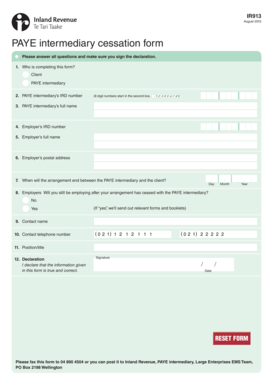

Ir913 Form

What is the IR913?

The IR913 form is a specific tax document utilized in the United States, primarily for reporting certain financial information to the Internal Revenue Service (IRS). This form is essential for individuals and businesses that need to disclose particular income types or deductions. Understanding the purpose of the IR913 is crucial for compliance with federal tax regulations.

How to use the IR913

Using the IR913 involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents that pertain to the information required on the form. Next, fill out the form carefully, providing accurate data as per IRS guidelines. It is important to review the completed form for any errors before submission. Finally, submit the IR913 through the appropriate channels, either electronically or via mail, depending on the IRS instructions for that tax year.

Steps to complete the IR913

Completing the IR913 requires a systematic approach:

- Gather relevant financial records, including income statements and receipts.

- Carefully read the instructions provided with the form to understand the required information.

- Fill out the form, ensuring all fields are completed accurately.

- Double-check for any mistakes or missing information.

- Submit the completed form by the specified deadline.

Legal use of the IR913

The legal use of the IR913 is defined by IRS regulations. To be considered valid, the form must be filled out accurately and submitted on time. Failure to comply with these requirements can lead to penalties or delays in processing. It is essential to adhere to all legal stipulations associated with the IR913 to ensure that the information reported is accepted by the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the IR913 are critical to avoid penalties. Typically, the form must be submitted by April fifteenth of each year, aligning with the general tax filing deadline in the United States. However, specific circumstances may alter this date, such as extensions granted by the IRS. Keeping track of these important dates ensures compliance and helps avoid unnecessary complications.

Required Documents

To complete the IR913, certain documents are required. These may include:

- Income statements, such as W-2s or 1099s.

- Receipts for deductions or credits claimed.

- Any prior year tax returns for reference.

Having these documents ready will facilitate a smoother completion process for the IR913.

Quick guide on how to complete ir913

Complete Ir913 effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely save it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents rapidly without delays. Handle Ir913 on any device with airSlate SignNow's Android or iOS applications and simplify any document-centric process today.

The easiest way to edit and eSign Ir913 without hassle

- Locate Ir913 and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow manages all your document needs in a few clicks from any device you prefer. Modify and eSign Ir913 and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ir913

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ir913 feature in airSlate SignNow?

The ir913 feature in airSlate SignNow allows users to send documents for eSignature efficiently. It streamlines the signing process, ensuring that all parties can review and sign documents quickly. This feature is designed to enhance productivity and reduce turnaround times.

-

How much does airSlate SignNow cost with the ir913 capabilities?

Pricing for airSlate SignNow with ir913 capabilities varies based on the plan you choose. The plans are structured to accommodate different business sizes, ensuring that you get the best value for your investment. It's advisable to check the website for the most up-to-date pricing details.

-

What are the main benefits of using airSlate SignNow's ir913?

The ir913 feature provides numerous benefits such as improved collaboration, time-saving efficiencies, and reduced paper usage. By utilizing airSlate SignNow, users can streamline their document workflows and enhance overall business productivity. This leads to quicker deal closures and enhanced client satisfaction.

-

Can I integrate airSlate SignNow with other applications while using the ir913 feature?

Yes, airSlate SignNow with the ir913 feature supports integrations with various popular applications. This allows users to connect their existing workflows seamlessly, improving efficiency further. Common integrations include CRM systems, project management tools, and cloud storage services.

-

Is the ir913 feature suitable for small businesses?

Absolutely! The ir913 feature in airSlate SignNow is designed to cater to businesses of all sizes, including small businesses. It offers a cost-effective solution for managing document signatures without sacrificing functionality, making it ideal for smaller teams with limited resources.

-

What types of documents can I sign using the ir913 feature?

With the ir913 feature in airSlate SignNow, you can sign various document types, including contracts, agreements, and more. This versatility ensures that whether you're in legal, HR, or sales, your document signing needs are efficiently met. The platform supports multiple file formats for added convenience.

-

How secure is the signing process with the ir913 feature?

The airSlate SignNow's ir913 feature prioritizes security by employing advanced encryption protocols. This ensures that all documents and signed agreements are protected throughout the signing process. Users can have peace of mind knowing their sensitive information is secure.

Get more for Ir913

Find out other Ir913

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast