Form 8621 Turbotax

What is the Form 8621 Turbotax

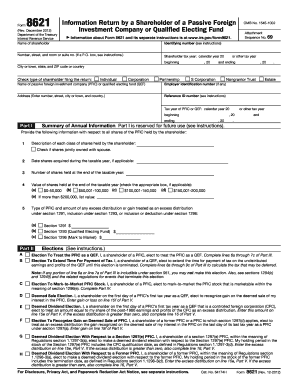

The Form 8621 is used by U.S. taxpayers to report their ownership of shares in a Passive Foreign Investment Company (PFIC). This form is crucial for individuals who have invested in foreign mutual funds or other foreign entities classified as PFICs. It helps taxpayers disclose information about their foreign investments and any income generated from them. Properly completing this form is essential to avoid potential tax penalties and ensure compliance with U.S. tax laws.

How to use the Form 8621 Turbotax

Using the Form 8621 in TurboTax involves several steps to ensure accurate reporting of your foreign investments. First, gather all necessary documentation related to your foreign investments, including statements from the PFIC. Next, open TurboTax and navigate to the section for foreign income. Follow the prompts to input your PFIC information, including the number of shares owned and any income received. TurboTax will guide you through the process, ensuring that you complete the form correctly and file it with your tax return.

Steps to complete the Form 8621 Turbotax

Completing the Form 8621 in TurboTax requires careful attention to detail. Here are the steps to follow:

- Gather all relevant documents, including PFIC statements and any prior year filings.

- Open TurboTax and select the option for foreign income reporting.

- Enter the required information about your PFIC investments, including the name of the entity and the number of shares owned.

- Report any income received from the PFIC, including dividends or capital gains.

- Complete any additional sections as prompted by TurboTax, ensuring all information is accurate.

- Review the completed Form 8621 for errors before submitting your tax return.

Legal use of the Form 8621 Turbotax

The legal use of Form 8621 is essential for compliance with U.S. tax regulations. Taxpayers must file this form if they own shares in a PFIC, as failure to do so can result in significant penalties. The form must be submitted along with your annual tax return, and it is important to ensure that all information is accurate and complete. Utilizing TurboTax can help streamline this process, as the software is designed to guide users through the legal requirements associated with foreign investments.

Filing Deadlines / Important Dates

Filing deadlines for Form 8621 are typically aligned with the standard tax return deadlines. Generally, individual taxpayers must submit their tax returns, including Form 8621, by April 15 of each year. If additional time is needed, taxpayers can file for an extension, which typically extends the deadline to October 15. However, it is crucial to check for any specific updates or changes to deadlines that may occur, especially for expatriates or those with complex tax situations.

Required Documents

To complete Form 8621 accurately, several documents are necessary. These include:

- Statements from the PFIC detailing your investment and any income earned.

- Prior year tax returns, if applicable, to reference any carryover amounts.

- Documentation of any sales or transactions involving PFIC shares.

Having these documents on hand will facilitate the completion of the form and help ensure compliance with IRS regulations.

Quick guide on how to complete form 8621 turbotax

Complete Form 8621 Turbotax effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-conscious alternative to conventional printed and signed documents, allowing you to find the right form and securely archive it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents quickly and without interruptions. Manage Form 8621 Turbotax on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to modify and eSign Form 8621 Turbotax without hassle

- Obtain Form 8621 Turbotax and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and holds the same legal validity as a conventional handwritten signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, via email, text message (SMS), an invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tiring searches for forms, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 8621 Turbotax while ensuring excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8621 turbotax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8621 Turbotax and why is it important?

Form 8621 Turbotax is a tax form used by shareholders of passive foreign investment companies (PFICs) to report income and distributions. Understanding and accurately completing this form is crucial to ensure compliance with IRS regulations and avoid potential penalties.

-

How can airSlate SignNow help with Form 8621 Turbotax?

airSlate SignNow streamlines the eSigning process for documents related to Form 8621 Turbotax. With our user-friendly platform, you can easily send forms for signatures and securely store signed documents, making tax filing simpler and more efficient.

-

What features does airSlate SignNow offer for handling Form 8621 Turbotax?

AirSlate SignNow provides features such as document templates, customizable workflows, and secure eSignatures specifically designed to simplify the completion of Form 8621 Turbotax. These tools ensure that your documents are accurate and accessible when you need them.

-

Is airSlate SignNow compatible with other tax software for Form 8621 Turbotax?

Yes, airSlate SignNow integrates seamlessly with various tax software, including Turbotax, to facilitate the management of Form 8621. This integration enables users to simplify their tax preparation process and securely collect necessary signatures within their existing workflow.

-

What is the pricing structure for airSlate SignNow when managing Form 8621 Turbotax?

airSlate SignNow offers flexible pricing plans that cater to both individual users and businesses needing to manage Form 8621 Turbotax. Our cost-effective solutions are designed to provide maximum value, ensuring you have access to all the necessary features without exceeding your budget.

-

Can I customize documents for Form 8621 Turbotax using airSlate SignNow?

Absolutely! AirSlate SignNow allows you to customize your document templates for Form 8621 Turbotax according to your specific needs. This customization can help ensure that all relevant information is captured accurately while maintaining a professional appearance.

-

What are the benefits of using airSlate SignNow for Form 8621 Turbotax?

Using airSlate SignNow for Form 8621 Turbotax offers numerous benefits, including faster document turnaround, enhanced security, and improved organization. Our platform enables users to manage their tax documents efficiently, reducing the stress associated with tax season.

Get more for Form 8621 Turbotax

- Deed for temporary easement form

- Mobile home lotfree legal forms

- This agreement made this day of between form

- Lease forms

- Registration pursuant to section 10a 1 7 form

- Control number al 00inc form

- Alabama adoption forms packageus legal forms

- Organized pursuant to the laws of the state of alabama hereinafter quotcorporationquot form

Find out other Form 8621 Turbotax

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF