Da Form 5329

What is the Da Form 5329

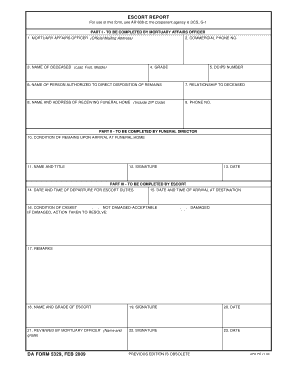

The Da Form 5329 is a document used by the United States Army to report and request information regarding various personnel matters. This form is essential for service members and their families, as it helps in the management of benefits and entitlements. It is particularly relevant for those seeking to address issues related to their military service, including adjustments to their records or benefits. Understanding the purpose and requirements of the Da Form 5329 is crucial for ensuring compliance and proper processing.

How to use the Da Form 5329

Using the Da Form 5329 involves several key steps. First, individuals must ensure they have the correct version of the form, which can typically be obtained from official Army resources. Next, it is important to fill out the form accurately, providing all required information such as personal details and specific requests. Once completed, the form should be submitted according to the instructions provided, which may include online submission, mailing, or in-person delivery to the appropriate office. Proper use of the form ensures that requests are processed efficiently.

Steps to complete the Da Form 5329

Completing the Da Form 5329 requires careful attention to detail. Follow these steps for successful completion:

- Obtain the latest version of the Da Form 5329 from an official source.

- Read the instructions thoroughly to understand the requirements.

- Fill in your personal information, including your name, rank, and service number.

- Provide any additional details requested, such as the nature of your request or issue.

- Review the form for accuracy and completeness before submission.

- Submit the form via the designated method, ensuring it reaches the correct office.

Legal use of the Da Form 5329

The legal use of the Da Form 5329 is governed by military regulations and policies. It is important to ensure that the form is filled out truthfully and accurately, as any discrepancies can lead to legal consequences. The form serves as an official record, and its contents may be subject to review by military authorities. Understanding the legal implications of the information provided on the form is essential for all service members and their families.

Key elements of the Da Form 5329

The Da Form 5329 contains several key elements that are crucial for its effectiveness. These include:

- Personal Information: This section requires details such as name, rank, and service number.

- Request Details: A clear description of the request or issue being addressed.

- Signature: The form must be signed by the individual submitting it to validate the information.

- Date: The date of submission is important for processing timelines.

How to obtain the Da Form 5329

Obtaining the Da Form 5329 is a straightforward process. Service members can access the form through official Army websites or by visiting their local administrative office. It is important to ensure that the most current version of the form is used, as outdated forms may not be accepted. Additionally, some installations may provide the form in digital format, allowing for easier access and completion.

Quick guide on how to complete da form 5329

Complete [SKS] effortlessly on any device

Digital document management has gained traction among companies and individuals alike. It serves as an optimal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the required form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, alter, and electronically sign your documents swiftly without hindrance. Handle [SKS] on any device using airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to alter and electronically sign [SKS] with ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to submit your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs within a few clicks from any device you choose. Modify and electronically sign [SKS] to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Da Form 5329

Create this form in 5 minutes!

How to create an eSignature for the da form 5329

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Da Form 5329 and why is it important?

Da Form 5329 is a crucial document for military personnel, used to request a waiver for specific requirements in the Army. Having a proper understanding of this form ensures compliance and expedites the waiver process. Utilizing tools like airSlate SignNow can signNowly simplify the eSigning and submission of Da Form 5329.

-

How can airSlate SignNow help with managing Da Form 5329?

airSlate SignNow offers an intuitive platform that allows users to easily fill out, sign, and send Da Form 5329 electronically. Its user-friendly interface streamlines the entire process, ensuring that your documents are completed quickly and securely. With our solution, managing Da Form 5329 becomes seamless and efficient.

-

What are the pricing options for using airSlate SignNow for Da Form 5329?

airSlate SignNow provides flexible pricing plans tailored to meet various needs and budgets. Whether you're an individual or part of a larger organization, we have a solution that fits. Our pricing is designed to offer exceptional value while ensuring convenient access to features necessary for processing Da Form 5329.

-

Can I integrate airSlate SignNow with other tools while working on Da Form 5329?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your workflow while handling Da Form 5329. This allows you to connect with tools you already use, making it easier to manage document workflows and collaborate effectively. Our integrations support a more cohesive environment for your documents.

-

What security measures does airSlate SignNow implement for documents like Da Form 5329?

Security is paramount when dealing with documents such as Da Form 5329. airSlate SignNow employs advanced encryption and authentication protocols to protect your sensitive information. You can sign and store your documents confidently, knowing they are secure throughout the entire process.

-

Is airSlate SignNow mobile-friendly for completing Da Form 5329?

Absolutely! airSlate SignNow is designed to be mobile-friendly, allowing users to access and complete Da Form 5329 from any device. This flexibility ensures that you can manage your documents on-the-go, making the eSigning process convenient and efficient.

-

What are some benefits of using airSlate SignNow for Da Form 5329?

Using airSlate SignNow for Da Form 5329 offers numerous benefits, including time savings, enhanced efficiency, and improved accuracy. The platform reduces paper clutter and accelerates the signing process, helping you get approvals faster. It's an ideal solution to streamline your documentation needs.

Get more for Da Form 5329

- Notice of termination of agreement general contractor for workers compensation tennessee form

- Tennessee workers compensation 497326957 form

- Tennessee annual file form

- Notices resolutions simple stock ledger and certificate tennessee form

- Minutes organizational meeting 497326960 form

- Sample transmittal letter to secretary of states office to file articles of incorporation tennessee tennessee form

- Js 44 civil cover sheet federal district court tennessee form

- Tn lead based paint form

Find out other Da Form 5329

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document