Form 1040X Rev November Irs

What is the Form 1040X Rev November IRS

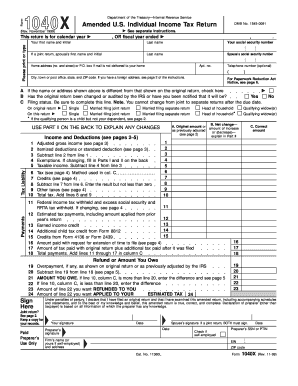

The Form 1040X Rev November IRS is an amended tax return form used by taxpayers in the United States to make corrections to their previously filed Form 1040, 1040A, or 1040EZ. This form allows individuals to report changes in income, deductions, or credits, ensuring that their tax return accurately reflects their financial situation. It is essential for taxpayers who discover errors or wish to claim additional deductions or credits after their original filing.

How to use the Form 1040X Rev November IRS

Using the Form 1040X Rev November IRS involves a few straightforward steps. First, obtain the form from the IRS website or other authorized sources. Next, fill out the form by providing your personal information, including your name, address, and Social Security number. Then, indicate the changes you are making by completing the appropriate sections and providing explanations for each change. Finally, review the form for accuracy before submitting it to the IRS.

Steps to complete the Form 1040X Rev November IRS

Completing the Form 1040X Rev November IRS requires careful attention to detail. Follow these steps:

- Download the form from the IRS website.

- Fill out your personal information at the top of the form.

- In Part I, explain the changes you are making and the reasons for those changes.

- In Part II, provide the corrected amounts for your income, deductions, and credits.

- Calculate the new tax liability or refund amount.

- Sign and date the form before submitting it to the IRS.

Legal use of the Form 1040X Rev November IRS

The Form 1040X Rev November IRS is legally recognized for amending tax returns in the United States. It must be completed accurately to ensure compliance with IRS regulations. When filed correctly, it allows taxpayers to rectify mistakes in their tax filings, which can help avoid penalties and interest on unpaid taxes. It is advisable to keep copies of both the original and amended returns for your records.

Filing Deadlines / Important Dates

When filing the Form 1040X Rev November IRS, it is crucial to be aware of the deadlines. Generally, taxpayers have three years from the original filing date to submit an amended return. If you are seeking a refund, ensure that you file within this timeframe. Additionally, if you are amending a return for a specific tax year, check for any changes in deadlines that may apply based on your situation.

Form Submission Methods (Online / Mail / In-Person)

The Form 1040X Rev November IRS can be submitted through various methods. While the IRS does not currently allow electronic filing for amended returns, you can mail the completed form to the appropriate IRS address based on your state of residence. Ensure that you use the correct mailing address as specified in the form instructions. In-person submissions are not typically accepted for amended returns.

Quick guide on how to complete form 1040x rev november irs

Complete Form 1040X Rev November Irs effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-conscious alternative to conventional printed and signed papers, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents rapidly without delays. Manage Form 1040X Rev November Irs on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Form 1040X Rev November Irs seamlessly

- Find Form 1040X Rev November Irs and then click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal authority as a traditional handwritten signature.

- Verify all the details and then click on the Done button to save your modifications.

- Decide how you want to share your form—via email, SMS, or invitation link—or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and eSign Form 1040X Rev November Irs and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1040x rev november irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 1040X Rev November Irs and how is it used?

The Form 1040X Rev November Irs is an official IRS form used for amending previously filed tax returns. It allows taxpayers to make corrections to their income, deductions, or credits. Using airSlate SignNow, you can easily eSign and send your amended Form 1040X, ensuring a smooth submission process.

-

How much does airSlate SignNow cost for filing the Form 1040X Rev November Irs?

airSlate SignNow offers various pricing plans that cater to individual and business needs, making it cost-effective. Prices start at a budget-friendly monthly fee, with options for annual subscriptions that offer additional savings. By using airSlate SignNow, you can manage your Form 1040X Rev November Irs efficiently without incurring high costs.

-

What features does airSlate SignNow provide for handling Form 1040X Rev November Irs?

airSlate SignNow provides a user-friendly interface for preparing and signing documents like the Form 1040X Rev November Irs. Key features include secure eSigning, document tracking, and templates that save you time. These features streamline the amendment process, ensuring you complete your Form 1040X efficiently.

-

Can I integrate airSlate SignNow with other tools for filing the Form 1040X Rev November Irs?

Yes, airSlate SignNow seamlessly integrates with numerous tools and applications commonly used for tax preparation and filing, enhancing your workflow. This integration allows you to import necessary data directly into your Form 1040X Rev November Irs. It simplifies the eSigning process and helps maintain your records efficiently.

-

What are the benefits of using airSlate SignNow for the Form 1040X Rev November Irs?

Using airSlate SignNow for your Form 1040X Rev November Irs provides numerous benefits, including faster processing and improved accuracy with eSignature solutions. The platform also ensures compliance with IRS requirements, reducing the risks of errors. Additionally, it enhances document security through encryption and authentication features.

-

Is airSlate SignNow suitable for businesses filing multiple Form 1040X Rev November Irs?

Absolutely! airSlate SignNow is tailored for both individuals and businesses, making it perfect for companies filing multiple Form 1040X Rev November Irs. The platform's bulk send feature allows users to manage numerous documents simultaneously, ensuring efficiency in processing amendments.

-

How does airSlate SignNow ensure the security of my Form 1040X Rev November Irs?

airSlate SignNow prioritizes security with advanced encryption methods to protect your Form 1040X Rev November Irs and other sensitive documents. The platform also offers secure authentication options ensuring only authorized users have access. This commitment to security helps you file with confidence and peace of mind.

Get more for Form 1040X Rev November Irs

- Corporation was held on the day of 20 form

- With legal forms

- Liability for defects in construction contracts form

- The air force journal of indo pacific affairs form

- Tx deed general warranty cash 12009 6formswww

- This arbitration submission agreement this agreementquot is made this form

- I have received your letter of resignation form

- Of shareholders on the day of 20 at form

Find out other Form 1040X Rev November Irs

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now