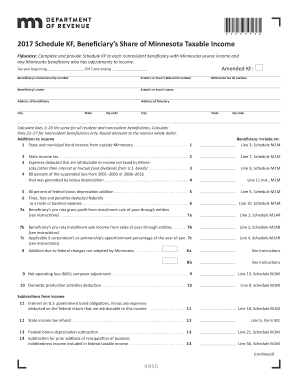

KF, Beneficiary's Share of Minnesota Taxable Income Form

What is the KF, Beneficiary's Share Of Minnesota Taxable Income

The KF form, officially known as the Beneficiary's Share Of Minnesota Taxable Income, is a crucial document for beneficiaries of estates or trusts in Minnesota. This form is used to report the income that beneficiaries receive from these entities, ensuring that the income is accurately reflected in their personal tax filings. The KF form helps to clarify how much of the estate or trust income is taxable at the individual level, which is essential for compliance with state tax laws.

Steps to Complete the KF, Beneficiary's Share Of Minnesota Taxable Income

Completing the KF form involves several key steps to ensure accuracy and compliance:

- Gather necessary documents: Collect all relevant financial statements from the estate or trust, including income statements and distributions received.

- Fill out personal information: Include your name, address, and Social Security number at the top of the form.

- Report income: Enter the amounts distributed to you from the estate or trust in the appropriate sections of the form.

- Calculate taxable income: Follow the instructions to determine the taxable portion of the income you received.

- Review and sign: Ensure all information is accurate before signing and dating the form.

Legal Use of the KF, Beneficiary's Share Of Minnesota Taxable Income

The KF form is legally binding and must be completed in accordance with Minnesota tax regulations. It serves as a formal declaration of the income received by beneficiaries and is essential for ensuring compliance with state tax laws. Proper use of the KF form helps avoid potential penalties and ensures that beneficiaries report their income accurately, reflecting their financial obligations to the state.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the KF form. Generally, the KF form should be filed by the same deadline as your personal income tax return, which is typically April fifteenth. If you require an extension for your personal tax return, ensure that the KF form is also submitted by the extended deadline to avoid penalties.

Who Issues the KF Form

The KF form is issued by the Minnesota Department of Revenue. This state agency is responsible for overseeing tax collection and ensuring compliance with state tax laws. Beneficiaries should obtain the KF form directly from the Minnesota Department of Revenue's official website or through authorized tax professionals to ensure they are using the most current version.

Examples of Using the KF, Beneficiary's Share Of Minnesota Taxable Income

Understanding how to use the KF form can be illustrated through various scenarios:

- Trust distributions: If you receive distributions from a trust, the KF form will help you report this income on your tax return.

- Estate income: As a beneficiary of an estate, you may need to report your share of the estate's income using the KF form.

- Tax planning: Using the KF form can aid in tax planning by clarifying your taxable income from trusts or estates, allowing for better financial decisions.

Quick guide on how to complete minnesota taxable income

Effortlessly prepare minnesota taxable income on any device

Digital document management has gained traction among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to easily locate the appropriate form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents quickly and without interruptions. Manage schedule kf on any device using airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

How to modify and electronically sign kf form with ease

- Locate kf income and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which only takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your updates.

- Choose how you wish to distribute your form, be it via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs with just a few clicks from any device of your preference. Modify and electronically sign minnesota schedule kf to guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs kf income

-

A senior resident has dividend income of 2 lakhs from equity shares and 9 lakhs from mutual funds. How do you fill out ITR 2 for 2017-2018?

Hi ,The dividend income from equity is exempt and the dividend income from mutual fund is exempt if STT ( security transaction tax) has been paid on the same. If both the dividend income is exempt then you need to disclose the same in schedule of exempt income in ITR-2.For income tax relatex assiatance kindly connect with me on khushbu.2893@gmail.com with your contact no

-

To use Google AdMob in my iOS apps, do I need to fill out a form, similar to Apple's "Paid Applications" contract? And do I need to connect it to Apple somehow (so that they can take a share of the ad income)?

