SEC Gov Forms ListFS Form 1522 Special Form of Request for Payment of UnitedForms SEC Securities and Exchange Commission 2022-2026

Understanding the S 1099 Form

The S 1099 form is a critical tax document used in the United States to report various types of income other than wages, salaries, or tips. This form is typically issued by businesses to independent contractors, freelancers, and other non-employees who have received payments throughout the tax year. It is essential for both the payer and the recipient to accurately report this income to the Internal Revenue Service (IRS).

There are several variants of the 1099 form, including the 1099-MISC for miscellaneous income and the 1099-NEC specifically for non-employee compensation. Understanding which version to use is crucial for compliance and accurate reporting.

Key Elements of the S 1099 Form

The S 1099 form contains several important elements that must be completed accurately. Key components include:

- Payer Information: This section includes the name, address, and taxpayer identification number (TIN) of the entity issuing the form.

- Payee Information: This includes the name, address, and TIN of the recipient of the payments.

- Income Amount: The total amount paid to the recipient during the tax year must be reported in the appropriate box.

- Tax Year: The form must indicate the specific tax year for which the income is being reported.

Filing Deadlines for the S 1099 Form

Timely filing of the S 1099 form is essential to avoid penalties. The deadlines vary depending on whether the form is filed electronically or by mail:

- Paper Filing: The deadline for mailing the S 1099 form to recipients is typically January thirty-first of the following year.

- Electronic Filing: If filing electronically, the deadline usually extends to March fifteenth.

It is important to check the IRS website for any updates or changes to these deadlines.

Penalties for Non-Compliance

Failing to file the S 1099 form on time or providing incorrect information can result in significant penalties. The IRS imposes fines based on how late the form is filed:

- Late Filing: Penalties can range from fifty dollars to three hundred dollars per form, depending on how late the form is submitted.

- Incorrect Information: Providing incorrect payee information can also incur penalties, emphasizing the importance of accuracy.

IRS Guidelines for Completing the S 1099 Form

To ensure compliance with IRS regulations, it is crucial to follow specific guidelines when completing the S 1099 form. These include:

- Accurate Reporting: Ensure that all information is correct and matches the IRS records.

- Use of Correct Form: Select the appropriate version of the 1099 form based on the type of income being reported.

- Retain Copies: Keep copies of the filed forms for your records, as they may be needed for future reference or audits.

Taxpayer Scenarios for the S 1099 Form

Different taxpayer scenarios may affect how the S 1099 form is used. Common situations include:

- Self-Employed Individuals: Freelancers and independent contractors must report all income received via the S 1099 form.

- Business Entities: LLCs, corporations, and partnerships may also need to issue S 1099 forms for payments made to non-employees.

Understanding these scenarios helps ensure compliance and accurate reporting for all parties involved.

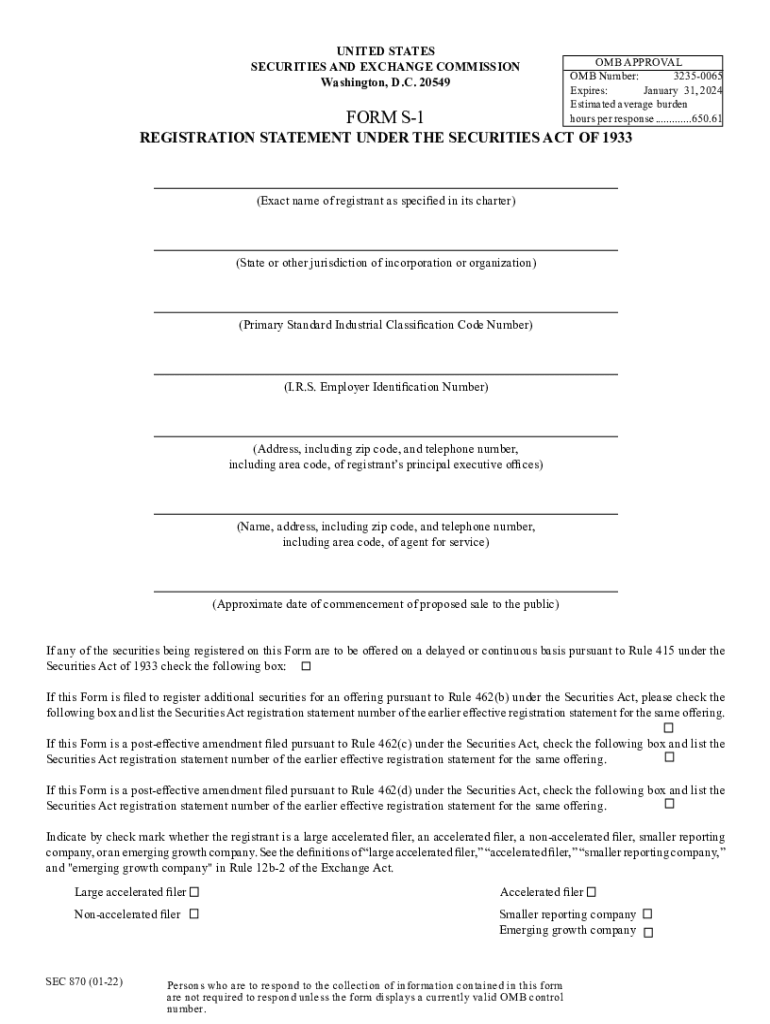

Quick guide on how to complete secgov forms listfs form 1522 special form of request for payment of unitedforms sec securities and exchange commission

Effortlessly Complete SEC gov Forms ListFS Form 1522 Special Form Of Request For Payment Of UnitedForms SEC Securities And Exchange Commission on Any Device

The management of online documents has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, enabling you to find the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to swiftly create, modify, and eSign your documents without delays. Administer SEC gov Forms ListFS Form 1522 Special Form Of Request For Payment Of UnitedForms SEC Securities And Exchange Commission on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

Edit and eSign SEC gov Forms ListFS Form 1522 Special Form Of Request For Payment Of UnitedForms SEC Securities And Exchange Commission with Ease

- Locate SEC gov Forms ListFS Form 1522 Special Form Of Request For Payment Of UnitedForms SEC Securities And Exchange Commission and click Get Form to begin.

- Make use of the tools we provide to finalize your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to submit your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searches, or errors that necessitate printing additional document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and eSign SEC gov Forms ListFS Form 1522 Special Form Of Request For Payment Of UnitedForms SEC Securities And Exchange Commission and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct secgov forms listfs form 1522 special form of request for payment of unitedforms sec securities and exchange commission

Create this form in 5 minutes!

How to create an eSignature for the secgov forms listfs form 1522 special form of request for payment of unitedforms sec securities and exchange commission

The best way to generate an e-signature for a PDF document in the online mode

The best way to generate an e-signature for a PDF document in Chrome

How to generate an e-signature for putting it on PDFs in Gmail

The best way to create an e-signature from your mobile device

How to create an e-signature for a PDF document on iOS devices

The best way to create an e-signature for a PDF file on Android devices

People also ask

-

What is airSlate SignNow and how does it improve business efficiency?

airSlate SignNow is a digital signature platform that empowers businesses by streamlining the document signing process. Its intuitive interface allows teams to send, receive, and eSign documents in just a few clicks, which signNowly reduces turnaround times and improves overall workflow efficiency.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers flexible pricing plans designed to suit different business needs. With options ranging from a free trial to premium subscriptions, you can choose a plan that provides the most value for your organization’s document management and eSigning needs.

-

What features does airSlate SignNow provide?

airSlate SignNow includes a variety of features such as customizable templates, in-person signing, and advanced security options. Additionally, its robust API allows for seamless integrations with other applications, making it a comprehensive solution for your document eSigning requirements.

-

How does airSlate SignNow ensure the security of documents?

airSlate SignNow prioritizes your document security with advanced encryption and compliance with industry standards. Each eSignature created through the platform is legally binding and comes with a Certificate of Completion, ensuring that your business's sec. documents are protected throughout their lifecycle.

-

Can airSlate SignNow integrate with other software tools?

Yes, airSlate SignNow offers integrations with popular software tools such as Salesforce, Google Drive, and Microsoft 365. This allows for a more streamlined workflow, enabling businesses to manage their document sec. processes without switching between different platforms.

-

What are the benefits of using airSlate SignNow for eSigning?

Using airSlate SignNow for eSigning improves productivity by reducing the time spent on document processing. Businesses can track signers, set reminders, and automate repetitive tasks, which enhances efficiency and provides a better overall experience for both teams and clients.

-

Is airSlate SignNow suitable for small businesses?

Absolutely! airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses. Its user-friendly interface and affordable pricing plans make it an ideal choice for those looking to simplify their document management sec. processes.

Get more for SEC gov Forms ListFS Form 1522 Special Form Of Request For Payment Of UnitedForms SEC Securities And Exchange Commission

Find out other SEC gov Forms ListFS Form 1522 Special Form Of Request For Payment Of UnitedForms SEC Securities And Exchange Commission

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement