10a104 Form

What is the 10a104

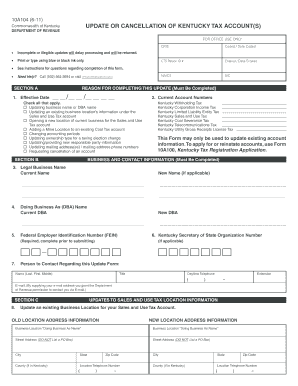

The 10a104 form, also known as the Kentucky Form 10a104, is a document used primarily for tax purposes in the state of Kentucky. This form is essential for individuals and businesses to report specific financial information to the state tax authority. It is crucial for ensuring compliance with state tax regulations and can affect tax liabilities, refunds, and eligibility for certain credits. Understanding the purpose and requirements of the 10a104 is vital for accurate and timely tax reporting.

How to use the 10a104

Using the 10a104 form involves several key steps. First, gather all necessary financial documents, including income statements and previous tax returns. Next, accurately fill out the form, ensuring that all information is complete and correct. It is important to follow the specific instructions provided with the form to avoid errors that could lead to delays or penalties. Once completed, the form can be submitted electronically or via mail, depending on your preference and the guidelines set by the Kentucky Department of Revenue.

Steps to complete the 10a104

Completing the 10a104 form requires careful attention to detail. Here are the steps to follow:

- Collect all relevant financial documents, such as W-2s, 1099s, and other income records.

- Download the latest version of the 10a104 form from the Kentucky Department of Revenue website.

- Fill out the form, ensuring that you provide accurate personal and financial information.

- Review the completed form for any errors or omissions.

- Submit the form either electronically through the designated online portal or by mailing it to the appropriate address.

Legal use of the 10a104

The legal use of the 10a104 form is governed by Kentucky state tax laws. It is important to ensure that the information provided is truthful and accurate, as submitting false information can lead to legal penalties. The form must be filed by the designated deadline to avoid late fees or additional penalties. Understanding the legal implications of using the 10a104 is essential for maintaining compliance with state regulations.

Key elements of the 10a104

Several key elements are essential when dealing with the 10a104 form. These include:

- Personal Information: This section requires your name, address, and Social Security number.

- Income Reporting: You must accurately report all sources of income, including wages, dividends, and other earnings.

- Deductions and Credits: Identify any applicable deductions or credits that may reduce your tax liability.

- Signature: The form must be signed and dated to validate the information provided.

Form Submission Methods

The 10a104 form can be submitted through various methods, depending on the preferences of the filer. Options include:

- Online Submission: Many filers opt to submit the form electronically through the Kentucky Department of Revenue's online portal, which offers a streamlined process.

- Mail: The form can also be printed and mailed to the appropriate tax office, ensuring that it is sent well before the filing deadline.

- In-Person: For those who prefer face-to-face interaction, submitting the form in person at a local tax office is another option.

Quick guide on how to complete 10a104

Prepare 10a104 effortlessly on any device

Digital document management has gained traction with businesses and individuals alike. It offers a superb eco-friendly substitute to conventional printed and signed documents, allowing you to access the correct format and securely maintain it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents rapidly without delays. Manage 10a104 across any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to modify and eSign 10a104 effortlessly

- Obtain 10a104 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically supplies for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about missing or lost files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your preferred device. Adjust and eSign 10a104 and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 10a104

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 10a104 and how does it relate to airSlate SignNow?

10a104 is a unique identifier for a specific feature set within airSlate SignNow. This feature is designed to streamline the signing and document management process, making it easier for users to eSign their documents efficiently.

-

What are the pricing plans for airSlate SignNow featuring 10a104?

airSlate SignNow offers competitive pricing plans that include access to the 10a104 features. Customers can choose from various tiers based on their needs, with affordable options that cater to small businesses as well as large enterprises.

-

What features are included in the 10a104 package of airSlate SignNow?

The 10a104 package includes essential features such as document templates, advanced eSigning options, and integrations with popular applications. These functionalities help businesses automate their document workflows effectively.

-

How can businesses benefit from using the 10a104 solution?

By utilizing the 10a104 solution on airSlate SignNow, businesses can enhance their document workflow efficiency and reduce turnaround times. Additionally, it allows for seamless collaboration among team members and improves overall productivity.

-

What integrations does airSlate SignNow offer with 10a104?

airSlate SignNow with 10a104 integrates with major platforms such as Google Drive, Microsoft Office, and CRM software. These integrations provide users with a comprehensive toolkit to manage their documents from multiple sources seamlessly.

-

Is there customer support available for issues related to 10a104?

Yes, airSlate SignNow provides dedicated customer support for all users needing assistance with the 10a104 features. Their support team is available to help troubleshoot issues and offer guidance for maximizing the platform's capabilities.

-

Can I try out the 10a104 features before committing to a plan?

Absolutely! airSlate SignNow offers a free trial that allows prospective customers to explore the 10a104 features. This trial period gives users a chance to experience the benefits before making a financial commitment.

Get more for 10a104

- Transfer death deed 481377297 form

- Indiana quitclaim deed business entity grantor by attorney in fact to individual grantee form

- Indiana fiduciary deed for use by executors trustees trustors administrators and other fiduciaries form

- Indiana family form

- Indiana quitclaim deed form

- Ks limited company form

- Ks husband wife form

- Kansas warranty deed form

Find out other 10a104

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form