California Form 100

What is the California Form 100

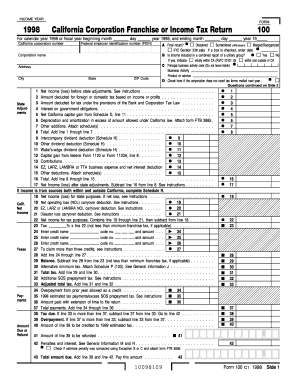

The California Form 100, also known as the California Corporation Franchise or Income Tax Return, is a crucial document for corporations operating within the state. This form is required for corporations to report their income, calculate their tax liability, and ensure compliance with California tax laws. It is essential for both domestic and foreign corporations that are doing business in California. The form captures various financial details, including gross receipts, deductions, and credits, which determine the corporation's taxable income.

Steps to complete the California Form 100

Completing the California Form 100 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements and balance sheets. Next, follow these steps:

- Enter the corporation's identifying information, such as name, address, and Employer Identification Number (EIN).

- Report total income, including gross receipts from sales and services.

- Deduct allowable expenses, such as operating costs and depreciation.

- Calculate the taxable income by subtracting total deductions from total income.

- Apply the appropriate tax rate to determine the tax liability.

- Complete any additional schedules as required, based on the corporation's specific activities.

- Review the form for accuracy before submission.

How to obtain the California Form 100

The California Form 100 can be easily obtained through the California Franchise Tax Board (FTB) website. It is available in a printable PDF format, allowing corporations to fill it out manually or digitally. Additionally, tax preparation software often includes the form, streamlining the filing process. Corporations can also request a paper copy by contacting the FTB directly if they prefer to complete the form offline.

Legal use of the California Form 100

The legal use of the California Form 100 is essential for maintaining compliance with state tax regulations. To ensure that the form is legally binding, corporations must adhere to specific guidelines, including accurate reporting of financial information and timely submission. The form must be signed by an authorized officer of the corporation, affirming that the information provided is true and accurate. Failure to comply with these legal requirements may result in penalties or audits by the California Franchise Tax Board.

Filing Deadlines / Important Dates

Corporations must be aware of key filing deadlines for the California Form 100 to avoid penalties. Generally, the form is due on the 15th day of the fourth month after the close of the corporation's taxable year. For corporations operating on a calendar year, this means the due date is April 15. Extensions may be available, but they require filing a separate request and do not extend the time to pay any taxes owed.

Form Submission Methods (Online / Mail / In-Person)

Corporations have several options for submitting the California Form 100. The form can be filed electronically through the California Franchise Tax Board's e-file system, which is often the quickest method. Alternatively, corporations may choose to mail a paper copy of the completed form to the appropriate FTB address. In-person submissions are also accepted at designated FTB offices, although this option may require an appointment. Each method has specific guidelines and processing times, so it is important to choose the one that best suits the corporation's needs.

Quick guide on how to complete california form 100 10922274

Easily Prepare California Form 100 on Any Device

Digital document management has become increasingly preferred among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools needed to create, modify, and eSign your documents quickly without any delays. Manage California Form 100 on any device with airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

How to Edit and eSign California Form 100 Effortlessly

- Obtain California Form 100 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign California Form 100 and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the california form 100 10922274

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is CA Form 100 and who needs it?

CA Form 100 is a California corporate income tax return that businesses must file if they are doing business in California. It's essential for corporations to comply with state tax regulations and accurately report their income. Filing this form helps ensure your business remains in good standing with the California Franchise Tax Board.

-

How can airSlate SignNow assist with CA Form 100?

airSlate SignNow streamlines the process of signing and sending your CA Form 100. With its easy-to-use platform, you can quickly gather necessary signatures and ensure the form is completed accurately. This not only saves time but also helps eliminate errors during the filing process.

-

Is airSlate SignNow a cost-effective solution for managing CA Form 100?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes, making it a cost-effective solution for managing CA Form 100. By using our platform, you can reduce the costs associated with printing, mailing, and in-person meetings. Our transparent pricing ensures you know exactly what you're paying for.

-

What features does airSlate SignNow offer for CA Form 100 filing?

airSlate SignNow provides features such as document templates, customizable workflows, and secure electronic signatures specifically designed for forms like CA Form 100. These features enable users to streamline the document management process, ensuring that all necessary steps are completed efficiently and securely.

-

Can airSlate SignNow integrate with my accounting software for CA Form 100?

Absolutely! airSlate SignNow offers integrations with several popular accounting software systems. This means you can seamlessly manage your CA Form 100 along with your financial records, saving time and improving overall accuracy in your tax filings.

-

What benefits does using airSlate SignNow provide for CA Form 100 submissions?

Using airSlate SignNow for CA Form 100 submissions provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. The user-friendly interface allows for quick access to your documents, helping ensure that your submissions are timely and accurate.

-

How secure is airSlate SignNow for handling sensitive CA Form 100 information?

airSlate SignNow prioritizes the security of your documents, including sensitive information on your CA Form 100. We use advanced encryption methods and compliance with industry standards to protect your data, ensuring the safety and confidentiality of all your transactions.

Get more for California Form 100

- Warranty of completion of construction form

- Fill in the blanks will form

- Dance class waiver template form

- Brilliant public school sitamarhi worksheets class 10 maths form

- Omb approval no 3245 0188 form

- Employee declaration form in word

- Construction proposal and agreement projects under 50000 form

- Dc estate tax return form

Find out other California Form 100

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors