Oregon W2c Form

What is the Oregon W-2c?

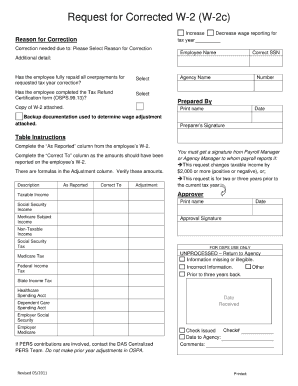

The Oregon W-2c is a corrected version of the standard W-2 form, which reports wages and taxes withheld for employees in the state of Oregon. It is specifically used to correct errors made on the original W-2 form. Employers must issue this form to ensure accurate reporting of income and tax information to both the employee and the state tax authorities. The W-2c serves as an essential document for employees to rectify any discrepancies in their tax records, ensuring compliance with state tax regulations.

How to use the Oregon W-2c

Using the Oregon W-2c involves several steps. First, an employer must identify the errors in the original W-2 form that need correction. Once identified, the employer completes the W-2c form, detailing the correct information. It is crucial to provide accurate data to avoid future complications. After completing the form, the employer must distribute copies to the affected employees and submit the W-2c to the Oregon Department of Revenue. Employees can then use this corrected information when filing their state tax returns.

Steps to complete the Oregon W-2c

Completing the Oregon W-2c involves a systematic approach:

- Review the original W-2 for errors, such as incorrect names, Social Security numbers, or wage amounts.

- Obtain the Oregon W-2c form, which can be downloaded from the Oregon Department of Revenue website.

- Fill out the form with the correct information, ensuring that all fields are accurately completed.

- Provide an explanation for the corrections made in the designated section of the form.

- Distribute copies of the completed W-2c to the affected employees.

- Submit the W-2c to the Oregon Department of Revenue by the required deadline.

Legal use of the Oregon W-2c

The legal use of the Oregon W-2c is governed by state tax laws. Employers are required to issue a W-2c when there are corrections to be made on the original W-2 form. This ensures that both the employee’s and the state’s tax records are accurate. Failure to issue a W-2c when necessary can result in penalties for the employer. It is important for both employers and employees to understand their rights and responsibilities regarding this form to maintain compliance with Oregon tax regulations.

Key elements of the Oregon W-2c

The Oregon W-2c includes several key elements that are essential for accurate reporting:

- Employee's correct name and Social Security number.

- Employer's information, including name, address, and Employer Identification Number (EIN).

- Corrected wage amounts and tax withholdings.

- Reason for the correction, which provides context for the changes made.

- Signature of the employer or authorized representative, confirming the accuracy of the information provided.

Who Issues the Form

The Oregon W-2c is issued by employers who need to correct information previously submitted on the standard W-2 form. It is the responsibility of the employer to ensure that any errors are rectified promptly to comply with state tax laws. Employees do not issue this form; instead, they receive it from their employer when corrections are necessary.

Quick guide on how to complete oregon w2c

Complete Oregon W2c effortlessly on any device

Online document management has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to access the correct format and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Oregon W2c on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based procedure today.

The easiest way to edit and eSign Oregon W2c effortlessly

- Obtain Oregon W2c and then click Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about missing or lost documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choice. Edit and eSign Oregon W2c to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the oregon w2c

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a W-2 form and how does it relate to airSlate SignNow?

A W-2 form is a crucial tax document that employers in the U.S. must send to employees and the IRS. With airSlate SignNow, you can easily create, send, and eSign W-2 forms, streamlining your tax processing and improving compliance with tax regulations.

-

How can airSlate SignNow assist with the eSigning of W-2 forms?

airSlate SignNow provides a secure platform for eSigning W-2 forms, allowing businesses to eliminate the need for paper documents. This solution not only speeds up the signing process but also ensures that your W-2 forms are stored safely and accessed easily when needed.

-

What features does airSlate SignNow offer for managing W-2 forms?

airSlate SignNow offers numerous features for managing W-2 forms, including templates for quick generation, customizable fields, and comprehensive audit trails. These features enhance accuracy and help you manage your document workflows more effectively.

-

Is airSlate SignNow cost-effective for handling W-2 forms?

Yes, airSlate SignNow is a cost-effective solution for handling W-2 forms. With competitive pricing plans that cater to businesses of all sizes, you can streamline your document management without breaking the bank.

-

Can airSlate SignNow integrate with other software for W-2 form processing?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and HR software, making it easy to incorporate W-2 form processing into your existing workflows. This flexibility ensures that you can manage employee documents efficiently across different platforms.

-

What are the benefits of using airSlate SignNow for W-2 forms?

Using airSlate SignNow for W-2 forms provides several benefits, including enhanced security, reduced processing time, and improved organization. The eSigning capabilities also allow for faster approvals, ensuring that your records are accurate and up-to-date.

-

How does airSlate SignNow ensure the security of W-2 forms?

airSlate SignNow prioritizes security with features like encryption, multi-factor authentication, and secure storage for W-2 forms. This level of security helps protect sensitive employee information and maintain compliance with data protection regulations.

Get more for Oregon W2c

- Laws of the state of hereinafter referred to as grantor does hereby grant form

- Bargain sell and confirm with warranty covenants unto form

- With quitclaim covenants to a limited liability company form

- Of the state of hereinafter referred to as grantor does hereby give grant form

- Of the state of hereinafter referred to as grantor does hereby grant with form

- Know ye that a corporation organized under the laws form

- Husband and wife to trust form

- Does hereby give grant bargain sell and confirm with warranty covenants unto form

Find out other Oregon W2c

- How Can I eSign Minnesota Partnership agreements

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now

- eSign Georgia Rental lease agreement template Simple

- Can I eSign Wyoming Rental lease agreement forms

- eSign New Hampshire Rental lease agreement template Online

- eSign Utah Rental lease contract Free