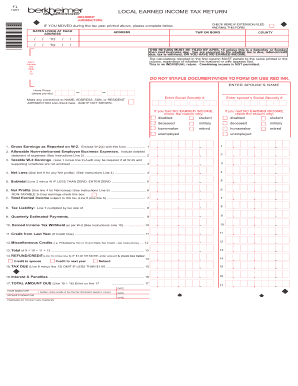

Earned Income Tax for Emmaus Form

What is the Earned Income Tax For Emmaus Form

The Earned Income Tax For Emmaus Form is a specific tax document utilized by individuals to report their earned income for tax purposes. This form is essential for determining eligibility for various tax credits, including the Earned Income Tax Credit (EITC). It is primarily designed for residents of Emmaus, Pennsylvania, who need to accurately report their income to comply with local tax regulations. Understanding this form is crucial for ensuring that taxpayers receive the appropriate credits and avoid potential penalties.

How to use the Earned Income Tax For Emmaus Form

Using the Earned Income Tax For Emmaus Form involves several steps to ensure accurate completion. First, gather all necessary documentation, including W-2 forms, 1099s, and any other income statements. Next, carefully fill out the form, ensuring that all income sources are reported accurately. It is important to review the form for any errors before submission. Finally, submit the completed form through the appropriate channels, whether online, by mail, or in person, depending on local regulations.

Steps to complete the Earned Income Tax For Emmaus Form

Completing the Earned Income Tax For Emmaus Form requires a systematic approach:

- Collect all relevant income documents, such as W-2s and 1099s.

- Fill in personal information, including your name, address, and Social Security number.

- Report all sources of income accurately, ensuring to include any self-employment income.

- Calculate any applicable deductions or credits, particularly the Earned Income Tax Credit.

- Double-check all entries for accuracy before submission.

Legal use of the Earned Income Tax For Emmaus Form

The legal use of the Earned Income Tax For Emmaus Form is governed by federal and state tax laws. This form must be completed truthfully and accurately to comply with tax regulations. Failure to provide accurate information can lead to penalties, including fines and interest on unpaid taxes. Additionally, the form must be submitted within the designated filing deadlines to avoid further legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the Earned Income Tax For Emmaus Form typically align with federal tax deadlines. Generally, individual tax returns are due by April fifteenth of each year. However, it is essential to check for any specific local deadlines that may apply. Taxpayers should also be aware of any extensions that may be available, which can provide additional time for filing without incurring penalties.

Required Documents

To complete the Earned Income Tax For Emmaus Form, several documents are necessary:

- W-2 forms from employers detailing annual earnings.

- 1099 forms for any freelance or contract work.

- Records of any additional income sources, such as rental income or dividends.

- Documentation of any deductions or credits claimed, including childcare expenses.

Who Issues the Form

The Earned Income Tax For Emmaus Form is typically issued by the local tax authority in Emmaus, Pennsylvania. This authority is responsible for providing residents with the necessary forms and information regarding local tax obligations. It is advisable for taxpayers to consult the local tax office or their website for the most current version of the form and any updates on filing requirements.

Quick guide on how to complete earned income tax for emmaus form

Prepare Earned Income Tax For Emmaus Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to easily find the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents promptly without any delays. Manage Earned Income Tax For Emmaus Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign Earned Income Tax For Emmaus Form without hassle

- Locate Earned Income Tax For Emmaus Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for this task.

- Create your signature with the Sign tool, which takes seconds and bears the same legal significance as a conventional wet ink signature.

- Review the information and press the Done button to save your changes.

- Choose how you want to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your requirements in document management in just a few clicks from your preferred device. Alter and electronically sign Earned Income Tax For Emmaus Form and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the earned income tax for emmaus form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Earned Income Tax For Emmaus Form?

The Earned Income Tax For Emmaus Form is a specific document required for individuals to report their earned income for tax purposes in Emmaus. This form ensures that you receive all eligible credits and deductions related to your earned income. Using airSlate SignNow, you can easily complete and eSign this form for a seamless filing experience.

-

How can airSlate SignNow help with the Earned Income Tax For Emmaus Form?

airSlate SignNow offers a user-friendly platform that simplifies the process of completing the Earned Income Tax For Emmaus Form. With its intuitive eSigning feature, you can quickly fill out and securely sign your tax documents. This efficient approach helps you save time and avoid delays in your tax filing.

-

What are the features of airSlate SignNow for tax forms?

airSlate SignNow provides a range of features for tax forms, including template creation, document sharing, and eSigning capabilities. Specifically for the Earned Income Tax For Emmaus Form, the platform allows for easy customization and ensures that all necessary fields are included. This minimizes errors and enhances the accuracy of your submissions.

-

Is there a cost associated with using airSlate SignNow for the Earned Income Tax For Emmaus Form?

Yes, there is a cost associated with using airSlate SignNow, but it remains a cost-effective solution for managing documents like the Earned Income Tax For Emmaus Form. Pricing plans are flexible, tailored to meet various needs, and provide substantial value considering the time saved on document handling. You can choose a plan that best suits your budget.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various tax preparation software, enhancing your ability to manage forms like the Earned Income Tax For Emmaus Form. This integration streamlines the workflow, allowing you to handle both tax preparation and document signing in one platform. Check our list of integrations for more details.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for tax documents like the Earned Income Tax For Emmaus Form provides signNow benefits, including increased efficiency, enhanced security, and easy access from anywhere. The electronic signing process speeds up document turnaround time while ensuring compliance with all legal requirements. Enjoy peace of mind knowing your sensitive information is protected.

-

How do I get started with airSlate SignNow for my Earned Income Tax For Emmaus Form?

Getting started with airSlate SignNow for your Earned Income Tax For Emmaus Form is simple. Just sign up for an account, choose your plan, and access the templates available for tax documents. You can then fill out the Earned Income Tax For Emmaus Form and utilize the eSignature feature to finalize your submissions.

Get more for Earned Income Tax For Emmaus Form

Find out other Earned Income Tax For Emmaus Form

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online