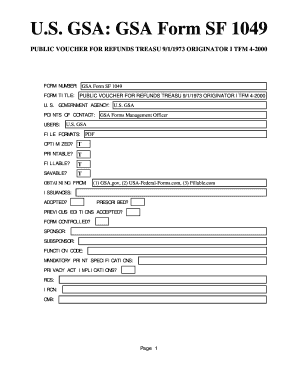

Sf1049 Form

What is the SF 1049?

The SF 1049, also known as the Standard Form 1049, is a federal form used primarily for reporting the completion of certain transactions and activities within the U.S. government. This form is essential for maintaining transparency and accountability in government operations. It serves as a record of transactions that may involve financial activities, contracts, or agreements, ensuring that all parties involved adhere to established guidelines and regulations.

How to Use the SF 1049

Using the SF 1049 involves several steps to ensure accurate reporting and compliance with federal regulations. First, gather all necessary information regarding the transaction or activity being reported. This includes details such as the parties involved, the nature of the transaction, and any relevant dates. Next, fill out the form accurately, ensuring that all fields are completed as required. Once completed, the form should be submitted to the appropriate government agency or department for processing.

Steps to Complete the SF 1049

Completing the SF 1049 requires careful attention to detail. Follow these steps:

- Gather all relevant information related to the transaction.

- Obtain a copy of the SF 1049 form, which can be downloaded from official government websites.

- Fill in the required fields, including names, dates, and descriptions of the transaction.

- Review the completed form for accuracy and completeness.

- Submit the form to the designated agency, either online or via mail, as specified in the instructions.

Legal Use of the SF 1049

The SF 1049 is legally binding when filled out correctly and submitted to the appropriate authorities. It is crucial to ensure compliance with all relevant federal laws and regulations when using this form. Failure to adhere to these guidelines may result in penalties or legal repercussions. Therefore, understanding the legal implications of the SF 1049 is essential for all parties involved in the transaction.

Key Elements of the SF 1049

Several key elements must be included in the SF 1049 to ensure its validity. These elements include:

- Transaction Details: A clear description of the transaction being reported.

- Parties Involved: Names and contact information of all parties involved in the transaction.

- Dates: Relevant dates, including the date of the transaction and the date of submission.

- Signatures: Required signatures from authorized individuals to validate the form.

Form Submission Methods

The SF 1049 can be submitted through various methods, depending on the agency's requirements. Common submission methods include:

- Online Submission: Many agencies allow for electronic submission through their official websites.

- Mail: The form can be printed and mailed to the designated office.

- In-Person: Some agencies may require or allow in-person submission for certain transactions.

Quick guide on how to complete sf1049

Effortlessly Prepare Sf1049 on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the right form and store it securely online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Sf1049 on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

Edit and Electronically Sign Sf1049 with Ease

- Obtain Sf1049 and click on Get Form to begin.

- Use the tools we offer to fill out your document.

- Highlight pertinent sections of the documents or redact sensitive information using the tools provided by airSlate SignNow specifically for that purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you want to share your form, whether via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searching, or errors necessitating the reprinting of new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Edit and electronically sign Sf1049 to ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sf1049

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 1049 form and its purpose?

A 1049 form is a document used for various tax purposes, including reporting income and expenses. It helps taxpayers provide detailed information to the IRS and ensures compliance with tax regulations. Understanding what a 1049 form is can streamline the filing process for individuals and businesses alike.

-

Who needs to file a 1049 form?

Individuals and businesses that have specific income types or deductions may need to file a 1049 form. Mostly, it's required for those involved in certain trades, hobbies, or businesses that generate income. Knowing if you need to file helps avoid penalties and ensures accurate tax reporting.

-

How can airSlate SignNow assist with 1049 forms?

airSlate SignNow allows you to easily eSign and manage your 1049 forms securely online. Our platform simplifies the documentation process, enabling quick access and submission. By leveraging airSlate SignNow, you can reduce the hassle of paperwork associated with 1049 forms.

-

Is there a cost to use airSlate SignNow for signing 1049 forms?

Yes, airSlate SignNow offers various pricing plans suitable for different business needs. We provide a cost-effective solution that ensures you can manage and eSign your 1049 forms without breaking the bank. You can choose a plan that best fits your document management needs.

-

What features does airSlate SignNow offer for managing 1049 forms?

With airSlate SignNow, you can easily create, edit, and eSign 1049 forms through our user-friendly interface. Our features also include templates, secure cloud storage, and collaboration tools. These capabilities make managing your 1049 forms efficient and accessible.

-

Can I integrate airSlate SignNow with other software for handling 1049 forms?

Absolutely, airSlate SignNow integrates seamlessly with a variety of software applications. This allows you to streamline your workflow when handling 1049 forms, ensuring you have all the tools you need in one place. Integrating with your existing systems enhances productivity and reduces errors.

-

What are the benefits of using airSlate SignNow for 1049 forms?

Using airSlate SignNow for your 1049 forms can signNowly enhance your efficiency and accuracy. Our platform allows for quick eSigning, which speeds up the filing process and reduces paper waste. Additionally, our encryption and security measures protect sensitive information associated with your 1049 forms.

Get more for Sf1049

- Stock purchase agreement among security secgov form

- 1 multi page tables tables continued this is an example of form

- Class a common stock and convertible preferred stock form

- Registration rights agreement as of the date secgov form

- Article list real estate alert form

- John liebig field service medical worldwide business form

- S 1a 033 63721 secgov form

- This pledge agreement agreement indiana board for depositories form

Find out other Sf1049

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy