Ftb 5821 Form

What is the Ftb 5821

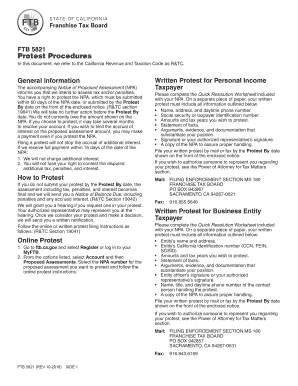

The Ftb 5821 form is a specific tax form used by individuals and businesses in the state of California. It is primarily utilized for reporting income and expenses related to certain business activities. Understanding the purpose of this form is essential for compliance with state tax regulations. The Ftb 5821 helps ensure that taxpayers accurately report their financial information, which is crucial for determining tax liabilities and eligibility for various deductions.

How to use the Ftb 5821

Using the Ftb 5821 involves several key steps to ensure accurate completion. First, gather all necessary financial documents, including income statements and expense receipts. Next, carefully fill out the form, ensuring that all sections are completed accurately. It is important to review the form for any errors or omissions before submission. Once completed, the form can be submitted electronically or by mail, depending on your preference and the requirements set by the California Franchise Tax Board.

Steps to complete the Ftb 5821

Completing the Ftb 5821 requires a systematic approach. Follow these steps for a smooth process:

- Gather all relevant financial documents, including income and expense records.

- Download the Ftb 5821 form from the California Franchise Tax Board website.

- Fill out the form, ensuring to provide accurate information in each section.

- Double-check the form for completeness and accuracy.

- Submit the completed form electronically or via mail as per your preference.

Legal use of the Ftb 5821

The legal use of the Ftb 5821 is governed by California tax laws. To ensure that the form is legally binding, it must be filled out accurately and submitted within the designated time frame. Compliance with the California Franchise Tax Board's regulations is essential to avoid penalties or legal issues. Proper use of the Ftb 5821 not only helps in fulfilling tax obligations but also supports transparency and accountability in business practices.

Required Documents

When completing the Ftb 5821, certain documents are required to support the information provided on the form. These typically include:

- Income statements from all business activities.

- Receipts for any deductible expenses.

- Previous year’s tax returns for reference.

- Any additional documentation requested by the California Franchise Tax Board.

Form Submission Methods

The Ftb 5821 can be submitted through various methods, providing flexibility for taxpayers. The available submission methods include:

- Online submission through the California Franchise Tax Board's website.

- Mailing a physical copy of the form to the appropriate address.

- In-person submission at designated tax offices, if applicable.

Quick guide on how to complete ftb 5821

Complete Ftb 5821 effortlessly on any gadget

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your files quickly without delays. Manage Ftb 5821 on any gadget using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Ftb 5821 effortlessly

- Obtain Ftb 5821 and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow caters to all your document management needs in just a few clicks from a device of your preference. Modify and eSign Ftb 5821 and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ftb 5821

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is FTB 5821 and how does it relate to airSlate SignNow?

FTB 5821 is a specific form used for California tax filings. airSlate SignNow simplifies the process of signing and submitting FTB 5821 forms, allowing users to electronically sign documents securely, thereby streamlining tax compliance.

-

How much does airSlate SignNow cost for FTB 5821 e-signatures?

airSlate SignNow offers various pricing plans tailored to fit different business needs. Users can choose a plan that allows unlimited e-signatures, including functionalities related to FTB 5821, at a cost-effective monthly rate.

-

What features does airSlate SignNow provide for FTB 5821 document management?

With airSlate SignNow, you can upload, customize, and send FTB 5821 documents for signing. The platform also offers features like templates, automated workflows, and real-time tracking, making it easy to manage tax forms.

-

Can airSlate SignNow integrate with accounting software for FTB 5821 submissions?

Yes, airSlate SignNow integrates seamlessly with various accounting software platforms. This allows users to automate the process of handling FTB 5821 submissions, ensuring accurate and timely filings.

-

What are the benefits of using airSlate SignNow for FTB 5821?

Using airSlate SignNow for FTB 5821 provides numerous benefits, including reduced turnaround time for document signing and enhanced security. The platform also helps ensure compliance with electronic signature laws, which can be invaluable during tax season.

-

Is airSlate SignNow secure for signing FTB 5821 forms?

Absolutely! airSlate SignNow uses industry-standard encryption and security measures to protect sensitive information during the signing process of FTB 5821 forms. Users can trust that their data remains safe and confidential.

-

How can I get started with airSlate SignNow for my FTB 5821 needs?

Getting started with airSlate SignNow is easy. Simply sign up for a free trial, explore the features for managing and signing FTB 5821, and see how the platform can meet your e-signature needs effectively.

Get more for Ftb 5821

- Nj buy online form

- New jersey postnuptial agreements package form

- New mexico procedures form

- New mexico property form

- New mexico process form

- Nm employment form

- New mexico prenuptial agreement form

- Nevada no fault uncontested agreed divorce package for dissolution of marriage with adult children and with or without property form

Find out other Ftb 5821

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free