Authorization Agreement to the Ri Division of Taxation Eft Section Rhode Island Form

What is the Authorization Agreement To The Ri Division Of Taxation Eft Section Rhode Island Form

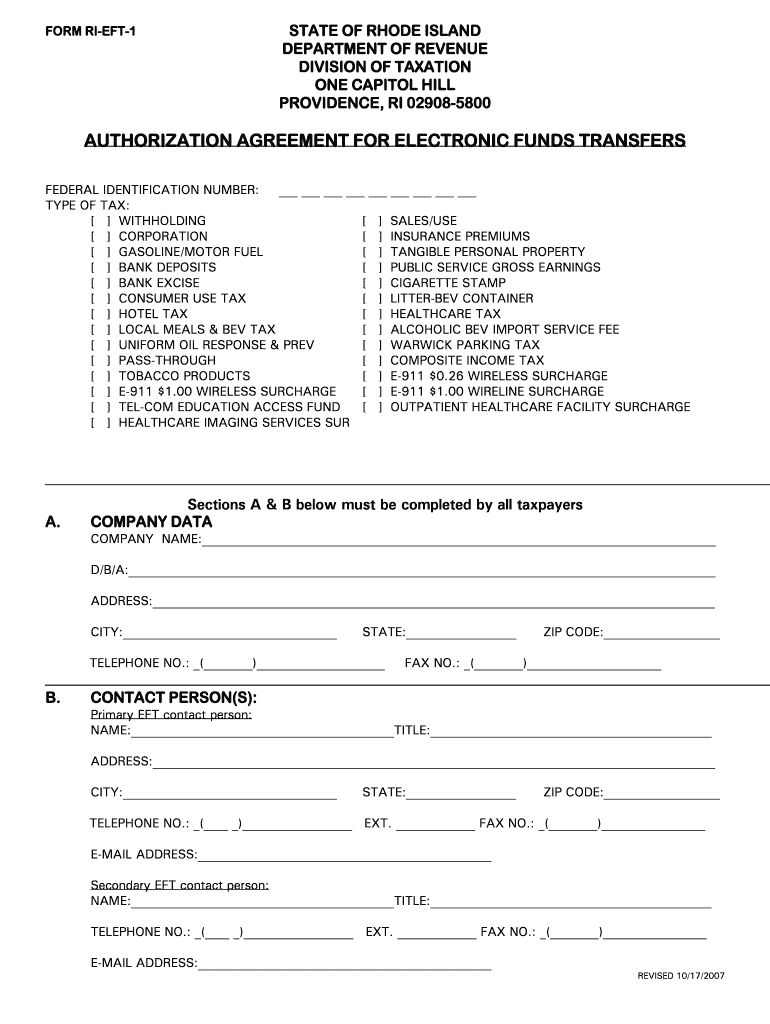

The Authorization Agreement To The Ri Division Of Taxation EFT Section Rhode Island Form is a crucial document that allows taxpayers to authorize electronic funds transfers (EFT) for tax payments. This form facilitates a seamless process for both individuals and businesses to manage their tax obligations efficiently. By completing this form, taxpayers can ensure that their payments are processed electronically, providing a convenient alternative to traditional payment methods.

How to use the Authorization Agreement To The Ri Division Of Taxation Eft Section Rhode Island Form

Using the Authorization Agreement To The Ri Division Of Taxation EFT Section Rhode Island Form involves several straightforward steps. First, obtain the form from the Rhode Island Division of Taxation website or through authorized channels. Next, fill out the required information, including your personal or business details and banking information for the EFT. Once completed, submit the form according to the specified guidelines to initiate the electronic payment process. It is essential to ensure that all information is accurate to avoid any delays in processing.

Steps to complete the Authorization Agreement To The Ri Division Of Taxation Eft Section Rhode Island Form

Completing the Authorization Agreement To The Ri Division Of Taxation EFT Section Rhode Island Form requires careful attention to detail. Follow these steps:

- Download the form from the Rhode Island Division of Taxation website.

- Provide your name, address, and taxpayer identification number.

- Enter your bank account details, including account number and routing number.

- Sign and date the form to authorize the EFT.

- Submit the completed form via the specified method, whether online, by mail, or in person.

Key elements of the Authorization Agreement To The Ri Division Of Taxation Eft Section Rhode Island Form

Several key elements must be included in the Authorization Agreement To The Ri Division Of Taxation EFT Section Rhode Island Form to ensure its validity. These elements include:

- Taxpayer identification information, such as name and address.

- Banking information for EFT, including the account and routing numbers.

- A clear statement of authorization for electronic payments.

- Signature of the taxpayer or authorized representative.

- Date of the authorization.

Legal use of the Authorization Agreement To The Ri Division Of Taxation Eft Section Rhode Island Form

The legal use of the Authorization Agreement To The Ri Division Of Taxation EFT Section Rhode Island Form is governed by state regulations regarding electronic payments. This form is legally binding once submitted and accepted by the Rhode Island Division of Taxation. It ensures that the taxpayer's authorization for electronic payments is documented, providing a reliable method for fulfilling tax obligations. Compliance with the form's requirements is essential to avoid penalties and ensure proper processing of payments.

Form Submission Methods

Taxpayers have several options for submitting the Authorization Agreement To The Ri Division Of Taxation EFT Section Rhode Island Form. These methods include:

- Online submission through the Rhode Island Division of Taxation's secure portal.

- Mailing the completed form to the designated address provided on the form.

- In-person submission at local tax offices or authorized locations.

Quick guide on how to complete authorization agreement to the ri division of taxation eft section rhode island form

Prepare Authorization Agreement To The Ri Division Of Taxation Eft Section Rhode Island Form effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and sign your documents quickly without hold-ups. Manage Authorization Agreement To The Ri Division Of Taxation Eft Section Rhode Island Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The easiest way to modify and sign Authorization Agreement To The Ri Division Of Taxation Eft Section Rhode Island Form without any hassle

- Locate Authorization Agreement To The Ri Division Of Taxation Eft Section Rhode Island Form and then click Get Form to begin.

- Utilize the features we provide to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Alter and sign Authorization Agreement To The Ri Division Of Taxation Eft Section Rhode Island Form to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the authorization agreement to the ri division of taxation eft section rhode island form

How to generate an electronic signature for your Authorization Agreement To The Ri Division Of Taxation Eft Section Rhode Island Form in the online mode

How to make an eSignature for your Authorization Agreement To The Ri Division Of Taxation Eft Section Rhode Island Form in Google Chrome

How to create an electronic signature for signing the Authorization Agreement To The Ri Division Of Taxation Eft Section Rhode Island Form in Gmail

How to generate an electronic signature for the Authorization Agreement To The Ri Division Of Taxation Eft Section Rhode Island Form right from your mobile device

How to create an electronic signature for the Authorization Agreement To The Ri Division Of Taxation Eft Section Rhode Island Form on iOS

How to generate an electronic signature for the Authorization Agreement To The Ri Division Of Taxation Eft Section Rhode Island Form on Android devices

People also ask

-

What is the Authorization Agreement To The Ri Division Of Taxation Eft Section Rhode Island Form?

The Authorization Agreement To The Ri Division Of Taxation Eft Section Rhode Island Form is a document required for businesses to authorize electronic fund transfers to the Rhode Island Division of Taxation. This form streamlines the payment process, ensuring timely and secure transactions. Utilizing airSlate SignNow can help you easily create and eSign this essential authorization form.

-

How does airSlate SignNow simplify the Authorization Agreement To The Ri Division Of Taxation Eft Section Rhode Island Form process?

airSlate SignNow simplifies the Authorization Agreement To The Ri Division Of Taxation Eft Section Rhode Island Form by providing an intuitive platform where you can quickly fill out, sign, and send the document electronically. Our user-friendly interface reduces manual errors and accelerates the submission process, making compliance easier for your business.

-

Is there a cost associated with using airSlate SignNow for the Authorization Agreement To The Ri Division Of Taxation Eft Section Rhode Island Form?

Yes, while airSlate SignNow offers a free trial, there are subscription plans that provide various features tailored to your needs. Depending on your organization's size and document volume, you can choose a plan that includes seamless access to the Authorization Agreement To The Ri Division Of Taxation Eft Section Rhode Island Form and other essential tools.

-

What features does airSlate SignNow offer for managing the Authorization Agreement To The Ri Division Of Taxation Eft Section Rhode Island Form?

airSlate SignNow offers a range of features for managing the Authorization Agreement To The Ri Division Of Taxation Eft Section Rhode Island Form, including customizable templates, secure cloud storage, and automated workflows. These features ensure that your documents are not only easy to create but also securely stored and easily accessible when needed.

-

Can I integrate airSlate SignNow with other software for the Authorization Agreement To The Ri Division Of Taxation Eft Section Rhode Island Form?

Absolutely! airSlate SignNow offers seamless integrations with various software tools, enabling you to connect your workflow systems with the Authorization Agreement To The Ri Division Of Taxation Eft Section Rhode Island Form. This integration capability enhances productivity by allowing you to manage all your documents from one centralized platform.

-

What are the benefits of using airSlate SignNow for the Authorization Agreement To The Ri Division Of Taxation Eft Section Rhode Island Form?

Using airSlate SignNow for the Authorization Agreement To The Ri Division Of Taxation Eft Section Rhode Island Form offers numerous benefits, including faster processing times, enhanced security, and reduced paper usage. Additionally, our eSigning feature ensures that you can sign documents anytime, anywhere, making compliance effortless.

-

How secure is the Authorization Agreement To The Ri Division Of Taxation Eft Section Rhode Island Form when using airSlate SignNow?

Security is a top priority at airSlate SignNow. The Authorization Agreement To The Ri Division Of Taxation Eft Section Rhode Island Form is protected with advanced encryption, secure cloud storage, and access controls to ensure your sensitive information remains confidential and safe from unauthorized access.

Get more for Authorization Agreement To The Ri Division Of Taxation Eft Section Rhode Island Form

- Declaration of manufacturer producer exporter or importer of textiles textile products taco form

- Chj 121 medical release form asc x12005010x214e2 health care claim acknoledgment 277ca michigan

- Adult foster care plan form

- Illinois petitioner alcoholdrug evaluation report update form

- F027cp state of connecticut key ctgov ct form

- Prevailing wage report back older version thecontractorsgroup bb form

- Whistleblower retaliation complaint form ctgov ct

- Pnmi application form

Find out other Authorization Agreement To The Ri Division Of Taxation Eft Section Rhode Island Form

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple

- Sign Indiana Web Hosting Agreement Online

- Sign Indiana Web Hosting Agreement Easy

- How To Sign Louisiana Web Hosting Agreement

- Sign Maryland Web Hosting Agreement Now

- Sign Maryland Web Hosting Agreement Free

- Sign Maryland Web Hosting Agreement Fast

- Help Me With Sign New York Web Hosting Agreement

- Sign Connecticut Joint Venture Agreement Template Free

- Sign South Dakota Web Hosting Agreement Free

- Sign Wisconsin Web Hosting Agreement Later

- Sign Wisconsin Web Hosting Agreement Easy