From 700 Schedule D Fillable Form

What is the From 700 Schedule D Fillable Form

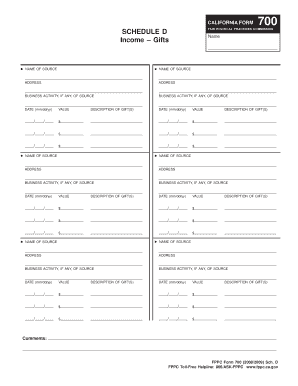

The From 700 Schedule D Fillable Form is a crucial document used by taxpayers in the United States to report capital gains and losses from the sale of assets. This form is essential for individuals who have sold stocks, bonds, or real estate, as it helps determine the amount of tax owed or the refund due based on these transactions. The fillable format allows users to complete the form electronically, ensuring accuracy and ease of submission.

How to use the From 700 Schedule D Fillable Form

Using the From 700 Schedule D Fillable Form involves several steps. First, gather all necessary documentation related to your asset sales, including purchase and sale dates, prices, and any associated costs. Next, access the fillable form online, where you can enter your information directly. Ensure that you follow the instructions carefully, filling out each section accurately to reflect your financial situation. Once completed, you can save the form and submit it electronically or print it for mailing.

Steps to complete the From 700 Schedule D Fillable Form

Completing the From 700 Schedule D Fillable Form requires careful attention to detail. Start by entering your personal information, including your name and Social Security number. Then, proceed to list each asset sold, providing details such as the date acquired, date sold, proceeds from the sale, and cost basis. Calculate your total capital gains or losses by subtracting the cost basis from the proceeds. Finally, review your entries for accuracy before submitting the form to ensure compliance with IRS regulations.

Legal use of the From 700 Schedule D Fillable Form

The legal use of the From 700 Schedule D Fillable Form is governed by IRS regulations. It is essential to ensure that all information provided is truthful and accurate, as discrepancies can lead to penalties or audits. The form must be submitted as part of your annual tax return, and it is important to keep copies of all supporting documents for your records. Compliance with these legal requirements helps maintain the integrity of your tax filings.

Filing Deadlines / Important Dates

Filing deadlines for the From 700 Schedule D Fillable Form align with the general tax return deadlines in the United States. Typically, individual taxpayers must file their returns by April fifteenth of each year. If you require additional time, you may file for an extension, but it is crucial to understand that any taxes owed are still due by the original deadline. Keeping track of these dates ensures that you avoid late fees and penalties.

Form Submission Methods (Online / Mail / In-Person)

The From 700 Schedule D Fillable Form can be submitted through various methods, providing flexibility for taxpayers. You can file electronically using approved e-filing software, which often simplifies the process and ensures accuracy. Alternatively, you may print the completed form and mail it to the appropriate IRS address. In-person submissions are generally not available for this form, making electronic filing the most efficient option.

Quick guide on how to complete from 700 schedule d fillable form

Effortlessly Prepare From 700 Schedule D Fillable Form on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed paperwork, allowing easy access to the right forms and secure online storage. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage From 700 Schedule D Fillable Form across any device using airSlate SignNow apps for Android or iOS and enhance your document-related processes today.

How to Modify and eSign From 700 Schedule D Fillable Form with Ease

- Obtain From 700 Schedule D Fillable Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal legitimacy as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether via email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searches, or errors that require new document copies. airSlate SignNow meets your document management needs with just a few clicks from your chosen device. Modify and eSign From 700 Schedule D Fillable Form and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the from 700 schedule d fillable form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the From 700 Schedule D Fillable Form, and who needs it?

The From 700 Schedule D Fillable Form is a tax document used by individuals to report capital gains and losses on their tax returns. It's essential for anyone who has sold assets like stocks or real estate, as it helps in calculating taxable income. By using this fillable form, taxpayers can easily track their investment performance and ensure compliance with tax regulations.

-

How can airSlate SignNow assist with the From 700 Schedule D Fillable Form?

airSlate SignNow provides a user-friendly platform to fill out and eSign the From 700 Schedule D Fillable Form with ease. Our tools simplify the document signing process, ensuring you can complete your tax documents quickly and efficiently. Additionally, our platform allows for secure storage and easy access to your completed forms.

-

Are there any costs associated with using airSlate SignNow for the From 700 Schedule D Fillable Form?

Yes, airSlate SignNow offers several pricing plans that cater to different business needs. Our cost-effective solutions ensure that you can access powerful document management tools without breaking the bank. You'll find that our pricing aligns well with the value derived from using the From 700 Schedule D Fillable Form electronically.

-

What features are included in airSlate SignNow for managing the From 700 Schedule D Fillable Form?

airSlate SignNow includes features such as customizable templates, real-time collaboration, and secure eSigning options specifically designed for documents like the From 700 Schedule D Fillable Form. These features make filling out and submitting your tax documents straightforward while ensuring all entries are legally binding and protected.

-

Is airSlate SignNow compatible with other software for the From 700 Schedule D Fillable Form?

Absolutely! airSlate SignNow integrates seamlessly with various software commonly used for tax preparation and document management. This compatibility allows for a streamlined workflow when dealing with the From 700 Schedule D Fillable Form, making it easier to synchronize your tax documents with your existing tools.

-

What are the benefits of using airSlate SignNow for the From 700 Schedule D Fillable Form?

Using airSlate SignNow for the From 700 Schedule D Fillable Form offers numerous benefits, including convenience, security, and cost-efficiency. Our platform enables quick access to your forms, reduces the risk of errors with automated fields, and provides a secure way to collect signatures. This allows you to focus on your financial strategy rather than the paperwork.

-

Can I save my progress while filling out the From 700 Schedule D Fillable Form with airSlate SignNow?

Yes, you can save your progress while completing the From 700 Schedule D Fillable Form using airSlate SignNow. This feature ensures that you can return to your document at any time, making it easier to gather necessary information and complete your filing without pressure. We prioritize user experience to accommodate your busy schedule.

Get more for From 700 Schedule D Fillable Form

- Virginia corporation form

- Interrogatories 481374694 form

- Virginia permissible form for orders of publication divorce or annulment

- Va tenancy form

- Satisfaction judgment court 481374698 form

- Notice lease 90 day form

- Virginia assignment of deed of trust by corporate mortgage holder form

- Virginia notice of dishonored check civil keywords bad check bounced check form

Find out other From 700 Schedule D Fillable Form

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple