Form 941 PRRev January Employer's Quarterly Federal Tax Return Puerto Rican Version

What is the Form 941 PRRev January Employer's Quarterly Federal Tax Return Puerto Rican Version

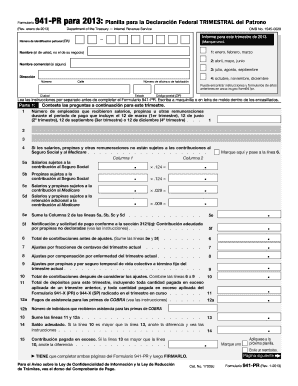

The Form 941 PRRev January is a specialized version of the Employer's Quarterly Federal Tax Return designed for businesses operating in Puerto Rico. This form is used to report income taxes withheld from employees, as well as the employer's share of Social Security and Medicare taxes. It is crucial for ensuring compliance with federal tax obligations specific to Puerto Rican employers. Understanding this form is essential for maintaining accurate payroll records and fulfilling tax responsibilities.

How to use the Form 941 PRRev January Employer's Quarterly Federal Tax Return Puerto Rican Version

Using the Form 941 PRRev January involves a systematic approach to accurately report payroll taxes. Employers must first gather all relevant payroll information for the quarter, including wages paid and taxes withheld. After completing the form, it should be reviewed for accuracy to avoid any discrepancies. The completed form can then be submitted electronically or via mail, depending on the employer's preference. Utilizing a trusted eSignature solution can streamline the submission process while ensuring compliance with legal standards.

Steps to complete the Form 941 PRRev January Employer's Quarterly Federal Tax Return Puerto Rican Version

Completing the Form 941 PRRev January involves several key steps:

- Gather all necessary payroll data for the reporting period.

- Fill out the form with accurate figures, including total wages, tips, and other compensation.

- Calculate the total taxes owed, including federal income tax withheld and Social Security and Medicare taxes.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline, either electronically or by mail.

Legal use of the Form 941 PRRev January Employer's Quarterly Federal Tax Return Puerto Rican Version

The legal use of the Form 941 PRRev January is governed by federal tax regulations. To ensure that the form is considered valid, it must be filled out accurately and submitted on time. Compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA) is essential when submitting electronically. This ensures that the eSignature used is legally binding and meets all necessary requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Form 941 PRRev January are critical for compliance. Employers must submit this form on a quarterly basis, with specific deadlines for each quarter. Typically, the deadlines are as follows:

- First Quarter: April 30

- Second Quarter: July 31

- Third Quarter: October 31

- Fourth Quarter: January 31

Failure to meet these deadlines may result in penalties and interest on unpaid taxes.

Penalties for Non-Compliance

Non-compliance with the filing requirements for the Form 941 PRRev January can lead to significant penalties. Employers may face fines for late submissions, inaccuracies, or failure to pay the taxes owed. The IRS imposes a penalty of five percent of the unpaid tax for each month the return is late, up to a maximum of twenty-five percent. It is essential for employers to stay informed about their filing obligations to avoid these financial repercussions.

Quick guide on how to complete form 941 prrev january employers quarterly federal tax return puerto rican version

Easily prepare Form 941 PRRev January Employer's Quarterly Federal Tax Return Puerto Rican Version on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Manage Form 941 PRRev January Employer's Quarterly Federal Tax Return Puerto Rican Version on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centered process today.

The easiest method to modify and eSign Form 941 PRRev January Employer's Quarterly Federal Tax Return Puerto Rican Version effortlessly

- Find Form 941 PRRev January Employer's Quarterly Federal Tax Return Puerto Rican Version and click Obtain Form to get started.

- Utilize the tools we provide to complete your form.

- Emphasize signNow sections of your documents or black out sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Finish button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and eSign Form 941 PRRev January Employer's Quarterly Federal Tax Return Puerto Rican Version and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 941 prrev january employers quarterly federal tax return puerto rican version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is prrev and how does it work with airSlate SignNow?

Prrev is an essential aspect of airSlate SignNow, allowing users to send and eSign documents quickly and securely. By utilizing prrev, businesses can streamline their document approval processes, ensuring that all signatures are gathered efficiently without any hassle.

-

How much does it cost to use airSlate SignNow with prrev?

The pricing for airSlate SignNow with prrev is designed to be budget-friendly for businesses of all sizes. You can choose from various plans based on your usage needs, including monthly and yearly subscriptions that provide access to all features at competitive rates.

-

What features does airSlate SignNow offer with prrev?

AirSlate SignNow offers a range of features with prrev, including customizable templates, document tracking, and automated reminders. This ensures that you not only send documents seamlessly but also keep track of their progress and receive notifications when actions are required.

-

How can the use of prrev improve my business’s workflow?

By integrating prrev into your business operations, you enhance collaboration and reduce the time spent on paperwork. This leads to faster turnaround times for contracts and agreements, ultimately improving your overall productivity and customer satisfaction.

-

Can I integrate airSlate SignNow with other applications while using prrev?

Yes, airSlate SignNow offers various integrations with popular applications while using prrev. This flexibility allows you to seamlessly connect with CRMs, project management tools, and other software, ensuring a cohesive digital workflow that saves time and effort for your team.

-

Is airSlate SignNow with prrev secure for sensitive documents?

Absolutely! AirSlate SignNow prioritizes security, especially when using prrev. With advanced encryption and compliance with industry standards, you can trust that your sensitive documents are protected throughout the signing process.

-

What types of documents can I send and eSign using prrev?

With prrev, you can send and eSign various types of documents, including contracts, agreements, and forms. This versatility makes airSlate SignNow a valuable tool for businesses across different industries, catering to their unique document needs.

Get more for Form 941 PRRev January Employer's Quarterly Federal Tax Return Puerto Rican Version

- Colorado employment form

- Revocation of anatomical gift donation colorado form

- Employment or job termination package colorado form

- Newly widowed individuals package colorado form

- Colorado dnr form

- Employment interview package colorado form

- Employment employee personnel file package colorado form

- Assignment of mortgage package colorado form

Find out other Form 941 PRRev January Employer's Quarterly Federal Tax Return Puerto Rican Version

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word