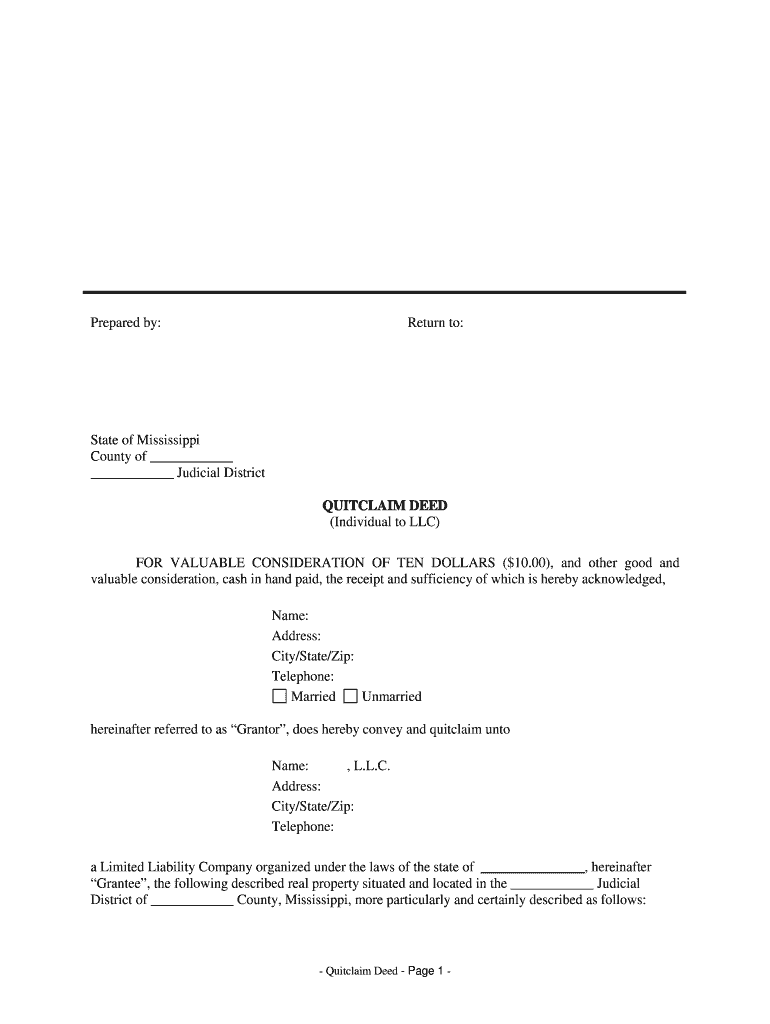

The Mississippi quitclaim deed from individual to LLC is a legal document that facilitates the transfer of real property ownership from an individual to a limited liability company (LLC). This type of deed is particularly useful for property owners who wish to change the title of their property to a business entity for liability protection or tax purposes. Unlike warranty deeds, quitclaim deeds do not guarantee that the title is free of claims or encumbrances. Instead, they transfer whatever interest the grantor has in the property at the time of the transfer.

Steps to Complete the Mississippi Quitclaim Deed From Individual To LLC

Completing a Mississippi quitclaim deed involves several important steps:

- Gather necessary information, including the names and addresses of the grantor (individual) and grantee (LLC), as well as a legal description of the property.

- Obtain the correct quitclaim deed form, which can be found through legal resources or state websites.

- Fill out the form accurately, ensuring all required fields are completed, including the date of transfer.

- Have the document signed in the presence of a notary public to ensure its legal validity.

- File the completed quitclaim deed with the appropriate county clerk’s office to officially record the transfer.

Legal Use of the Mississippi Quitclaim Deed From Individual To LLC

The legal use of a quitclaim deed in Mississippi is primarily to transfer property rights without warranties. This deed is commonly used in situations where the grantor is conveying property to their own LLC. It is important to understand that while the quitclaim deed transfers the interest of the property, it does not guarantee that the property is free from liens or other claims. Therefore, it is advisable for individuals to conduct a title search before executing the deed to ensure clarity of ownership.

Key Elements of the Mississippi Quitclaim Deed From Individual To LLC

Several key elements must be included in the Mississippi quitclaim deed for it to be considered valid:

- Grantor and Grantee Information: Full names and addresses of both the individual transferring the property and the LLC receiving it.

- Legal Description of Property: A detailed description of the property, including boundaries and any relevant identifiers.

- Consideration: The amount paid for the property or a statement indicating that the transfer is a gift.

- Signature and Notarization: The grantor must sign the deed in front of a notary public to validate the document.