Hi ,To integrate ADMob in your application, no need to fill out form or connect with apple , Complete the following steps to link an app.Sign in to your AdMob account at https://apps.admob.com.Click Apps in the sidebar.Select the name of the app you want to link. Note: If you don't see it in the list of recent apps, you can click All apps, then click the name of the app.Click App settings in the sidebar.Click the icon in the "App info" section.Click the link to link your app with the appropriate app store. A dialog box appears.Enter the app name, developer name, app ID, and/or OS and click Search. Note: If an Android app doesn't appear in the search results in AdMob and it's been at least 1 week since you published it, our Application Visibility and Discoverability troubleshooter may help.Click Select beside the app you want to link to.If you need any help you can connect with us at Kodesoft TechnologiesOr If you have any idea in your mind. do share your idea at - Kodesoft Technologies

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

Related searches to minnesota schedule kf

Create this form in 5 minutes!

How to create an eSignature for the minnesota taxable income

How to make an electronic signature for your 2017 Kf Beneficiarys Share Of Minnesota Taxable Income online

How to make an eSignature for the 2017 Kf Beneficiarys Share Of Minnesota Taxable Income in Google Chrome

How to create an electronic signature for putting it on the 2017 Kf Beneficiarys Share Of Minnesota Taxable Income in Gmail

How to create an electronic signature for the 2017 Kf Beneficiarys Share Of Minnesota Taxable Income from your smartphone

How to generate an eSignature for the 2017 Kf Beneficiarys Share Of Minnesota Taxable Income on iOS

How to create an electronic signature for the 2017 Kf Beneficiarys Share Of Minnesota Taxable Income on Android devices

People also ask kf form

-

What is the best way to schedule kf for document signing?

To effectively schedule kf for document signing, you can use airSlate SignNow's intuitive scheduling tool. This feature allows you to set specific dates and times for sending documents for signatures, ensuring a timely process. By utilizing this capability, you streamline your workflows and enhance the efficiency of your signing tasks.

-

How much does it cost to schedule kf with airSlate SignNow?

Pricing for scheduling kf with airSlate SignNow varies based on the plan you choose. Our tiered pricing structure caters to businesses of all sizes, offering affordable solutions with a range of features. Be sure to check our website for the most current pricing information and to find the best fit for your budget.

-

What features support my ability to schedule kf?

airSlate SignNow offers several features that support scheduling kf, including automated reminders and customizable workflows. These tools help to ensure that all parties are kept in the loop, signNowly reducing the chances of missed deadlines. Additionally, the platform's user-friendly interface makes scheduling and managing documents simple and efficient.

-

Can I integrate airSlate SignNow to schedule kf with other software tools?

Yes, airSlate SignNow allows you to integrate with various software tools to schedule kf seamlessly. Popular integrations include CRM systems, email platforms, and productivity apps, which enhance your document management processes. These integrations ensure that you have a centralized system for all your scheduling and signing tasks.

-

What are the benefits of using airSlate SignNow to schedule kf?

Using airSlate SignNow to schedule kf offers numerous benefits, including time savings and improved document accuracy. The platform's efficient scheduling features minimizes the back-and-forth often associated with document signing. Moreover, it enhances collaboration between team members and clients, making the entire signing process more streamlined.

-

Is it easy to schedule kf for multiple signers?

Absolutely! airSlate SignNow makes it easy to schedule kf for multiple signers with its robust features. You can set up documents to be signed in a specified order or simultaneously, depending on your needs. This flexibility ensures that all necessary parties can complete the signing process efficiently and on time.

-

What kind of support can I expect when scheduling kf?

When scheduling kf with airSlate SignNow, our dedicated support team is available to assist you. We offer comprehensive resources, including guides and tutorials to help you navigate the scheduling process. Whether you need technical assistance or general inquiries, our customer service team is here to ensure your experience is smooth and successful.

Get more for kf income

Find out other minnesota schedule kf

- Sign Mississippi Legal Business Plan Template Easy

- How Do I Sign Minnesota Legal Residential Lease Agreement

- Sign South Carolina Insurance Lease Agreement Template Computer

- Sign Missouri Legal Last Will And Testament Online

- Sign Montana Legal Resignation Letter Easy

- How Do I Sign Montana Legal IOU

- How Do I Sign Montana Legal Quitclaim Deed

- Sign Missouri Legal Separation Agreement Myself

- How Do I Sign Nevada Legal Contract

- Sign New Jersey Legal Memorandum Of Understanding Online

- How To Sign New Jersey Legal Stock Certificate

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online