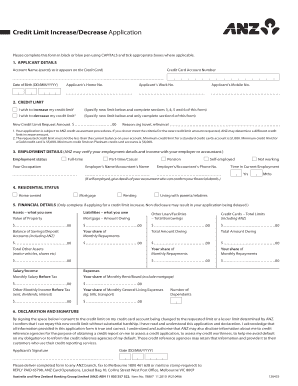

Anz Increase Credit Card Limit Form

What is the ANZ Increase Credit Card Limit

The ANZ increase credit card limit refers to the process by which a cardholder can request a higher spending limit on their ANZ credit card. This increase can provide greater purchasing power and flexibility for managing expenses. Factors that may influence the decision to grant an increase include the cardholder's credit score, payment history, and overall financial situation. Understanding the implications of a higher limit is essential, as it can affect credit utilization ratios and overall credit health.

How to Use the ANZ Increase Credit Card Limit

Using an increased credit card limit responsibly can enhance financial management. Cardholders should consider the following guidelines:

- Maintain regular payments to avoid interest charges and penalties.

- Monitor spending to ensure it remains within a manageable range.

- Utilize the increased limit for necessary purchases rather than impulsive spending.

- Review statements regularly to track expenses and identify any discrepancies.

Steps to Complete the ANZ Increase Credit Card Limit

Completing the process to increase your ANZ credit card limit involves several steps:

- Log in to your ANZ online banking account or mobile app.

- Navigate to the credit card section and select the option to request a limit increase.

- Provide necessary information, including your income, employment status, and desired limit.

- Submit the request and await confirmation from ANZ regarding the decision.

Eligibility Criteria

To qualify for an increase in the ANZ credit card limit, applicants typically need to meet specific eligibility criteria. These may include:

- A minimum credit score as determined by ANZ.

- A history of timely payments on existing credit accounts.

- Stable income that meets ANZ's requirements.

- Duration of account ownership, often requiring a minimum period before applying for an increase.

Legal Use of the ANZ Increase Credit Card Limit

When requesting an increase in credit card limits, it is important to understand the legal implications. The request must comply with relevant financial regulations and consumer protection laws. This includes ensuring that the cardholder provides accurate information and understands the terms associated with the increased limit. Misrepresentation or failure to comply with these regulations can lead to penalties or denial of the request.

Key Elements of the ANZ Increase Credit Card Limit

Several key elements are essential when considering an increase in the ANZ credit card limit:

- Credit utilization ratio: A lower ratio can positively impact credit scores.

- Payment history: Consistent, on-time payments demonstrate creditworthiness.

- Income verification: Proof of income may be required to support the request.

- Account standing: An account in good standing is crucial for approval.

Application Process & Approval Time

The application process for increasing the ANZ credit card limit is straightforward. Once the request is submitted, ANZ typically reviews it within a few business days. Approval times may vary based on the complexity of the request and the completeness of the information provided. Cardholders will be notified of the outcome via email or through their online banking portal.

Quick guide on how to complete anz increase credit card limit

Complete Anz Increase Credit Card Limit seamlessly on any device

Digital document management has become increasingly favored by both companies and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, enabling you to obtain the appropriate form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage Anz Increase Credit Card Limit on any platform with the airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to modify and eSign Anz Increase Credit Card Limit effortlessly

- Find Anz Increase Credit Card Limit and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your updates.

- Choose how you wish to send your form, either via email, text message (SMS), or an invite link, or download it to your computer.

Eliminate the issues of lost or mislaid documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow takes care of your document management needs in just a few clicks from any device of your choice. Edit and eSign Anz Increase Credit Card Limit and ensure excellent communication at any stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the anz increase credit card limit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to increase credit card limit ANZ NZ?

To increase your credit card limit with ANZ NZ, you'll need to log into your online banking, navigate to the credit card section, and select the option to request a limit increase. Ensure you meet the eligibility criteria, such as a good payment history and income verification. The approval process is typically quick, and you will be notified of the decision shortly.

-

How can I check my eligibility to increase my credit card limit ANZ NZ?

You can check your eligibility to increase your credit card limit ANZ NZ by reviewing your credit card account details on the ANZ NZ website or mobile app. Look for factors like your account age, payment history, and income level, which are considered during the review process. If you're unsure, contacting customer service for guidance is recommended.

-

Are there any fees associated with increasing my credit card limit ANZ NZ?

Generally, there are no fees associated with requesting an increase in credit card limit ANZ NZ. However, it’s essential to review your credit card terms and conditions, as certain conditions may apply based on your specific card type. Keep in mind that a higher limit may result in increased responsibilities for managing your credit wisely.

-

What advantages come with increasing my credit card limit ANZ NZ?

Increasing your credit card limit ANZ NZ can enhance your purchasing power, allowing for larger purchases or unforeseen expenses. It may also positively impact your credit utilization ratio, which can help improve your credit score if managed well. Additionally, having a higher limit can provide an extra layer of financial security in emergencies.

-

How long does it take to increase my credit card limit ANZ NZ?

The time it takes to process a request to increase your credit card limit ANZ NZ varies, but you can usually expect a response within a few minutes to a few days. If additional information or documentation is needed, this may delay the process. Make sure to check your email or online account for updates after your request.

-

Can I request a temporary increase in my credit card limit ANZ NZ?

Yes, many banks, including ANZ NZ, allow customers to request a temporary increase in their credit card limit for special occasions or emergencies. This option typically requires you to specify the duration for which you need the increase. Be sure to inquire about how long the temporary limit will last and any terms associated with it.

-

Will increasing my credit card limit ANZ NZ affect my credit score?

Increasing your credit card limit ANZ NZ might temporarily impact your credit score due to a hard inquiry on your credit report. However, if you manage your new limit responsibly by minimizing utilization, it can have a positive long-term effect on your score. Always ensure to pay your balances on time to maintain a healthy credit profile.

Get more for Anz Increase Credit Card Limit

- I name am the parent of name form

- County of colorado form

- After hearing on the petition for appointment of guardian for the above minor the court finds that venue is form

- In the matter of the estate of form

- Trust registration statement co courts form

- Settlor testator form

- Petition for allowance of claims by personal representative form

- Colorado judicial branch self help forms co courts

Find out other Anz Increase Credit Card Limit

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template