State-Specific Rules for the Mississippi Quitclaim Deed From Individual To LLC

In Mississippi, specific rules govern the execution and recording of quitclaim deeds. It is essential to ensure that the deed complies with state laws, including the requirement for notarization. Additionally, the deed must be filed with the county clerk’s office where the property is located. Failure to comply with these regulations may result in the deed being deemed invalid. It is advisable to consult legal counsel to ensure all state-specific requirements are met.

How to Obtain the Mississippi Quitclaim Deed From Individual To LLC

Obtaining a Mississippi quitclaim deed is a straightforward process. Individuals can access the necessary forms through various legal resources, including state government websites or local county clerk offices. Many online platforms also provide templates for quitclaim deeds that can be customized for specific needs. It is crucial to ensure that the form used is the most current version and complies with Mississippi state laws.

Quick guide on how to complete mississippi quitclaim deed from individual to llc

Effortlessly Complete Mississippi Quitclaim Deed From Individual To LLC on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents promptly without delays. Manage Mississippi Quitclaim Deed From Individual To LLC on any device using the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

How to Edit and Electronically Sign Mississippi Quitclaim Deed From Individual To LLC with Ease

- Find Mississippi Quitclaim Deed From Individual To LLC and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searches, or errors that necessitate reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Mississippi Quitclaim Deed From Individual To LLC and guarantee exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

What tax form do I need to fill out to convert from single member LLC to multi-member LLC?

When you add a member to your previously single member LLC (which you can do structurally by amending your operating agreement and filing an amended report, if required, with your secretary of state), you cease to be a 'disregarded entity' under the applicable Treasury Regulations.Going forward, you will either be a (a) partnership, by default, and will have to file a partnership income tax return on Form 1065, or (b) a corporation, if you so elect, and will have to file a Form 1120 if you are a C corporation or Form 1120S if you elect to be taxed as an S corporation.There can be other tax issues as well, and these need to be addressed with a business CPA.

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

What forms do I need to fill out as a first-year LLC owner? It's a partnership LLC.

A Limited Liability Company (LLC) is business structure that provides the limited liability protection features of a corporation and the tax efficiencies and operational flexibility of a partnership.Unlike shareholders in a corporation, LLCs are not taxed as a separate business entity. Instead, all profits and losses are "passed through" the business to each member of the LLC. LLC members report profits and losses on their personal federal tax returns, just like the owners of a partnership would.The owners of an LLC have no personal liability for the obligations of the LLC. An LLC is the entity of choice for a businesses seeking to flow through losses to its investors because an LLC offers complete liability protection to all its members. The basic requirement for forming an Limited Liability Company are:Search your business name - before you form an LLC, you should check that your proposed business name is not too similar to another LLC registered with your state's Secretary of StateFile Articles of Organization - the first formal paper you will need file with your state's Secretary of State to form an LLC. This is a necessary document for setting up an LLC in many states. Create an Operating Agreement - an agreement among LLC members governing the LLC's business, and member's financial and managerial rights and duties. Think of this as a contract that governs the rules for the people who own the LLC. Get an Employer Identification Number (EIN) - a number assigned by the IRS and used to identify taxpayers that are required to file various business tax returns. You can easily file for an EIN online if you have a social security number. If you do not have a social security number or if you live outsides of United States, ask a business lawyer to help you get one.File Statement of Information - includes fairly basic information about the LLC that you need to file with your state’s Secretary of State every 2 years. Think of it as a company census you must complete every 2 years.Search and Apply for Business Licenses and Permits - once your business is registered, you should look and apply for necessary licenses and permits you will need from the county and city where you will do business. Every business has their own business licenses and permits so either do a Google search of your business along with the words "permits and licenses" or talk to a business lawyer to guide you with this.If you have any other questions, talk to a business lawyer who will clarify and help you with all 6 above steps or answer any other question you may have about starting your business.I am answering from the perspective of a business lawyer who represents businesspersons and entrepreneurs with their new and existing businesses. Feel free to contact me sam@mollaeilaw.com if you need to form your LLC.In my course, How To Incorporate Your Business on Your Own: Quick & Easy, you will learn how to form your own Limited Liability Company (LLC) or Corporation without a lawyer, choose a business name, file a fictitious business name, file Articles of Organization or Articles of Incorporation, create Operating Agreement or Bylaws, apply for an EIN, file Statement of Information, and how to get business licenses and permits.

-

When dissolving an LLC do you need to fill out IRS Form 966?

The answer will be yes or no depending on how your entity is recognized for tax purposes. An LLC is not a recognized entity by the IRS. By default, a single-member LLC is organized for tax purposes as a sole proprietorship and a partnership for tax purposes if there is more than one member. However, you can make an election to be taxed as a C Corporation (i.e., an LLC for legal purposes that is taxed as a C Corporation for tax purposes).You must complete and file form 966 to dissolve your LLC if you have elected to be a C Corporation or a Cooperative (Coop) for tax purposes. S Corporations and tax-exempt non-profits are exempt from filing this form (see here).If you are organized for tax purposes as an S Corporation you would file your taxes via form 1120S for the last time and check the box indicating that your return is a “Final Return.” Same is true for a Partnership, but with form 1065.On a state and local level, best practice is to check with your state and local agencies for requirements.For digestible information and tools for understanding how the tax landscape affects your business, visit Financial Telepathy

-

Do I need to fill out Form W-9 (US non-resident alien with an LLC in the US)?

A single-member LLC is by default a disregarded entity. Assuming you have not made a “check-the-box” election to have it treated as a corporation, this means for tax purposes, you are a sole proprietor.As a non-resident alien, you would not complete form W-9. You would likely provide form W-8ECI; possibly W-8BEN.

-

What do you need from your partners in order to fill out a k1-form? We all used LLC's to split our partnership up, so do I just need thier EINs or do I need their personal SSN as well?

Assuming each LLC is a single member disregarded entity, then you need the individual's SSN not the EIN of the LLC. You also put the individual's name on the K1 not the name of the LLC. If the LLC's are any other type of entity, then use the EIN and name of the LLC.You also need each partner's address and capital, loss and profit percentage.

Create this form in 5 minutes!

How to create an eSignature for the mississippi quitclaim deed from individual to llc

How to create an eSignature for the Mississippi Quitclaim Deed From Individual To Llc in the online mode

How to create an electronic signature for the Mississippi Quitclaim Deed From Individual To Llc in Chrome

How to create an eSignature for putting it on the Mississippi Quitclaim Deed From Individual To Llc in Gmail

How to generate an eSignature for the Mississippi Quitclaim Deed From Individual To Llc right from your smart phone

How to create an eSignature for the Mississippi Quitclaim Deed From Individual To Llc on iOS devices

How to create an eSignature for the Mississippi Quitclaim Deed From Individual To Llc on Android OS

People also ask

-

What is a quitclaim deed in Mississippi?

A quitclaim deed in Mississippi is a legal document used to transfer ownership interest in real property from one party to another without any warranties. It's commonly utilized during divorce proceedings or to transfer property among family members. This straightforward document can expedite the property transfer process.

-

How do I create a quitclaim deed in Mississippi?

To create a quitclaim deed in Mississippi, you need to fill out a quitclaim deed form that includes the names of both the grantor and the grantee, property description, and the date. It's crucial to follow local regulations for notarization before recording the deed at your county clerk's office. Using airSlate SignNow can simplify this process by providing an electronic template for quick completion.

-

What is the cost of filing a quitclaim deed in Mississippi?

The cost of filing a quitclaim deed in Mississippi varies by county but typically ranges from $10 to $30 plus additional fees for notarization. It's essential to check with your local county office for specific pricing. Leveraging airSlate SignNow, you can save time and potentially lower costs by eliminating the need for physical trips to the office.

-

What are the benefits of using airSlate SignNow for quitclaim deeds?

Using airSlate SignNow for quitclaim deeds offers a user-friendly platform to eSign documents quickly and securely. It boosts efficiency by allowing you to monitor the signing process in real-time and ensures compliance with state laws. Furthermore, the cost-effective solution facilitates easy document management for all your real estate needs.

-

Can I customize a quitclaim deed template in airSlate SignNow?

Yes, you can customize a quitclaim deed template in airSlate SignNow to suit your specific requirements. The platform enables users to modify fields, add or remove sections, and include any pertinent information necessary for your unique situation. Customization ensures that your quitclaim deed in Mississippi meets all legal standards.

-

Are there any legal considerations for quitclaim deeds in Mississippi?

Yes, when executing a quitclaim deed in Mississippi, it's important to ensure that the document is correctly filled out, signed, and signNowd. Additionally, since a quitclaim deed does not guarantee clear title, it's advisable to conduct a title search beforehand. Utilizing airSlate SignNow can help you adhere to these legal requirements effortlessly.

-

How can I integrate airSlate SignNow with my existing tools?

airSlate SignNow offers easy integration options with popular business applications, including Google Drive, Dropbox, and Salesforce. This allows for seamless workflows when managing your quitclaim deed documents alongside other business processes. Integrating these tools can enhance productivity and streamline your document management.

Get more for Mississippi Quitclaim Deed From Individual To LLC

- Kindergarten readiness checklist parents rating form

- State of iowa dhs criminal history record check form b 43679750

- Philippine eagles club application form

- Employee benefits comparison template form

- Tar 1406 form

- Ctpta form

- Investigational medicinal product dossier form

- Arkansas quitclaim deed form

Find out other Mississippi Quitclaim Deed From Individual To LLC

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document