Form VRTER1 Revenue

What is the Form VRTER1 Revenue

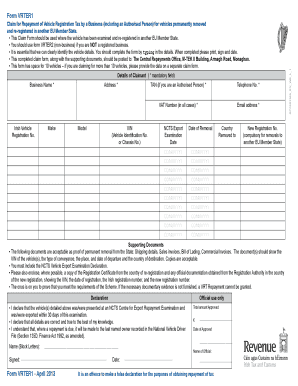

The Form VRTER1 Revenue is a specific document used for reporting revenue information to the appropriate authorities. This form is essential for businesses and individuals who need to disclose their income accurately for tax purposes. Understanding the purpose of this form is crucial for compliance with federal and state regulations.

How to use the Form VRTER1 Revenue

Using the Form VRTER1 Revenue involves several steps to ensure accurate reporting. First, gather all necessary financial documents that detail your revenue streams. Next, fill out the form with the required information, including income sources, amounts, and any deductions applicable. It is important to review the completed form for accuracy before submission to avoid any potential issues with tax authorities.

Steps to complete the Form VRTER1 Revenue

Completing the Form VRTER1 Revenue requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents, such as income statements and receipts.

- Enter your personal information, including name, address, and taxpayer identification number.

- List all sources of revenue and their corresponding amounts.

- Include any deductions or credits that apply to your situation.

- Review the form for accuracy and completeness.

- Submit the form according to the specified submission methods.

Legal use of the Form VRTER1 Revenue

The Form VRTER1 Revenue is legally binding when completed accurately and submitted in compliance with relevant laws. It is essential to ensure that all information provided is truthful and complete to avoid potential legal repercussions. Misrepresentation or failure to file can lead to penalties and fines, making it crucial to adhere to legal guidelines.

Filing Deadlines / Important Dates

Filing deadlines for the Form VRTER1 Revenue can vary based on your specific situation. Generally, it is advisable to submit the form by the tax filing deadline to avoid any penalties. Keeping track of important dates, such as the end of the tax year and submission deadlines, will help ensure compliance and timely reporting.

Form Submission Methods

The Form VRTER1 Revenue can be submitted through various methods, including online submission, mailing a physical copy, or in-person delivery to the appropriate tax office. Each method may have different processing times and requirements, so it is important to choose the one that best fits your needs. Ensure that you retain a copy of the submitted form for your records.

Quick guide on how to complete form vrter1 revenue

Easily Prepare Form VRTER1 Revenue on Any Device

Digital document management has gained popularity among businesses and individuals. It offers a superb environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Manage Form VRTER1 Revenue on any platform using airSlate SignNow apps for Android or iOS and simplify any document-related task today.

How to Edit and Electronically Sign Form VRTER1 Revenue with Ease

- Find Form VRTER1 Revenue and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important parts of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which only takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to preserve your modifications.

- Choose how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, cumbersome form navigation, or mistakes requiring new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form VRTER1 Revenue to ensure effective communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form vrter1 revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form VRTER1 Revenue?

Form VRTER1 Revenue is a specific document needed for reporting revenue in compliance with financial regulations. By utilizing airSlate SignNow, businesses can efficiently create, send, and eSign Form VRTER1 Revenue, ensuring accuracy and compliance without delays.

-

How does airSlate SignNow facilitate the completion of Form VRTER1 Revenue?

airSlate SignNow allows users to fill out Form VRTER1 Revenue electronically, streamlining the process. Its easy-to-use interface enables quick data entry, ensuring that your revenue reporting is both accurate and compliant while eliminating the need for paper documentation.

-

Is there a cost associated with using airSlate SignNow for Form VRTER1 Revenue?

Yes, airSlate SignNow offers various pricing plans, which include features for managing Form VRTER1 Revenue. These plans are designed to be cost-effective for businesses of all sizes, ensuring you only pay for the features you need while maximizing your return on investment.

-

What features does airSlate SignNow offer for handling Form VRTER1 Revenue?

airSlate SignNow provides several features for handling Form VRTER1 Revenue, including templates, eSignature capabilities, and real-time tracking. These features optimize your document management process, enhancing efficiency and ensuring compliance with legal standards.

-

Can I integrate airSlate SignNow with other applications for managing Form VRTER1 Revenue?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing for smooth data transfers when managing Form VRTER1 Revenue. Whether it's your CRM or accounting software, these integrations enhance your workflow and save you time.

-

What are the benefits of using airSlate SignNow for Form VRTER1 Revenue?

Using airSlate SignNow for Form VRTER1 Revenue provides numerous benefits, including increased efficiency, reduced errors, and a quicker turnaround time. By digitizing the process, businesses can enhance productivity and focus on their core operations without getting bogged down in paperwork.

-

Is the platform secure for handling sensitive information in Form VRTER1 Revenue?

Yes, airSlate SignNow places a high priority on security and compliance, employing advanced encryption and authentication measures. This ensures that all sensitive information related to Form VRTER1 Revenue is securely handled and protected from unauthorized access.

Get more for Form VRTER1 Revenue

- Casualty claim service organization form

- Rule 32 post conviction remedies huntsville madison county form

- Terms ampamp conditionsus ledgeneral ampamp signage led lighting form

- State of alabama jefferson county statement form

- Affidavit concerning immigration calhoun county form

- Divorce issues huntsville madison county bar association form

- Final divorce forms with children tennessee administrative

- Sample civil form 4 in the court of county ab

Find out other Form VRTER1 Revenue

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online