CONSUMER LOAN APPLICATION CREDIT REQUESTED Account Requested Individual Joint We Intend to Apply for Joint Credit Form

Understanding the consumer loan application credit requested form

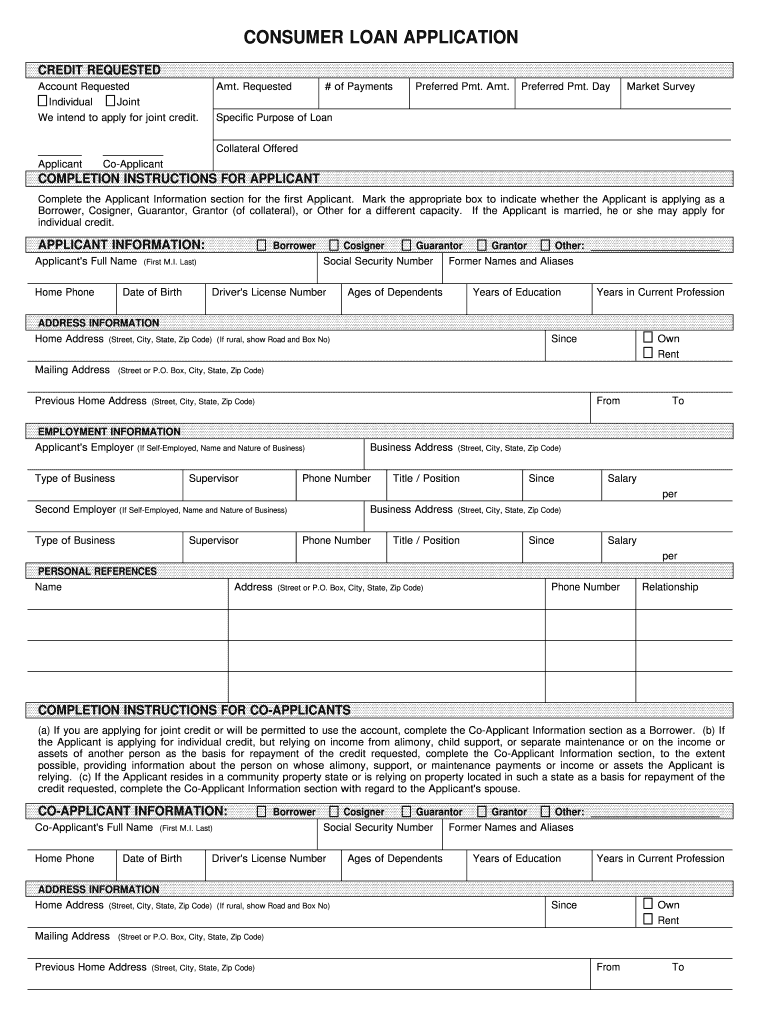

The consumer loan application credit requested form is a crucial document for individuals or businesses seeking joint credit for commercial loans. This form captures essential information about the applicants, including their financial backgrounds, credit histories, and the purpose of the loan. It is designed to assess the creditworthiness of both parties involved in the application, ensuring that lenders have a comprehensive view of the applicants' financial situations. By providing accurate and complete information, applicants can enhance their chances of approval for joint credit.

Steps to complete the consumer loan application credit requested form

Completing the consumer loan application credit requested form involves several key steps:

- Gather necessary information: Collect personal and financial details for all applicants, including Social Security numbers, income sources, and employment history.

- Fill out the form accurately: Ensure that all sections of the form are completed truthfully, as discrepancies can lead to delays or denials.

- Review for completeness: Double-check the form for any missing information or errors before submission.

- Sign the form: Both applicants must provide their signatures, indicating their agreement to the terms and conditions of the loan.

Legal use of the consumer loan application credit requested form

The legal validity of the consumer loan application credit requested form hinges on compliance with federal and state regulations. When completed electronically, the form must adhere to the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). These laws ensure that electronic signatures are recognized as legally binding, provided that certain requirements are met. It is essential for applicants to understand their rights and obligations under these laws to avoid potential legal issues.

Key elements of the consumer loan application credit requested form

Several key elements are vital to the consumer loan application credit requested form:

- Applicant information: Names, addresses, and contact details of all parties applying for joint credit.

- Financial information: Details about income, assets, liabilities, and employment status.

- Loan specifics: The amount requested, purpose of the loan, and preferred repayment terms.

- Consent and signatures: Acknowledgment of the terms, conditions, and the necessity for both parties to sign.

Eligibility criteria for joint credit applications

Eligibility for joint credit applications typically requires both applicants to meet certain criteria. Lenders often assess factors such as:

- Credit scores: Both applicants should have acceptable credit scores to increase the likelihood of approval.

- Income stability: A steady income source for both parties is crucial for demonstrating the ability to repay the loan.

- Debt-to-income ratio: Lenders will evaluate the ratio of total debt to income, which should ideally be within acceptable limits.

Application process and approval time for joint credit

The application process for joint credit typically involves submitting the completed consumer loan application credit requested form along with any required documentation to the lender. After submission, the lender will review the application, which may take anywhere from a few days to several weeks, depending on the institution and the complexity of the application. During this time, the lender may request additional information or clarification from the applicants. Once the review is complete, the lender will communicate the decision regarding the loan approval.

Quick guide on how to complete consumer loan application credit requested account requested individual joint we intend to apply for joint credit

Complete CONSUMER LOAN APPLICATION CREDIT REQUESTED Account Requested Individual Joint We Intend To Apply For Joint Credit effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to obtain the needed form and securely save it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly and without delay. Manage CONSUMER LOAN APPLICATION CREDIT REQUESTED Account Requested Individual Joint We Intend To Apply For Joint Credit on any platform with airSlate SignNow Android or iOS applications and improve any document-related process today.

The easiest way to alter and electronically sign CONSUMER LOAN APPLICATION CREDIT REQUESTED Account Requested Individual Joint We Intend To Apply For Joint Credit without hassle

- Obtain CONSUMER LOAN APPLICATION CREDIT REQUESTED Account Requested Individual Joint We Intend To Apply For Joint Credit and then click Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your requirements in document management with just a few clicks from a device of your choice. Modify and electronically sign CONSUMER LOAN APPLICATION CREDIT REQUESTED Account Requested Individual Joint We Intend To Apply For Joint Credit and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

I had a hard inquiry to a credit reporting agency that I did not generate in anyway shape or form. How do I contact the credit reporting agency and company where credit was requested to find out what was applied for and who applied?

You challenge the hard inquiry in writing with the agencies that are reporting it.Your credit report will show the name of the firms that placed the hard inquiry and the date of the inquiry. Most of the time that is sufficient to jog your memory but if it isn't, the credit reporting agencies will provide additional information about inquiry in response to your challenge.

Create this form in 5 minutes!

How to create an eSignature for the consumer loan application credit requested account requested individual joint we intend to apply for joint credit

How to generate an eSignature for your Consumer Loan Application Credit Requested Account Requested Individual Joint We Intend To Apply For Joint Credit online

How to make an eSignature for the Consumer Loan Application Credit Requested Account Requested Individual Joint We Intend To Apply For Joint Credit in Chrome

How to make an electronic signature for putting it on the Consumer Loan Application Credit Requested Account Requested Individual Joint We Intend To Apply For Joint Credit in Gmail

How to make an electronic signature for the Consumer Loan Application Credit Requested Account Requested Individual Joint We Intend To Apply For Joint Credit straight from your mobile device

How to generate an electronic signature for the Consumer Loan Application Credit Requested Account Requested Individual Joint We Intend To Apply For Joint Credit on iOS devices

How to generate an eSignature for the Consumer Loan Application Credit Requested Account Requested Individual Joint We Intend To Apply For Joint Credit on Android devices

People also ask

-

What is the process for submitting an intent to apply for joint credit commercial loans?

To submit an intent to apply for joint credit commercial loans, businesses can start by gathering necessary documentation and information. Then, they can use our user-friendly platform to fill out the application form and eSign it securely. Our system ensures that the application process is streamlined, making it easier for you to get started.

-

What are the benefits of using airSlate SignNow for joint credit commercial loans?

Using airSlate SignNow for your intent to apply for joint credit commercial loans offers numerous benefits. Our platform simplifies document signing and management, saves time, and reduces paperwork. With features that enhance security and compliance, you can ensure that your applications are both efficient and secure.

-

Does airSlate SignNow offer any pricing plans for small businesses applying for joint credit commercial loans?

Yes, airSlate SignNow offers affordable pricing plans tailored for small businesses looking to submit an intent to apply for joint credit commercial loans. Our flexible pricing ensures that whether you are a startup or an established business, you can access the tools you need without breaking the bank. We also offer a free trial to help you explore our features before committing.

-

How does airSlate SignNow ensure the security of my documents when applying for joint credit commercial loans?

We prioritize security at airSlate SignNow, especially when it comes to sensitive documents like those for the intent to apply for joint credit commercial loans. Our platform incorporates advanced encryption protocols and secure access controls to protect your information. Rest assured that your data remains confidential and secure throughout the entire eSigning process.

-

Can I integrate airSlate SignNow with other tools when applying for joint credit commercial loans?

Absolutely! airSlate SignNow seamlessly integrates with various third-party applications and services, making the process of submitting an intent to apply for joint credit commercial loans even easier. This allows you to connect your favorite CRM and productivity tools, thus streamlining your workflow and enhancing efficiency.

-

What features does airSlate SignNow provide to assist with joint credit commercial loan applications?

airSlate SignNow offers a variety of features designed to assist with your intent to apply for joint credit commercial loans. These include customizable templates, automatic reminders for signers, and real-time status tracking of your documents. These features not only enhance convenience but also ensure a smoother application process.

-

How long does it take to complete the eSigning process for joint credit commercial loans with airSlate SignNow?

The eSigning process for your intent to apply for joint credit commercial loans using airSlate SignNow is designed to be quick and efficient. Typically, documents can be signed in just a few minutes, depending on the number of signers. Our streamlined process minimizes delays, allowing you to move forward with your application without unnecessary waiting.

Get more for CONSUMER LOAN APPLICATION CREDIT REQUESTED Account Requested Individual Joint We Intend To Apply For Joint Credit

- Drug test results form private clinic

- Colligative properties gizmo answer key form

- Microbiology laboratory safety rules form

- Routing sheet alternate 2 043014 practice cs library form

- Positive behavior support plan for form

- Weekly light transit vehicle ltnltv inspection checklist one driver per form

- Cbi pre cbwe student assessment form

- Note sheet format 429102136

Find out other CONSUMER LOAN APPLICATION CREDIT REQUESTED Account Requested Individual Joint We Intend To Apply For Joint Credit

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will