Form N 35, Rev , S Corporation Income Tax Return Hawaii Gov

What is the Form N-35, Rev, S Corporation Income Tax Return Hawaii gov

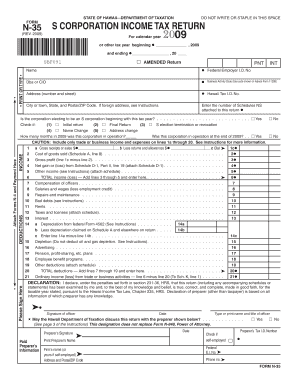

The Form N-35, Rev, is the official S Corporation Income Tax Return for the state of Hawaii. This form is specifically designed for S Corporations operating within Hawaii to report their income, deductions, and credits. It is essential for compliance with state tax laws and allows the corporation to calculate its tax liability accurately. The form must be filed annually, reflecting the corporation's financial activities for the previous tax year.

How to use the Form N-35, Rev, S Corporation Income Tax Return Hawaii gov

Using the Form N-35, Rev involves several steps that ensure accurate reporting of your S Corporation’s financial data. First, gather all necessary financial documents, including income statements, balance sheets, and any supporting documentation for deductions and credits. Next, complete the form by entering the required information in the designated fields. It is crucial to follow the instructions carefully to avoid errors that could lead to penalties or delays in processing. Once completed, the form can be submitted electronically or via mail, depending on your preference.

Steps to complete the Form N-35, Rev, S Corporation Income Tax Return Hawaii gov

Completing the Form N-35, Rev requires a systematic approach. Begin by downloading the latest version of the form from the Hawaii Department of Taxation website. Fill in the corporation's name, address, and federal employer identification number (EIN) at the top of the form. Proceed to report the corporation's total income, deductions, and credits in the appropriate sections. Ensure that all calculations are accurate, as discrepancies can lead to audits. After filling out the form, review it thoroughly for any mistakes before submitting it to the state tax authority.

Filing Deadlines / Important Dates

Filing deadlines for the Form N-35, Rev are crucial for compliance. Generally, S Corporations must file their tax returns by the 15th day of the third month following the end of their tax year. For corporations operating on a calendar year, this means the deadline is March 15. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. It's important to be aware of these dates to avoid late filing penalties.

Penalties for Non-Compliance

Failure to file the Form N-35, Rev on time can result in significant penalties. The state of Hawaii imposes a late filing penalty, which can accumulate daily until the form is submitted. Additionally, if the form is filed incorrectly or contains inaccuracies, the corporation may face further fines and interest on any unpaid taxes. To mitigate these risks, it is advisable to file on time and ensure all information is accurate and complete.

Digital vs. Paper Version

Both digital and paper versions of the Form N-35, Rev are available for submission. The digital version offers several advantages, including ease of completion, automatic calculations, and faster processing times. Filing electronically can also reduce the risk of errors associated with manual entry. However, some businesses may prefer the paper version for record-keeping purposes. Regardless of the method chosen, it is essential to ensure that the form is completed accurately to comply with state regulations.

Quick guide on how to complete form n 35 rev s corporation income tax return hawaii gov

Easily Prepare Form N 35, Rev , S Corporation Income Tax Return Hawaii gov on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent environmentally friendly substitute for traditional paper documents, as you can locate the right form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and eSign your documents swiftly without any delays. Manage Form N 35, Rev , S Corporation Income Tax Return Hawaii gov on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Edit and eSign Form N 35, Rev , S Corporation Income Tax Return Hawaii gov Effortlessly

- Obtain Form N 35, Rev , S Corporation Income Tax Return Hawaii gov and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your adjustments.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign Form N 35, Rev , S Corporation Income Tax Return Hawaii gov and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form n 35 rev s corporation income tax return hawaii gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form N 35, Rev, S Corporation Income Tax Return Hawaii gov?

Form N 35, Rev, S Corporation Income Tax Return Hawaii gov is a tax form used by S Corporations in Hawaii to report their income, deductions, and credits to the Department of Taxation. This form helps to ensure compliance with state tax laws and is crucial for accurate tax reporting. Properly completing this form can help minimize potential tax liabilities.

-

How can airSlate SignNow assist with Form N 35, Rev, S Corporation Income Tax Return Hawaii gov?

airSlate SignNow streamlines the process of preparing and signing Form N 35, Rev, S Corporation Income Tax Return Hawaii gov. Our platform allows users to collect necessary signatures and manage document workflows efficiently, ensuring your tax return is submitted on time. This service enhances accuracy and helps maintain compliance.

-

Is there a cost associated with using airSlate SignNow for Form N 35, Rev, S Corporation Income Tax Return Hawaii gov?

Yes, airSlate SignNow offers a range of pricing plans to suit different business needs when preparing documents like Form N 35, Rev, S Corporation Income Tax Return Hawaii gov. Each plan provides varying levels of features and services, allowing you to choose one that aligns with your budget. We also offer a free trial, so you can experience the benefits before committing.

-

What features does airSlate SignNow provide for handling Form N 35, Rev, S Corporation Income Tax Return Hawaii gov?

airSlate SignNow includes features such as eSigning, document templates, and advanced workflow management to support the processing of Form N 35, Rev, S Corporation Income Tax Return Hawaii gov. Users can easily track their documents and access them from anywhere, ensuring a smooth and efficient filing process. These features are designed to save time and improve accuracy.

-

What benefits do businesses gain from using airSlate SignNow for tax forms like Form N 35, Rev, S Corporation Income Tax Return Hawaii gov?

Using airSlate SignNow for Form N 35, Rev, S Corporation Income Tax Return Hawaii gov allows businesses to enhance efficiency and reduce processing time. The platform helps eliminate paperwork, minimizes errors, and makes it easier to manage document approvals. By automating part of the tax filing process, businesses can focus more on their core activities.

-

Can airSlate SignNow integrate with accounting software for Form N 35, Rev, S Corporation Income Tax Return Hawaii gov?

Yes, airSlate SignNow can integrate with various accounting software systems, making the filing of Form N 35, Rev, S Corporation Income Tax Return Hawaii gov easier. These integrations allow for seamless data exchange, reducing the risk of errors during the transfer of financial data. This capability enhances your overall workflow when preparing tax returns.

-

Is airSlate SignNow secure for submitting Form N 35, Rev, S Corporation Income Tax Return Hawaii gov?

Absolutely, airSlate SignNow prioritizes the security of your documents. We utilize encryption and secure storage methods to protect sensitive information, including your Form N 35, Rev, S Corporation Income Tax Return Hawaii gov. You can trust that your tax return and personal data are safe with us.

Get more for Form N 35, Rev , S Corporation Income Tax Return Hawaii gov

Find out other Form N 35, Rev , S Corporation Income Tax Return Hawaii gov

- eSignature Oregon Housekeeping Contract Computer

- eSignature Montana Home Loan Application Online

- eSignature New Hampshire Home Loan Application Online

- eSignature Minnesota Mortgage Quote Request Simple

- eSignature New Jersey Mortgage Quote Request Online

- Can I eSignature Kentucky Temporary Employment Contract Template

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online