Oklahoma Fillable 511 Form

What is the Oklahoma Fillable 511 Form

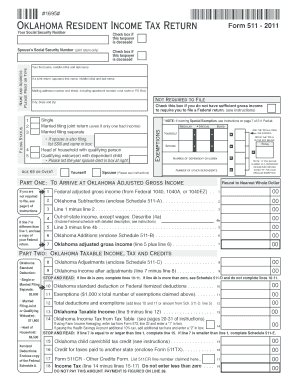

The Oklahoma Fillable 511 Form is a state-specific document used for filing individual income tax returns in Oklahoma. It allows taxpayers to report their income, deductions, and credits to the Oklahoma Tax Commission. This form is essential for both residents and non-residents who earn income in the state, ensuring compliance with state tax laws.

How to use the Oklahoma Fillable 511 Form

Using the Oklahoma Fillable 511 Form involves several steps. First, download the fillable version of the form from the Oklahoma Tax Commission website or a trusted source. Next, fill in the required information, including personal details, income sources, and deductions. Ensure that all entries are accurate to avoid delays or issues with processing. After completing the form, review it for any errors, then submit it according to the specified submission methods.

Steps to complete the Oklahoma Fillable 511 Form

Completing the Oklahoma Fillable 511 Form requires careful attention to detail. Follow these steps:

- Download the form and open it in a PDF reader that supports fillable forms.

- Enter your personal information, including your name, address, and Social Security number.

- Report your income from various sources, such as wages, self-employment, and investments.

- List any deductions you qualify for, such as education expenses or mortgage interest.

- Calculate your total tax liability and any credits you may claim.

- Sign and date the form electronically if using a digital platform.

Legal use of the Oklahoma Fillable 511 Form

The Oklahoma Fillable 511 Form is legally binding when filled out correctly and submitted to the Oklahoma Tax Commission. To ensure its legal validity, taxpayers must comply with all state regulations regarding income reporting and tax obligations. Utilizing a reputable eSignature solution, like signNow, can enhance the form's legal standing by providing a secure digital signature and maintaining compliance with relevant laws.

Form Submission Methods

Taxpayers have several options for submitting the Oklahoma Fillable 511 Form. The most common methods include:

- Online submission through the Oklahoma Tax Commission's e-file system.

- Mailing a printed copy of the completed form to the appropriate address.

- In-person submission at designated tax offices or during tax assistance events.

Filing Deadlines / Important Dates

Filing deadlines for the Oklahoma Fillable 511 Form typically align with federal tax deadlines. Generally, individual income tax returns must be filed by April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any changes in deadlines due to state-specific regulations or extensions granted by the Oklahoma Tax Commission.

Quick guide on how to complete oklahoma fillable 511 form

Complete Oklahoma Fillable 511 Form with ease on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the resources you need to create, edit, and eSign your documents quickly and smoothly. Manage Oklahoma Fillable 511 Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to modify and eSign Oklahoma Fillable 511 Form effortlessly

- Find Oklahoma Fillable 511 Form and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the information and then click on the Done button to store your changes.

- Choose how you would prefer to send your form, by email, text message (SMS), an invite link, or download it to your computer.

Eliminate the hassle of missing or mislaid documents, tiring form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device of your choice. Modify and eSign Oklahoma Fillable 511 Form and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the oklahoma fillable 511 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Oklahoma Fillable 511 Form?

The Oklahoma Fillable 511 Form is a document used for tax reporting in the state of Oklahoma. This form allows residents and businesses to easily complete their tax return electronically, ensuring accuracy and efficiency. Utilizing airSlate SignNow can streamline the process of filling out and submitting the Oklahoma Fillable 511 Form.

-

How can I complete the Oklahoma Fillable 511 Form online?

You can complete the Oklahoma Fillable 511 Form online using airSlate SignNow, which provides a user-friendly platform for filling out and signing documents. Simply upload the form, fill in the required fields, and you can eSign it within minutes. Our solution ensures your data is secure and accessible anytime.

-

Is airSlate SignNow a cost-effective solution for the Oklahoma Fillable 511 Form?

Yes, airSlate SignNow offers a cost-effective solution for handling the Oklahoma Fillable 511 Form. Our pricing plans are designed to fit various budgets, enabling businesses and individuals to manage their documentation without excessive costs. By streamlining this process, you save both time and money.

-

What features does airSlate SignNow provide for the Oklahoma Fillable 511 Form?

AirSlate SignNow includes essential features for the Oklahoma Fillable 511 Form such as eSignature capabilities, form templates, and collaborative editing. These features simplify document management and enhance accessibility, making it easier for users to complete and submit their forms efficiently. With these tools, you can handle your paperwork seamlessly.

-

Are there any integrations available for managing the Oklahoma Fillable 511 Form?

Yes, airSlate SignNow integrates with various applications and platforms, allowing for seamless management of the Oklahoma Fillable 511 Form. You can connect to popular software like Google Drive, Dropbox, and more to simplify document access and storage. These integrations ensure that you can work within your existing workflows effortlessly.

-

What benefits does using airSlate SignNow offer for the Oklahoma Fillable 511 Form?

Using airSlate SignNow for the Oklahoma Fillable 511 Form offers several benefits including enhanced security, convenience, and speedy processing. The platform provides a secure environment for sensitive information, and the eSigning feature eliminates the need for printing or mailing documents. This makes tax reporting simpler and faster.

-

Can I save my progress when filling out the Oklahoma Fillable 511 Form?

Absolutely! AirSlate SignNow allows you to save your progress when completing the Oklahoma Fillable 511 Form. This feature gives you the flexibility to return to your document at any time without losing your entered information, ensuring a hassle-free experience.

Get more for Oklahoma Fillable 511 Form

- Paving contract for contractor idaho form

- Site work contract for contractor idaho form

- Siding contract for contractor idaho form

- Refrigeration contract for contractor idaho form

- Idaho drainage form

- Foundation contract for contractor idaho form

- Plumbing contract for contractor idaho form

- Brick mason contract for contractor idaho form

Find out other Oklahoma Fillable 511 Form

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free