Form 3abc Instructions

What is the Form 3abc Instructions

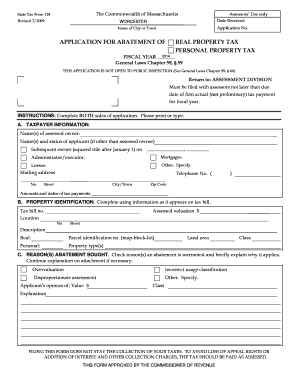

The city of Worcester form 3abc is a state tax form used for reporting various tax-related information. It is essential for residents and businesses to understand the specific requirements outlined in the form 3abc instructions. These instructions provide detailed guidance on how to accurately complete the form, ensuring compliance with local tax regulations. The form is particularly relevant for individuals and entities that need to report income, deductions, and credits applicable to their tax situation.

Steps to complete the Form 3abc Instructions

Completing the form 3abc requires careful attention to detail. Here are the key steps to follow:

- Gather all necessary financial documents, including income statements and previous tax returns.

- Review the form 3abc instructions thoroughly to understand each section's requirements.

- Fill out the form accurately, ensuring all information is complete and correct.

- Double-check calculations and ensure that all figures align with your financial documents.

- Sign and date the form as required before submission.

Legal use of the Form 3abc Instructions

The form 3abc instructions are legally binding when completed correctly. To ensure the form is recognized as valid, it must comply with the relevant state tax laws. Utilizing a reliable electronic signature solution, such as signNow, can enhance the legal standing of the completed form. This includes adherence to the ESIGN and UETA acts, which establish the legality of electronic signatures in the United States.

Form Submission Methods (Online / Mail / In-Person)

There are several methods available for submitting the form 3abc. Individuals can choose to file online through authorized platforms, which often provide a streamlined process. Alternatively, the form can be mailed to the appropriate tax authority or submitted in person at designated locations. Each method has its own set of guidelines, so it is important to follow the instructions provided to ensure timely processing.

Required Documents

When completing the city of Worcester form 3abc, certain documents are required to support the information provided. These documents may include:

- W-2 forms for reporting wages and salaries.

- 1099 forms for reporting other income sources.

- Receipts for deductions, such as business expenses or charitable contributions.

- Previous tax returns for reference.

Filing Deadlines / Important Dates

Staying aware of filing deadlines is crucial for compliance. The due date for the form 3abc typically aligns with the state tax filing deadline. It is advisable to check the specific dates each year, as they can vary. Late submissions may result in penalties or interest charges, making it important to file on time.

Quick guide on how to complete form 3abc instructions

Complete Form 3abc Instructions effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly substitute for conventional printed and signed paperwork, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Form 3abc Instructions on any platform using airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

How to edit and eSign Form 3abc Instructions without any hassle

- Obtain Form 3abc Instructions and click on Get Form to begin.

- Utilize the tools we supply to complete your document.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a standard wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 3abc Instructions and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 3abc instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the city of Worcester form 3abc?

The city of Worcester form 3abc is a specific document required for certain business filings within the city. It serves to streamline the submission process for various permits and licenses. Understanding this form is crucial for businesses operating in Worcester to ensure compliance with local regulations.

-

How can airSlate SignNow help with the city of Worcester form 3abc?

AirSlate SignNow provides an efficient solution for electronically signing and sending the city of Worcester form 3abc. With its user-friendly interface, you can easily fill out the form, collect signatures, and submit it without the hassle of paper documents. This accelerates your workflow and enhances productivity.

-

What are the pricing plans for using airSlate SignNow for the city of Worcester form 3abc?

AirSlate SignNow offers various pricing plans tailored to businesses of all sizes. Depending on the features you need for managing the city of Worcester form 3abc, you can choose a plan that fits your budget and requirements. Each plan provides a cost-effective way to manage your documents efficiently.

-

Are there any features specifically designed for the city of Worcester form 3abc in airSlate SignNow?

Yes, airSlate SignNow includes features that cater to the needs of users filling out the city of Worcester form 3abc. This includes templates for quick access, robust signing workflows, and secure document storage. These features make managing your forms easier and more effective.

-

Can airSlate SignNow integrate with other software to manage the city of Worcester form 3abc?

AirSlate SignNow seamlessly integrates with various software applications, enhancing your ability to manage the city of Worcester form 3abc. This includes CRMs, cloud storage services, and productivity tools, allowing you to streamline your document workflow across platforms. Integration simplifies sending and tracking your forms.

-

What benefits does airSlate SignNow offer for handling the city of Worcester form 3abc?

Using airSlate SignNow for the city of Worcester form 3abc provides several benefits, such as improved accuracy and reduced turnaround time. The platform minimizes paperwork and enhances collaboration, making it easier for businesses to manage their documentation efficiently. Additionally, it ensures that all submissions comply with local filing standards.

-

Is it secure to use airSlate SignNow for the city of Worcester form 3abc?

Absolutely, airSlate SignNow prioritizes security when handling documents like the city of Worcester form 3abc. It employs advanced encryption, secure storage, and authentication measures to protect your information. You can confidently send and sign documents knowing your data remains safe.

Get more for Form 3abc Instructions

- Quit claim deed portland efiles the city of portland oregon form

- Oregon real estate deed forms fill in the blank deedscom

- Free oregon quit claim deed form wordpdfeforms

- Fillable online oregon demand for list of services by form

- In county oregon circuit court form

- Change in ownershipccsf office of assessor recorder form

- With provision for secondary beneficiary form

- Control number or 030 78 form

Find out other Form 3abc Instructions

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement