Blank Business Deed Form

What is the Blank Business Deed Form

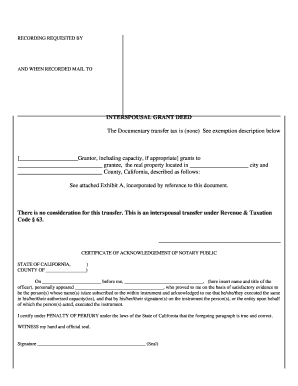

The blank business deed form is a legal document used to transfer ownership of property or assets between parties. This form outlines the terms and conditions of the transfer, ensuring that both parties understand their rights and obligations. It serves as a formal record of the transaction, which is essential for legal purposes. The form typically includes details such as the names of the parties involved, a description of the property or assets being transferred, and any specific conditions related to the transfer.

How to use the Blank Business Deed Form

Using the blank business deed form involves several key steps. First, gather all necessary information, including the names and addresses of the parties involved and a detailed description of the property or assets. Next, fill out the form completely, ensuring that all required fields are accurately completed. After filling out the form, both parties should review it for accuracy before signing. It is important to ensure that the signatures are witnessed or notarized, as required by state law, to make the deed legally binding.

Steps to complete the Blank Business Deed Form

Completing the blank business deed form requires careful attention to detail. Follow these steps for a successful completion:

- Gather necessary information about the parties and the property.

- Fill in the names and addresses of the grantor (seller) and grantee (buyer).

- Provide a detailed description of the property or assets being transferred.

- Include any specific terms or conditions of the transfer.

- Sign the form in the presence of a notary or witness, if required.

- Make copies of the completed form for your records.

Legal use of the Blank Business Deed Form

The blank business deed form is legally binding when completed correctly. To ensure its legal validity, it must comply with state-specific laws regarding property transfers. This includes proper execution, which often requires notarization or witnessing. Additionally, the form should be filed with the appropriate government office, such as the county recorder's office, to provide public notice of the transfer. Failure to follow these legal requirements may result in disputes or challenges to the validity of the deed.

Key elements of the Blank Business Deed Form

Several key elements must be included in the blank business deed form to ensure its effectiveness:

- Parties Involved: Clearly state the names and addresses of the grantor and grantee.

- Property Description: Provide a detailed description of the property or assets being transferred.

- Consideration: Indicate the value or payment exchanged for the transfer.

- Signatures: Ensure that both parties sign the form, along with any required witnesses or notaries.

- Date: Include the date of the transaction for record-keeping purposes.

State-specific rules for the Blank Business Deed Form

Each state in the U.S. has its own regulations governing the use of the blank business deed form. It is essential to be aware of these state-specific rules to ensure compliance. For example, some states may require additional disclosures or specific language to be included in the deed. Additionally, the requirements for notarization or witnessing may vary. Checking with local authorities or legal counsel can help ensure that the form meets all necessary state requirements.

Quick guide on how to complete blank business deed form

Easily prepare Blank Business Deed Form on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the resources needed to create, edit, and electronically sign your documents quickly and efficiently. Manage Blank Business Deed Form across any platform using the airSlate SignNow apps for Android or iOS and streamline your document-related processes today.

The easiest way to edit and electronically sign Blank Business Deed Form effortlessly

- Locate Blank Business Deed Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important parts of the documents or conceal sensitive information using the tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to record your changes.

- Choose how you prefer to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets all your documentation management needs in just a few clicks from any device of your choice. Modify and electronically sign Blank Business Deed Form to ensure outstanding communication at all stages of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the blank business deed form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Blank Business Deed Form?

A Blank Business Deed Form is a legal document used to outline the terms of a business transaction or agreement. It serves as a template that can be customized to meet specific needs. By using a Blank Business Deed Form, businesses can ensure that all essential details are included and avoid any potential disputes.

-

How can I create a Blank Business Deed Form using airSlate SignNow?

Creating a Blank Business Deed Form with airSlate SignNow is simple and straightforward. You can choose from pre-designed templates or start from scratch using our user-friendly interface. Once you've filled in the necessary fields, you can easily send it for eSignature.

-

Is the Blank Business Deed Form legally binding?

Yes, a Blank Business Deed Form becomes legally binding once all parties have signed it. airSlate SignNow ensures that these digital signatures are compliant with eSignature laws. This means your document holds the same legal weight as a traditional paper signature.

-

What are the pricing options for using airSlate SignNow for a Blank Business Deed Form?

airSlate SignNow offers flexible pricing plans to fit different business needs, starting with a free trial. Our plans are designed to be cost-effective, providing access to essential features for managing your Blank Business Deed Form. Check our website for specific plan details and pricing.

-

What features does airSlate SignNow offer for managing a Blank Business Deed Form?

airSlate SignNow provides a range of features for your Blank Business Deed Form, including customizable templates, automated workflows, and secure storage. Additionally, it allows you to track document status in real-time, ensuring a smooth and efficient process from creation to signing.

-

Can I integrate airSlate SignNow with other tools for my Blank Business Deed Form?

Yes, airSlate SignNow supports numerous integrations with popular applications like Google Drive, Salesforce, and Microsoft Office. This facilitates seamless management of your Blank Business Deed Form alongside other business workflows. Integrations enhance productivity and streamline processes.

-

How does airSlate SignNow ensure the security of my Blank Business Deed Form?

airSlate SignNow takes security seriously, implementing advanced encryption and authentication protocols to protect your Blank Business Deed Form. Our platform complies with industry standards to ensure that your documents are safe from unauthorized access or tampering.

Get more for Blank Business Deed Form

- Field 53 58 form

- Making a will in dcnolo form

- John schroeder pdf free download pdffoxcom form

- District of columbia passed away form

- Any agreements and decrees form

- Insurance carrierself insurerthird party adjuster form

- Department of labor and workforce developmentfrequently form

- To the industrial accident board of the state of delaware form

Find out other Blank Business Deed Form

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself