Eic Table Form

What is the EIC Table?

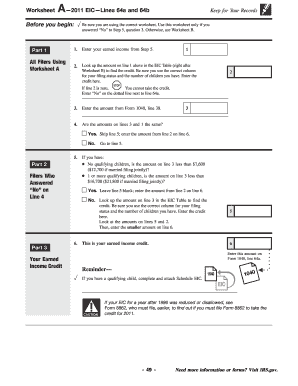

The EIC table, or Earned Income Credit table, is a crucial component for taxpayers in the United States who are eligible for the Earned Income Tax Credit (EITC). This table provides specific income thresholds and credit amounts based on filing status and the number of qualifying children. Understanding the EIC table is essential for accurately calculating the credit, which can significantly reduce tax liability and potentially result in a refund.

How to Use the EIC Table

To effectively use the EIC table, taxpayers should first determine their filing status and the number of qualifying children. Once this information is established, locate the corresponding income range in the table. The EIC table outlines the maximum credit available for each income level, allowing taxpayers to identify the exact amount of credit they may claim. It is important to ensure that all income sources are included when determining eligibility.

Steps to Complete the EIC Table

Completing the EIC table involves several key steps:

- Gather necessary documentation, including income statements and Social Security numbers for qualifying children.

- Identify your filing status: single, married filing jointly, or head of household.

- Count the number of qualifying children you have, as this affects the credit amount.

- Refer to the EIC table to find the income range that corresponds to your filing status and number of children.

- Calculate your credit based on the income level indicated in the table.

Legal Use of the EIC Table

The EIC table must be used in compliance with IRS regulations. Taxpayers should ensure that they meet all eligibility criteria, including income limits and residency requirements. Misuse of the EIC table, such as claiming ineligible children or overstating income, can lead to penalties and disqualification from future credits. It is advisable to consult IRS guidelines or a tax professional if there are uncertainties regarding eligibility.

IRS Guidelines

The IRS provides specific guidelines for using the EIC table, which include detailed instructions on eligibility, income calculations, and filing procedures. Taxpayers are encouraged to review IRS Publication 596, which outlines the Earned Income Credit in detail. This resource helps clarify the requirements and ensures compliance with tax laws, assisting taxpayers in maximizing their credits while avoiding potential issues.

Eligibility Criteria

To qualify for the Earned Income Credit and utilize the EIC table, taxpayers must meet certain eligibility criteria, including:

- Having earned income from employment or self-employment.

- Meeting specific income limits based on filing status and number of qualifying children.

- Being a U.S. citizen or resident alien for the entire tax year.

- Having a valid Social Security number.

Filing Deadlines / Important Dates

Taxpayers should be aware of critical deadlines related to the EIC and overall tax filing. The standard tax filing deadline is typically April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Additionally, taxpayers should note any changes in deadlines announced by the IRS, especially in light of emergencies or policy updates. Early filing is recommended to ensure timely processing of refunds, particularly for those claiming the EIC.

Quick guide on how to complete eic table 41891534

Effortlessly prepare Eic Table on any device

Managing documents online has gained signNow traction among companies and individuals. It serves as a superb environmentally-friendly alternative to conventional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to swiftly create, edit, and eSign your documents without any delays. Handle Eic Table on any platform using airSlate SignNow's Android or iOS applications and simplify any document-based task today.

Easily modify and eSign Eic Table without hassle

- Locate Eic Table and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Select how you wish to send your form, by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Eic Table to ensure effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the eic table 41891534

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2011 EIC table?

The 2011 EIC table is a reference used to determine the amount of the Earned Income Credit (EIC) that eligible taxpayers can claim on their tax returns. This table simplifies the calculation process by providing specific income thresholds based on filing status and the number of qualifying children.

-

How can I access the 2011 EIC table?

You can find the 2011 EIC table in the IRS tax publications or through various online tax resources. It is often included in the instructions for Form 1040, where you will find other relevant tax information that could be useful for your filings.

-

Why is the 2011 EIC table important for tax preparation?

Utilizing the 2011 EIC table during tax preparation is crucial for ensuring that eligible taxpayers receive the correct amount of Earned Income Credit. This can lead to signNow tax savings, making it an essential tool for maximizing refunds and reducing tax liability.

-

Does airSlate SignNow help with organizing tax documents related to the 2011 EIC table?

Yes, airSlate SignNow provides an efficient way to organize and eSign tax-related documents, including those that reference the 2011 EIC table. Our platform simplifies document management, ensuring all important tax forms are readily accessible when needed.

-

What features does airSlate SignNow offer that relate to tax documentation?

airSlate SignNow offers features such as eSignature capabilities, document templates, and secure cloud storage that can enhance your tax documentation process. This allows for easy handling of forms related to the 2011 EIC table and ensures compliance with tax regulations.

-

Are there any integrations available with airSlate SignNow for tax software?

Yes, airSlate SignNow integrates with a variety of tax software solutions, making it easier to manage forms that pertain to the 2011 EIC table. These integrations streamline workflows and help tax professionals enhance their efficiency during the busy tax season.

-

How does airSlate SignNow ensure the security of sensitive tax information?

AirSlate SignNow takes security seriously, implementing robust measures such as encryption and access controls to protect sensitive documents associated with the 2011 EIC table. Our platform is compliant with industry standards to ensure that your tax information remains confidential.

Get more for Eic Table

- Ar minors form

- Arkansas theft form

- Arkansas deceased form

- Identity theft by known imposter package arkansas form

- Organizing your personal assets package arkansas form

- Essential documents for the organized traveler package arkansas form

- Essential documents for the organized traveler package with personal organizer arkansas form

- Postnuptial agreement form 497296745

Find out other Eic Table

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document